Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show THE PROCESS OF HOW YOU GET THE ANSWERS. I need the answers for 11 and 12. Use the following information for the next 8

Show THE PROCESS OF HOW YOU GET THE ANSWERS. I need the answers for 11 and 12.

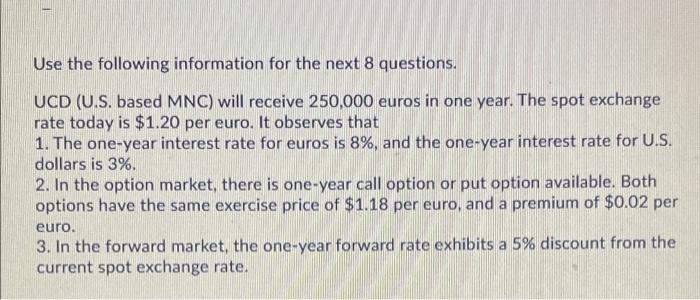

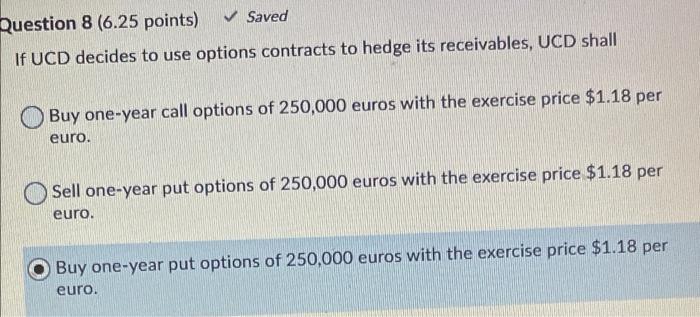

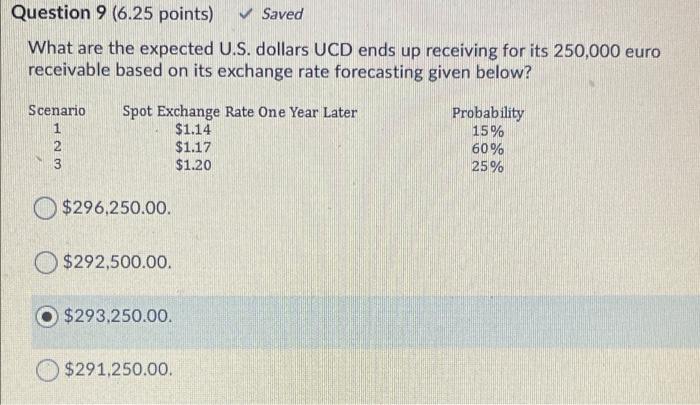

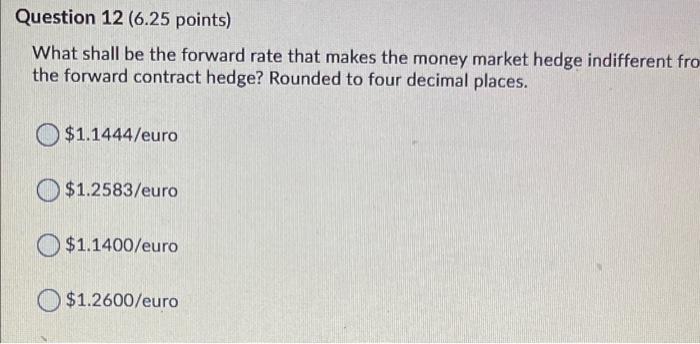

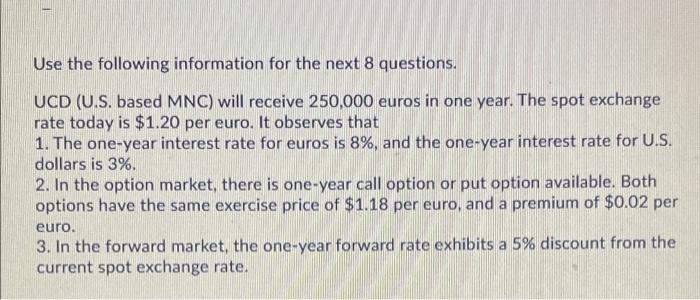

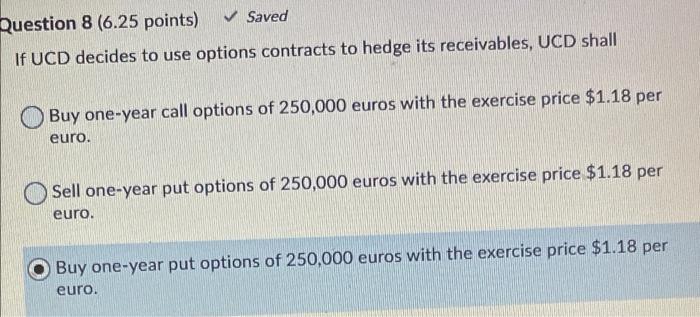

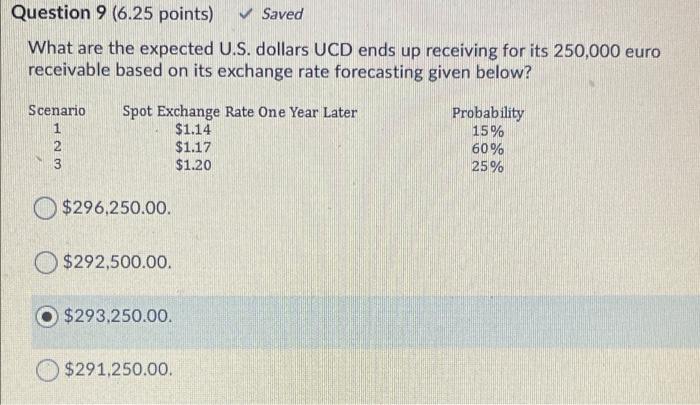

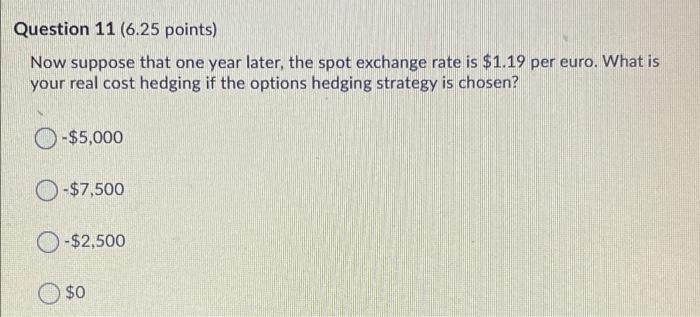

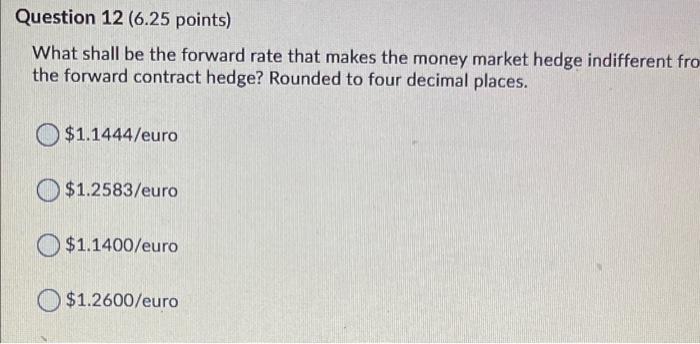

Use the following information for the next 8 questions. UCD (U.S. based MNC) will receive 250,000 euros in one year. The spot exchange rate today is $1.20 per euro. It observes that 1. The one-year interest rate for euros is 8%, and the one-year interest rate for U.S. dollars is 3%. 2. In the option market, there is one-year call option or put option available. Both options have the same exercise price of $1.18 per euro, and a premium of $0.02 per euro. 3. In the forward market, the one-year forward rate exhibits a 5% discount from the current spot exchange rate. Question 8 (6.25 points) Saved If UCD decides to use options contracts to hedge its receivables, UCD shall Buy one-year call options of 250,000 euros with the exercise price $1.18 per euro. Sell one-year put options of 250,000 euros with the exercise price $1.18 per euro. Buy one-year put options of 250,000 euros with the exercise price $1.18 per euro. Question 9 (6.25 points) Saved What are the expected U.S. dollars UCD ends up receiving for its 250,000 euro receivable based on its exchange rate forecasting given below? Scenario 1 2 3 Spot Exchange Rate One Year Later $1.14 $1.17 $1.20 Probability 15% 60% 25% CON $296,250.00. $292,500.00 $293.250.00. $291,250.00 Question 11 (6.25 points) Now suppose that one year later, the spot exchange rate is $1.19 per euro. What is your real cost hedging if the options hedging strategy is chosen? O-$5,000 0-$7,500 O-$2,500 $0 Question 12 (6.25 points) What shall be the forward rate that makes the money market hedge indifferent fro the forward contract hedge? Rounded to four decimal places. $1.1444/euro $1.2583/euro $1.1400/euro $1.2600/euro

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started