Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show the step by step solutions and explanation of of Simple payback period and the discounted payback period. The Payback (Pay-Out) Period . Often called

show the step by step solutions and explanation of of Simple payback period and the discounted payback period.

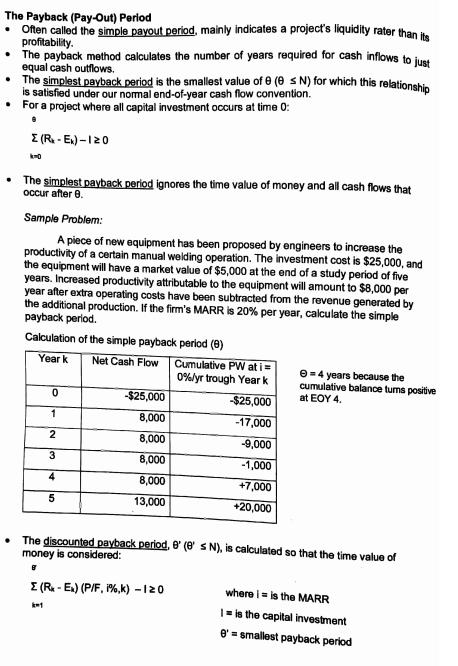

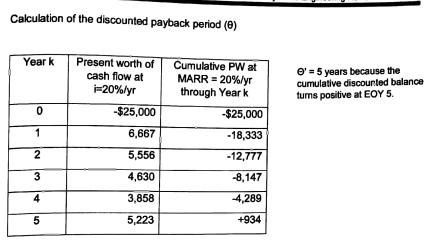

The Payback (Pay-Out) Period . Often called the simple payout period, mainly indicates a project's liquidity rater than its profitability. The payback method calculates the number of years required for cash inflows to just equal cash outflows. The simplest payback period is the smallest value of 0 (0 N) for which this relationship is satisfied under our normal end-of-year cash flow convention. For a project where all capital investment occurs at time 0: (Rx-Ex)-120 - The simplest payback period ignores the time value of money and all cash flows that occur after 8. Sample Problem: A piece of new equipment has been proposed by engineers to increase the productivity of a certain manual welding operation. The investment cost is $25,000, and the equipment will have a market value of $5,000 at the end of a study period of five years. Increased productivity attributable to the equipment will amount to $8,000 per year after extra operating costs have been subtracted from the revenue generated by the additional production. If the firm's MARR is 20% per year, calculate the simple payback period. Calculation of the simple payback period (8) Year k Net Cash Flow Cumulative PW at i= 0%/yr trough Year k 0 -$25,000 -$25,000 -4 years because the cumulative balance turns positive at EOY 4. 1 8,000 -17,000 2 8,000 -9,000 3 8,000 -1,000 4 8,000 +7,000 5 13,000 +20,000 The discounted payback period, e' (e s N), is calculated so that the time value of money is considered: (Rx-Ex) (P/F, %,k) -120 km1 where i = is the MARR is the capital investment e smallest payback period

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started