show the working on an excel

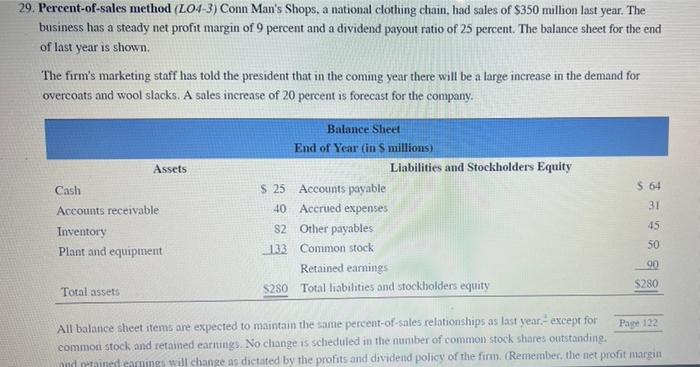

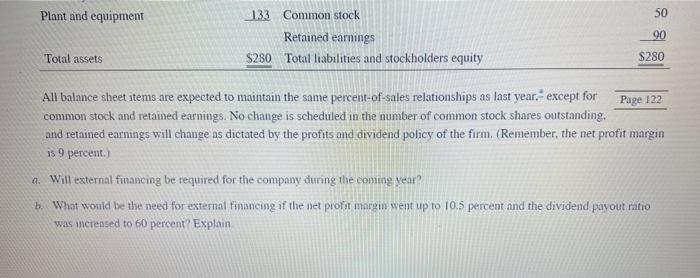

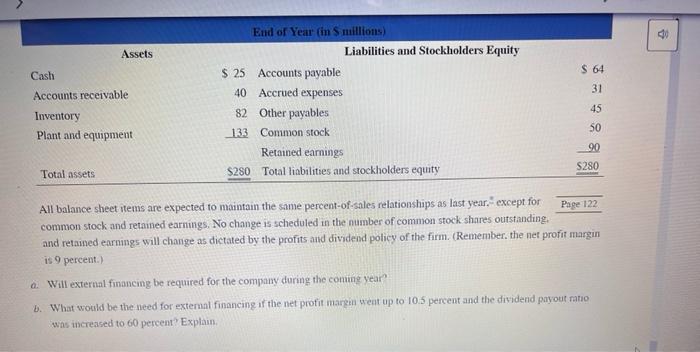

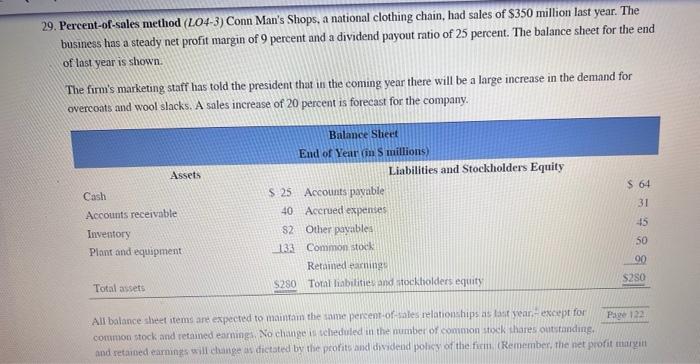

29. Percent-of-sales method (L04-3) Conn Man's Shops, a national clothing chain, had sales of $350 million last year. The business has a steady net profit margin of 9 percent and a dividend payout ratio of 25 percent. The balance sheet for the end of last year is shown. The firm's marketing staff has told the president that in the coming year there will be a large increase in the demand for overcoats and wool slacks. A sales increase of 20 percent is forecast for the company. $ 64 Assets Cash Accounts receivable Balance Sheet End of Year (in S millions Liabilities and Stockholders Equity S 25 Accounts payable 40 Accrued expenses S2 Other payables 133 Common stock Retained earnings S280 Total liabilities and stockholders equity 31 45 Inventory Plant and equipment 50 90 S280 Total assets All balance sheet items are expected to maintain the same percent-of-sales relationships as last year.- except for Page 122 common stock and retained earnings. No change is scheduled in the number of common stock shares outstanding baltained emings will change as dictated by the profits and dividend policy of the firm. (Remember, the net profit margin Plant and equipment 133 Common stock 50 Retained earnings $280 Total liabilities and stockholders equity 90 $280 Total assets All balance sheet items are expected to maintain the same percent-of-sales relationships as last year.- except for Page 122 common stock and retained earnings. No change is scheduled in the number of common stock shares outstanding. and retained earnings will change as dictated by the profits and dividend policy of the firm. (Remember, the net profit margin is 9 percent.) a. Will external financing be required for the company during the coming year? b. What would be the need for external financing if the net profit margin went up to 10.5 percent and the dividend payout ratio was increased to 60 percent Explain Assets S 64 31 Cash Accounts receivable Inventory Plant and equipment End of Year (in millions) Liabilities and Stockholders Equity $ 25 Accounts payable 40 Accrued expenses 82 Other payables 133 Common stock Retained earings $250 Total liabilities and stockholders equity 45 50 90 S280 Total assets All balance sheet items are expected to maintain the same percent-of-sales relationships as last year. except for Page 122 common stock and retained earnings. No change is scheduled in the number of common stock shares outstanding. and retained earnings will change as dictated by the profits and dividend policy of the firm (Remember, the net profit margin is 9 percent) . Will external financing be required for the company doring the coming year . What would be the need for external financing of the net profit margin weet up to 10.5 percent and the dividend payout ratio was increased to 60 percent Explain 29. Percent-of-sales method (L04-3) Conn Man's Shops, a national clothing chain, had sales of $350 million last year. The business has a steady net profit margin of 9 percent and a dividend payout ratio of 25 percent. The balance sheet for the end of last year is shown. The firm's marketing staff has told the president that in the coming year there will be a large increase in the demand for overcoats and wool slacks. A sales increase of 20 percent is forecast for the company. Assets $ 64 31 Cash Accounts receivable Inventory Plant and equipment Balance Sheet End of Year (in S millions) Liabilities and Stockholders Equity $ 25 Accounts payable 40 Accrued expenses $2 Other pavables 132 Common stock Retained earnings S250 Toral liabilities and stockholders equity 15 50 00 $250 Total assets All balance sheet items are expected to maintain the same percent of sales relationships as fast year-except for Page 122 common stock and retained earnings No change is scheduled in the number of common stock thares outstanding, and retained earnings will change a dictated by the profits and dividend policy of the firm (Remember, the net profit marit