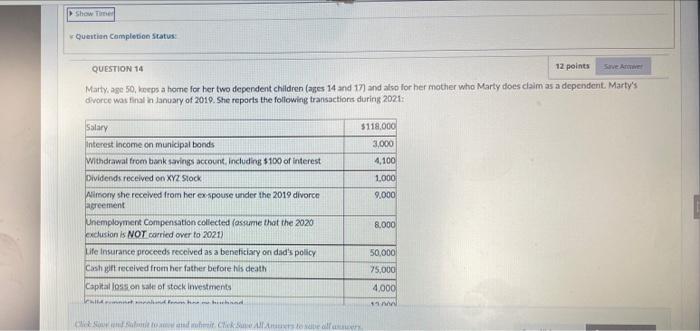

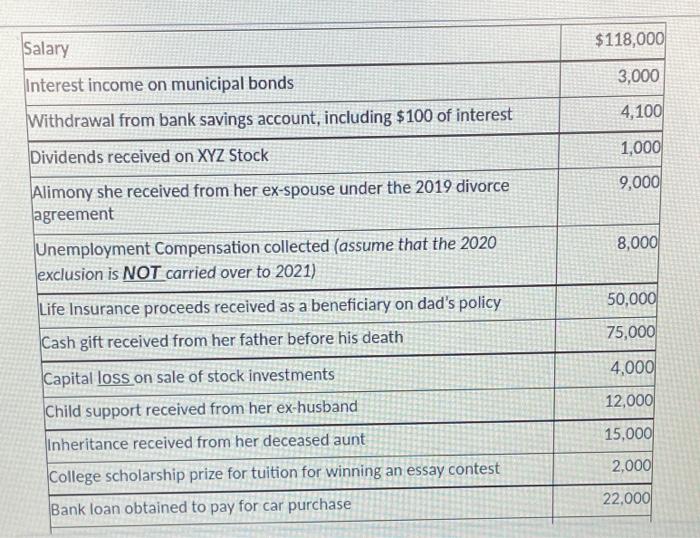

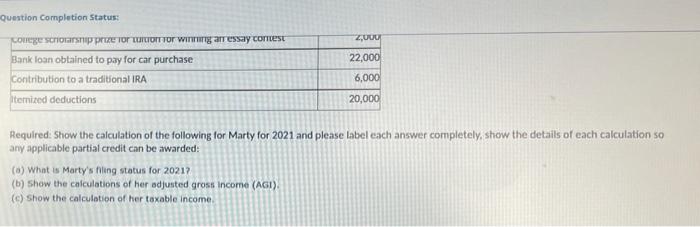

Show Time Question Completion Status: QUESTION 14 12 points Save Marty, age 50, kes a home for her two dependent children (ages 14 and 17) and also for her mother who Marty does claim as a dependent. Marty's dvorce was final in January of 2010. She reports the following transactions during 2021 $118.000 3,000 4.100 1.000 9,000 Salary Interest income on municipal bonds Withdrawal from bank savings account, including $100 of interest Dividends received on XYZ Stock Alimony she received from her ex spouse under the 2019 divorce agreement Unemployment Compensation collected (assume that the 2020 exclusion is NOT carried over to 2021) Life Insurance proceeds received as a beneficiary on dad's policy Cash gift received from her father before his death Capital loss on sale of stock investments IN 8,000 50,000 75,000 4.000 the wall Salary $118,000 3,000 4,100 1,000 9,000 Interest income on municipal bonds Withdrawal from bank savings account, including $100 of interest Dividends received on XYZ Stock Alimony she received from her ex-spouse under the 2019 divorce agreement Unemployment Compensation collected (assume that the 2020 exclusion is NOT carried over to 2021) Life Insurance proceeds received as a beneficiary on dad's policy Cash gift received from her father before his death 8,000 50,000 75,000 4,000 Capital loss on sale of stock investments Child support received from her ex-husband 12,000 15,000 2,000 Inheritance received from her deceased aunt College scholarship prize for tuition for winning an essay contest Bank loan obtained to pay for car purchase 22,000 Question Completion Status: ZUDU 22,000 Lovege scholarship prior TOT TO Wing an essay correst Bank loan obtained to pay for car purchase Contribution to a traditional IRA temized deductions 6,000 20,000 Required: Show the calculation of the following for Marty for 2021 and please label each answer completely, show the details of each calculation so any applicable partial credit can be awarded: (0) What is Marty's hling status for 2021? (b) Show the calculations of her adjusted gross income (AGI) (e) Show the calculation of her taxable income Show Time Question Completion Status: QUESTION 14 12 points Save Marty, age 50, kes a home for her two dependent children (ages 14 and 17) and also for her mother who Marty does claim as a dependent. Marty's dvorce was final in January of 2010. She reports the following transactions during 2021 $118.000 3,000 4.100 1.000 9,000 Salary Interest income on municipal bonds Withdrawal from bank savings account, including $100 of interest Dividends received on XYZ Stock Alimony she received from her ex spouse under the 2019 divorce agreement Unemployment Compensation collected (assume that the 2020 exclusion is NOT carried over to 2021) Life Insurance proceeds received as a beneficiary on dad's policy Cash gift received from her father before his death Capital loss on sale of stock investments IN 8,000 50,000 75,000 4.000 the wall Salary $118,000 3,000 4,100 1,000 9,000 Interest income on municipal bonds Withdrawal from bank savings account, including $100 of interest Dividends received on XYZ Stock Alimony she received from her ex-spouse under the 2019 divorce agreement Unemployment Compensation collected (assume that the 2020 exclusion is NOT carried over to 2021) Life Insurance proceeds received as a beneficiary on dad's policy Cash gift received from her father before his death 8,000 50,000 75,000 4,000 Capital loss on sale of stock investments Child support received from her ex-husband 12,000 15,000 2,000 Inheritance received from her deceased aunt College scholarship prize for tuition for winning an essay contest Bank loan obtained to pay for car purchase 22,000 Question Completion Status: ZUDU 22,000 Lovege scholarship prior TOT TO Wing an essay correst Bank loan obtained to pay for car purchase Contribution to a traditional IRA temized deductions 6,000 20,000 Required: Show the calculation of the following for Marty for 2021 and please label each answer completely, show the details of each calculation so any applicable partial credit can be awarded: (0) What is Marty's hling status for 2021? (b) Show the calculations of her adjusted gross income (AGI) (e) Show the calculation of her taxable income