Question

Show the ratio answers and answer the questions. 1. What are the default ratios? Will the properties make enough to at least break-even? 2. What

Show the ratio answers and answer the questions.

1. What are the default ratios? Will the properties make enough to at least break-even?

2. What are our annual returns? Do these projects cap rates meet our requirements for investment?

3. What is our EDR for each investment and is it higher than the cap rate?

4. On the same note, what are the Mortgage Constants and are they lower than the cap rate?

5. What is the DCR for each? Would a bank consider their debt coverage ratios satisfactory?

6. What are the OERs and which of the two would an investor prefer if the prices and down-payments were the same?

7. Which of the two investments would we rather own? And give one reason why?

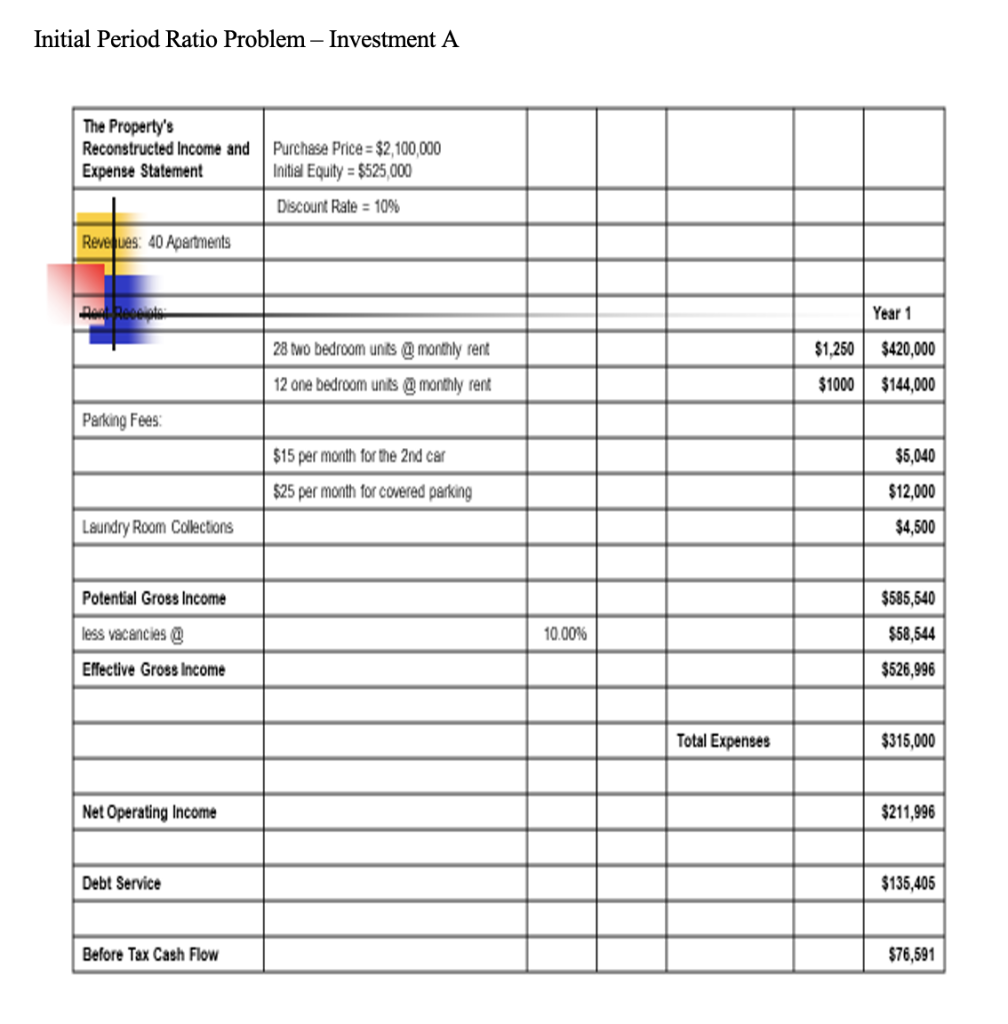

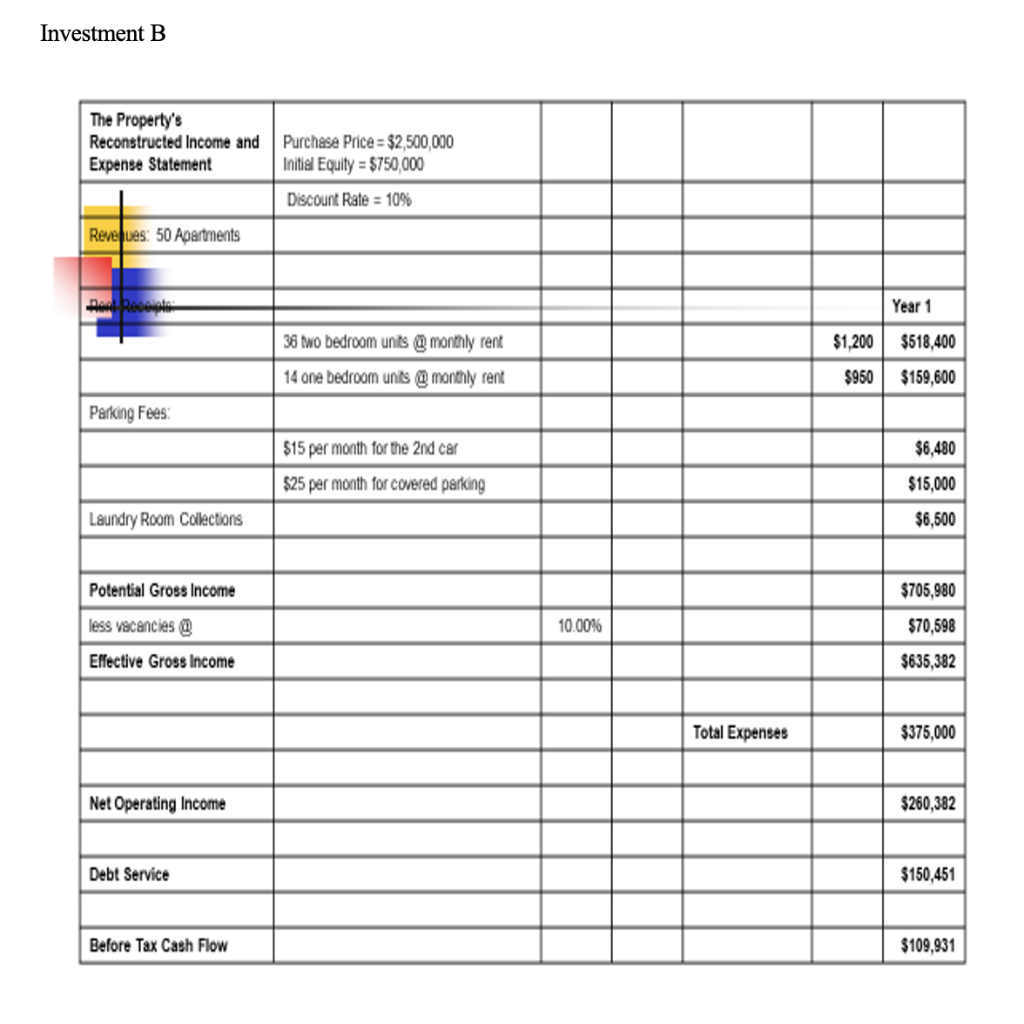

Initial Period Ratio Problem - Investment A The Property's Reconstructed Income and Purchase Price = $2,100,000 Expense Statement Initial Equity = $525,000 Discount Rate = 10% Revues: 40 Apartments parteorole Year 1 $1,250 $420,000 28 wo bedroom units monthly rent 12 one bedroom units monthly rent $1000 $144,000 Parking Fees: $5,040 $15 per month for the 2nd car $25 per month for covered parking $12,000 Laundry Room Collections $4,500 Potential Gross Income $585,540 less vacancies 10.00% $58,544 Effective Gross Income $526,996 Total Expenses $315,000 Net Operating Income $211,996 Debt Service $135,405 Before Tax Cash Flow $76,591 Investment B The Property's Reconstructed Income and Expense Statement Purchase Price = $2,500,000 Initial Equity = $750,000 Discount Rate = 10% Revelues: 50 Apartments -Pa Reople Year 1 $1,200 38 two bedroom units@ monthly rent 14 one bedroom units @ monthly rent $518,400 $159,600 $950 Parking Fees: $6,480 $15 per month for the 2nd car $25 per month for covered parking $15,000 Laundry Room Collections $6,500 Potential Gross Income $705,980 10.00% $70,598 less vacancies Effective Gross Income $635,382 Total Expenses $375,000 Net Operating Income $260,382 Debt Service $150,451 Before Tax Cash Flow $109,931 Initial Period Ratio Problem - Investment A The Property's Reconstructed Income and Purchase Price = $2,100,000 Expense Statement Initial Equity = $525,000 Discount Rate = 10% Revues: 40 Apartments parteorole Year 1 $1,250 $420,000 28 wo bedroom units monthly rent 12 one bedroom units monthly rent $1000 $144,000 Parking Fees: $5,040 $15 per month for the 2nd car $25 per month for covered parking $12,000 Laundry Room Collections $4,500 Potential Gross Income $585,540 less vacancies 10.00% $58,544 Effective Gross Income $526,996 Total Expenses $315,000 Net Operating Income $211,996 Debt Service $135,405 Before Tax Cash Flow $76,591 Investment B The Property's Reconstructed Income and Expense Statement Purchase Price = $2,500,000 Initial Equity = $750,000 Discount Rate = 10% Revelues: 50 Apartments -Pa Reople Year 1 $1,200 38 two bedroom units@ monthly rent 14 one bedroom units @ monthly rent $518,400 $159,600 $950 Parking Fees: $6,480 $15 per month for the 2nd car $25 per month for covered parking $15,000 Laundry Room Collections $6,500 Potential Gross Income $705,980 10.00% $70,598 less vacancies Effective Gross Income $635,382 Total Expenses $375,000 Net Operating Income $260,382 Debt Service $150,451 Before Tax Cash Flow $109,931Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started