Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show the comparison of cash flow statement for last 2 years 2019 2020 RO RO 179,578 244,640 143,580 OPERATING ACTIVITIES: Profit for the penod before

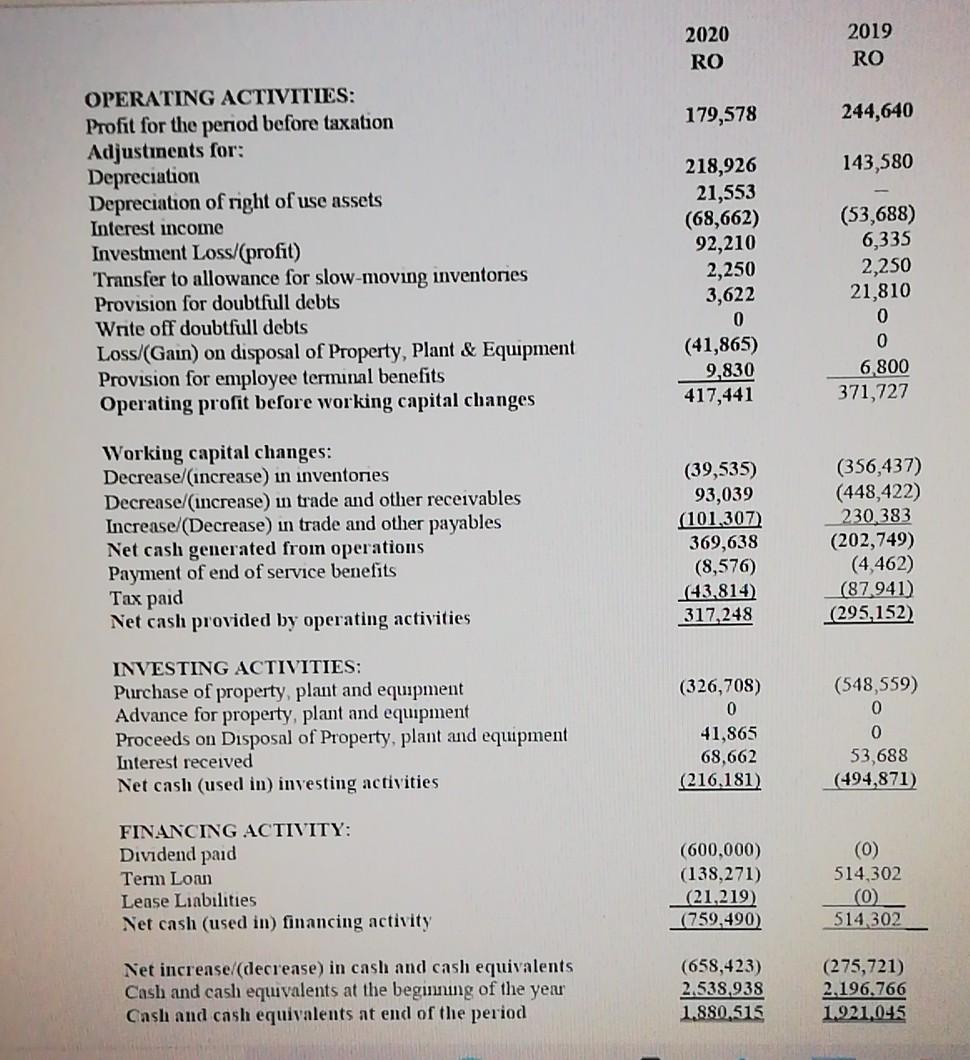

Show the comparison of cash flow statement for last 2 years

2019 2020 RO RO 179,578 244,640 143,580 OPERATING ACTIVITIES: Profit for the penod before taxation Adjustinents for: Depreciation Depreciation of right of use assets Interest income Investment Loss/(profit) Transfer to allowance for slow-moving inventories Provision for doubtfull debts Write off doubtfull debts Loss/(Gain) on disposal of Property, Plant & Equipment Provision for employee terminal benefits Operating profit before working capital changes 218,926 21,553 (68,662) 92,210 2,250 3,622 0 (41,865) 9,830 417,441 (53,688) 6,335 2,250 21,810 0 0 6,800 371,727 Working capital changes: Decrease/(increase) in inventores Decrease increase) in trade and other receivables Increase (Decrease) in trade and other payables Net cash generated from operations Payment of end of service benefits Tax paid Net cash provided by operating activities (39,535) 93,039 (101,307) 369,638 (8,576) 43.814) 317,248 (356,437) (448,422) 230 383 (202,749) (4,462) (87.941) (295,152) INVESTING ACTIVITIES: Purchase of property plant and equipment Advance for property, plant and equipment Proceeds on Disposal of Property, plant and equipment Interest received Net cash (used in) investing activities (326,708) 0 41,865 68,662 (216,181) (548,559) 0 0 53,688 (494,871) FINANCING ACTIVITY: Dividend paid Term Loan Lease Liabilities Net cash (used in) financing activity (600,000) 38,2 (21.219) (759,490) (0) 514,302 (0) 514 302 Net increase/(decrease) in cash and cash equivalents Cash and cash equivalents at the beginning of the year Cash and cash equivalents at end of the period (658,423) 2.538.938 1.880,515 (275,721) 2.196,766 1.921.045

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started