Question

Show transcribed image textSilver Tech Bhd is a local manufacturing company specialising in computer and technical services. The company was listed in Bursa Malaysia since

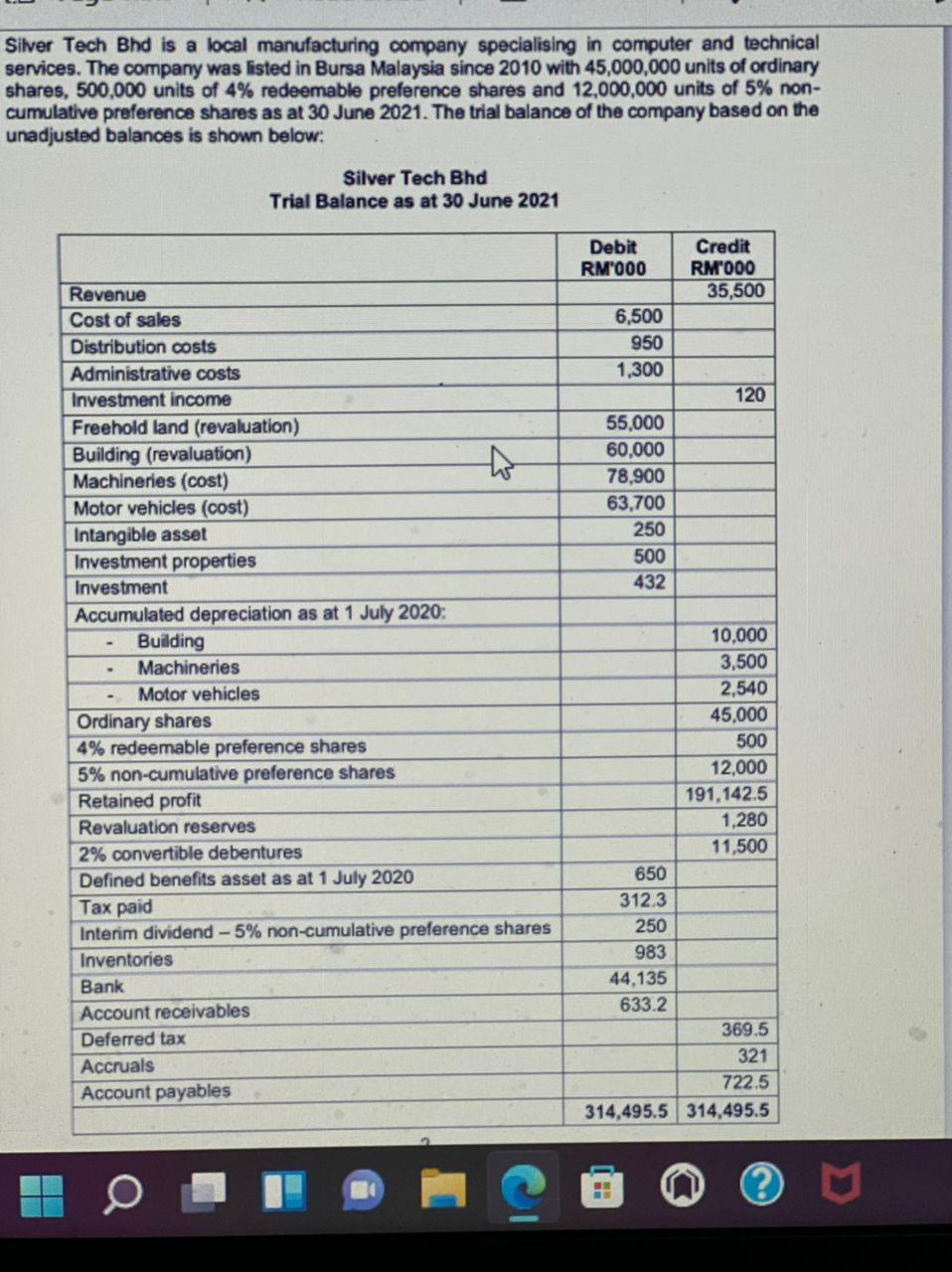

Show transcribed image textSilver Tech Bhd is a local manufacturing company specialising in computer and technical services. The company was listed in Bursa Malaysia since 2010 with 45,000,000 units of ordinary shares, 500,000 units of 4% redeemable preference shares and 12,000,000 units of 5% non- cumulative preference shares as at 30 June 2021. The trial balance of the company based on the unadjusted balances is shown below:

Question : Prepare statement of profit or loss and other comprehensive income for the year 30 June 2021 ( determine basic earning per share/ diluted earning per share)

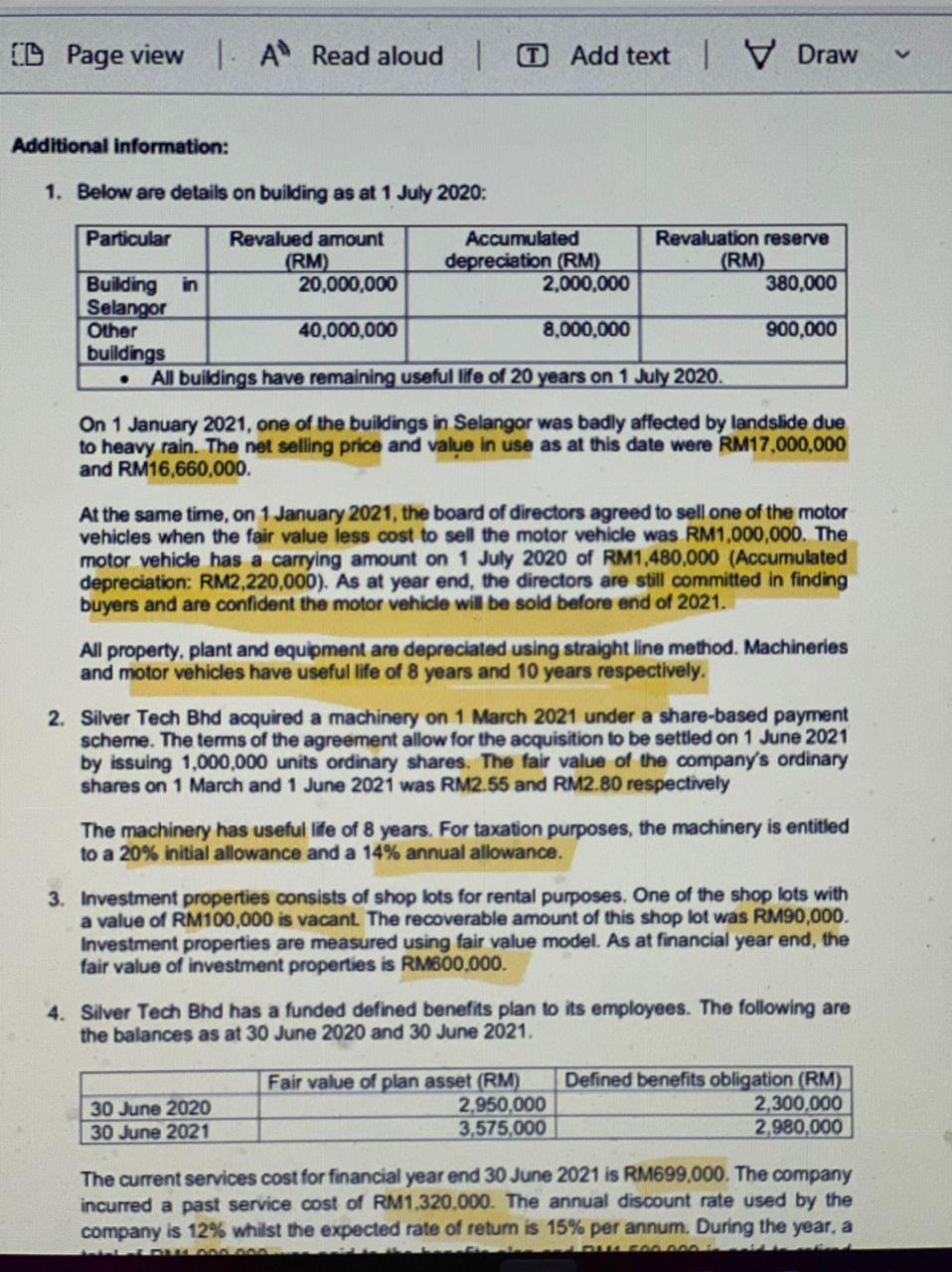

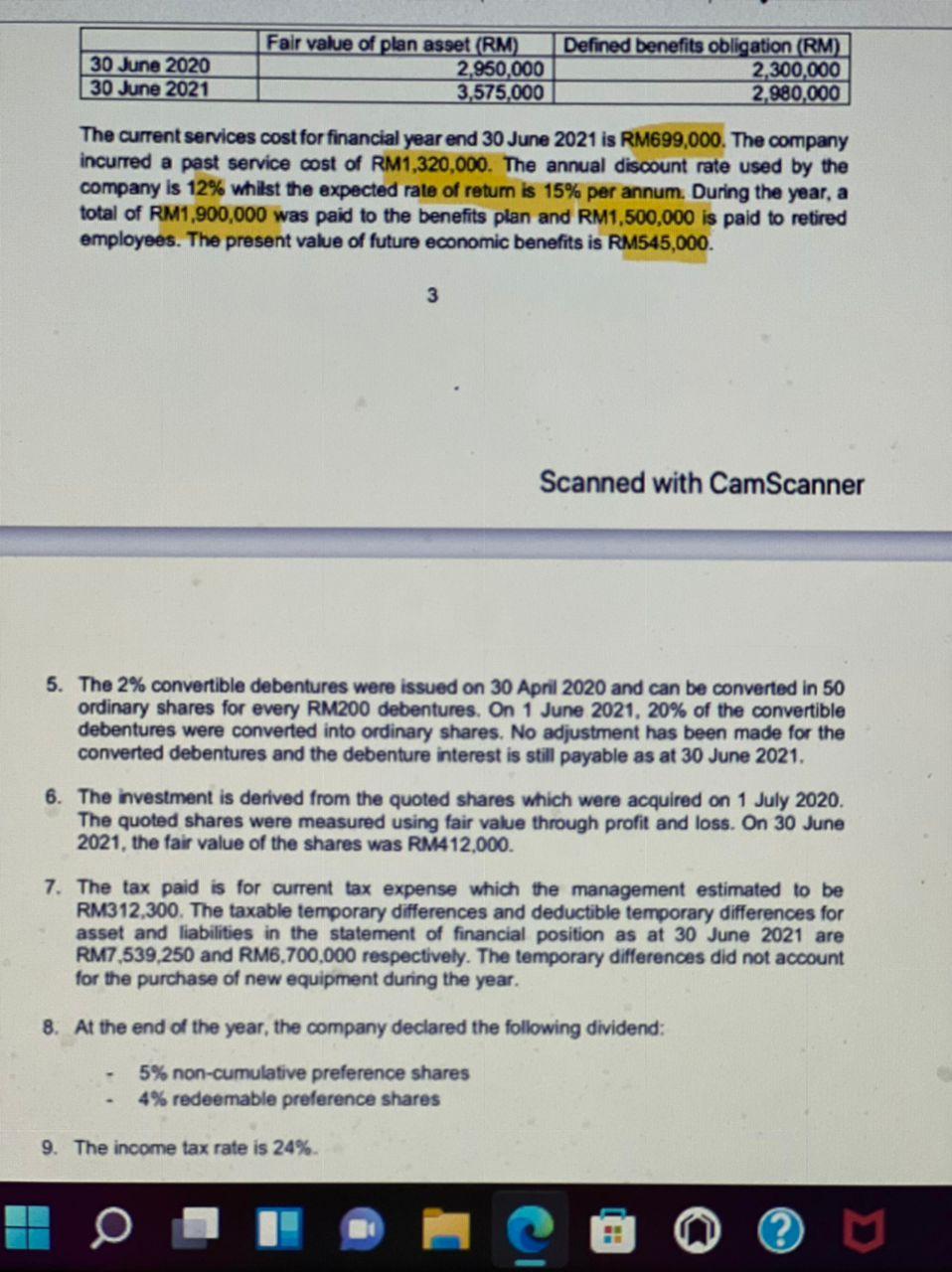

Silver Tech Bhd is a local manufacturing company specialising in computer and technical services. The company was listed in Bursa Malaysia since 2010 with 45,000,000 units of ordinary shares, 500,000 units of 4% redeemable preference shares and 12,000,000 units of 5% non- cumulative preference shares as at 30 June 2021. The trial balance of the company based on the unadjusted balances is shown below: Silver Tech Bhd Trial Balance as at 30 June 2021 Debit RM1000 Credit RM1000 35,500 6,500 950 1,300 120 to 55,000 60,000 78,900 63.700 250 500 432 . Revenue Cost of sales Distribution costs Administrative costs Investment income Freehold land (revaluation) Building (revaluation) Machineries (cost) Motor vehicles (cost) Intangible asset Investment properties Investment Accumulated depreciation as at 1 July 2020: Building Machineries Motor vehicles Ordinary shares 4% redeemable preference shares 5% non-cumulative preference shares Retained profit Revaluation reserves 2% convertible debentures Defined benefits asset as at 1 July 2020 Tax paid Interim dividend -5% non-cumulative preference shares Inventories Bank Account receivables Deferred tax Accruals Account payables 10,000 3,500 2,540 45,000 500 12,000 191,142.5 1,280 11,500 650 312.3 250 983 44,135 633.2 369.5 321 722.5 314,495.5 314,495.5 H D Page view | A Read aloud 1 0 Add text | Draw Additional information: 1. Below are details on building as at 1 July 2020: Particular Revalued amount Accumulated Revaluation reserve (RM) depreciation (RM) (RM) Building in 20,000,000 2,000,000 380,000 Selangor Other 40,000,000 8,000,000 900,000 buildings All buildings have remaining useful life of 20 years on 1 July 2020. On 1 January 2021, one of the buildings in Selangor was badly affected by landslide due to heavy rain. The net selling price and value in use as at this date were RM17.000.000 and RM16,660,000. At the same time, on 1 January 2021, the board of directors agreed to sell one of the motor vehicles when the fair value less cost to sell the motor vehicle was RM1,000,000. The motor vehicle has a carrying amount on 1 July 2020 of RM1,480,000 (Accumulated depreciation: RM2,220,000). As at year end, the directors are still committed in finding buyers and are confident the motor vehicle will be sold before end of 2021. All property, plant and equipment are depreciated using straight line method. Machineries and motor vehicles have useful life of 8 years and 10 years respectively. 2. Silver Tech Bhd acquired a machinery on 1 March 2021 under a share-based payment scheme. The terms of the agreement allow for the acquisition to be settled on 1 June 2021 by issuing 1,000,000 units ordinary shares. The fair value of the company's ordinary shares on 1 March and 1 June 2021 was RM2.55 and RM2.80 respectively The machinery has useful life of 8 years. For taxation purposes, the machinery is entitled to a 20% initial allowance and a 14% annual allowance. 3. Investment properties consists of shop lots for rental purposes. One of the shop lots with a value of RM100,000 is vacant. The recoverable amount of this shop lot was RM90,000 Investment properties are measured using fair value model. As at financial year end, the fair value of investment properties is RM600.000. 4. Silver Tech Bhd has a funded defined benefits plan to its employees. The following are the balances as at 30 June 2020 and 30 June 2021. 30 June 2020 30 June 2021 Fair value of plan asset (RM) 2.950.000 3,575,000 Defined benefits obligation (RM) 2.300.000 2,980,000 The current services cost for financial year end 30 June 2021 is RM699,000. The company incurred a past service cost of RM1.320.000. The annual discount rate used by the company is 12% whilst the expected rate of return is 15% per annum. During the year, a GAGALA 30 June 2020 30 June 2021 Fair value of plan asset (RM) 2,950,000 3,575,000 Defined benefits obligation (RM) 2,300,000 2.980,000 The current services cost for financial year end 30 June 2021 is RM699,000. The company incurred a past service cost of RM1,320,000. The annual discount rate used by the company is 12% whilst the expected rate of return is 15% per annum. During the year, a total of RM1,900,000 was paid to the benefits plan and RM1,500,000 is paid to retired employees. The present value of future economic benefits is RM545,000. 3 Scanned with CamScanner 5. The 2% convertible debentures were issued on 30 April 2020 and can be converted in 50 ordinary shares for every RM200 debentures. On 1 June 2021, 20% of the convertible debentures were converted into ordinary shares. No adjustment has been made for the converted debentures and the debenture interest is still payable as at 30 June 2021. 6. The investment is derived from the quoted shares which were acquired on 1 July 2020. The quoted shares were measured using fair value through profit and loss. On 30 June 2021, the fair value of the shares was RM412.000. 7. The tax paid is for current tax expense which the management estimated to be RM312,300. The taxable temporary differences and deductible temporary differences for asset and liabilities in the statement of financial position as at 30 June 2021 are RM7,539,250 and RM6,700,000 respectively. The temporary differences did not account for the purchase of new equipment during the year. 8. At the end of the year, the company declared the following dividend: - 5% non-cumulative preference shares 4% redeemable preference shares 9. The income tax rate is 24%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started