Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show the solution in the excel sheet please you have finally opened a brokerage account for BHD20,000 (BHD/2,4990 as of 27 April 2022) with Mubasher

show the solution in the excel sheet please

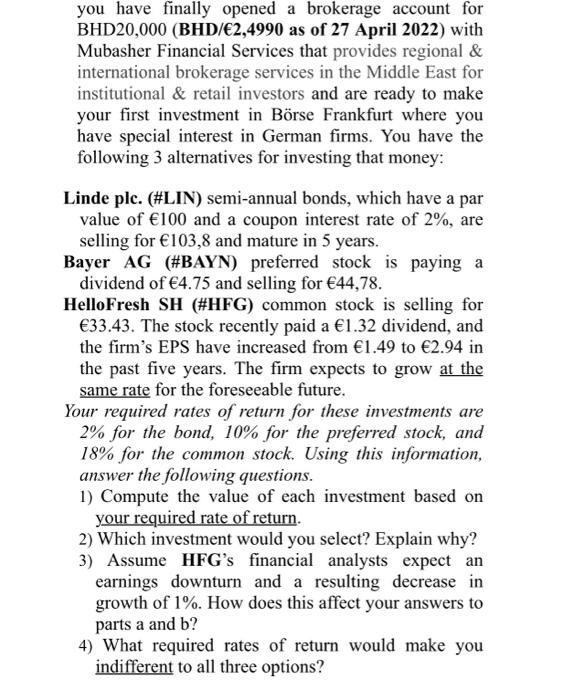

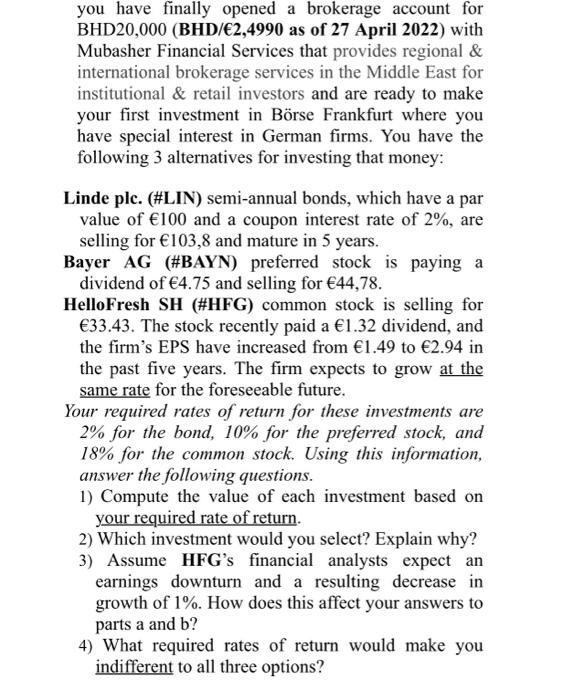

you have finally opened a brokerage account for BHD20,000 (BHD/2,4990 as of 27 April 2022) with Mubasher Financial Services that provides regional & international brokerage services in the Middle East for institutional & retail investors and are ready to make your first investment in Brse Frankfurt where you have special interest in German firms. You have the following 3 alternatives for investing that money: Linde plc. (#LIN) semi-annual bonds, which have a par a value of 100 and a coupon interest rate of 2%, are selling for 103,8 and mature in 5 years. Bayer AG (#BAYN) preferred stock is paying a dividend of 4.75 and selling for 44,78. HelloFresh SH (#HFG) common stock is selling for 33.43. The stock recently paid a 1.32 dividend, and the firm's EPS have increased from 1.49 to 2.94 in the past five years. The firm expects to grow at the same rate for the foreseeable future. Your required rates of return for these investments are 2% for the bond, 10% for the preferred stock, and 18% for the common stock. Using this information, answer the following questions. 1) Compute the value of each investment based on your required rate of return. 2) Which investment would you select? Explain why? 3) Assume HFG's financial analysts expectan earnings downturn and a resulting decrease in growth of 1%. How does this affect your answers to parts a and b? 4) What required rates of return would make you indifferent to all three options

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started