Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show the solution and the answer. Thanks 11 Suppose the nominal peso/dollar exchange rate is fixed at MXN 12.7263/S. If the inflation rates in the

Show the solution and the answer. Thanks

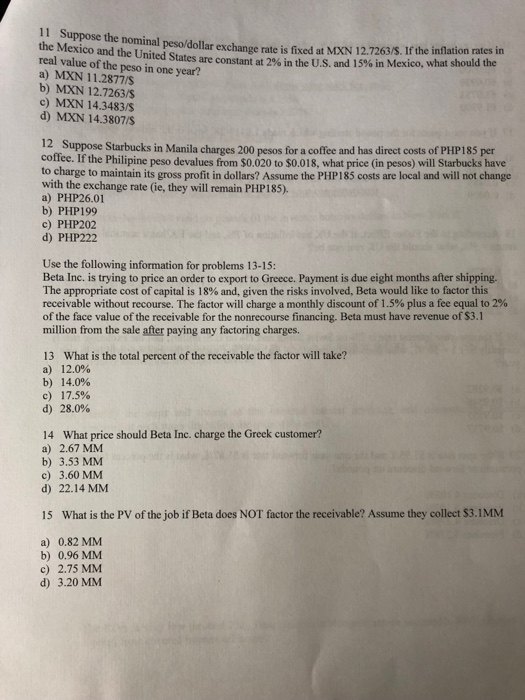

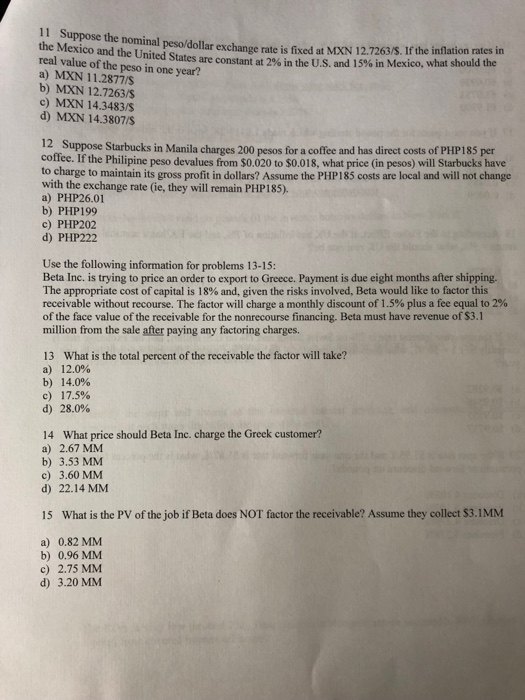

11 Suppose the nominal peso/dollar exchange rate is fixed at MXN 12.7263/S. If the inflation rates in the Mexico and the United States are constant at 2% in the U.S. and 15% in Mexico, what should the real value of the peso in one year? a) MXN 11.2877/S b) MXN 12.7263/S c) MXN 14.3483/S d) MXN 14.3807/S 12 Suppose Starbucks in Manila charges 200 pesos for a coffee and has direct costs of PHP185 per coffee. If the Philipine peso devalues from $0.020 to $0,018, what price (in pesos) will Starbucks have to charge to maintain its gross profit in dollars? Assume the PHP185 costs are local and will not change with the exchange rate (ie, they will remain PHP185). a) PHP26.01 b) PHP199 c) PHP202 d) PHP222 Use the following information for problems 13-15: Beta Inc. is trying to price an order to export to Greece. Payment is due eight months after shipping. The appropriate cost of capital is 18% and, given the risks involved, Beta would like to factor this receivable without recourse. The factor will charge a monthly discount of 1.5 % plus a fee equal to 2 % of the face value of the receivable for the nonrecourse financing. Beta must have revenue of S3.1 million from the sale after paying any factoring charges. What is the total percent of the receivable the factor will take? 13 a) 12.0% b) 14.0% c) 17.5 % d) 28.0% 14 What price should Beta Inc. charge the Greek customer? a) 2.67 MM b) 3.53 MM c) 3.60 MM d) 22.14 MM What is the PV of the job if Beta does NOT factor the receivable? Assume they collect $3.1MM 15 a) 0.82 MM b) 0.96 MM c) 2.75 MM d) 3.20 MM

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started