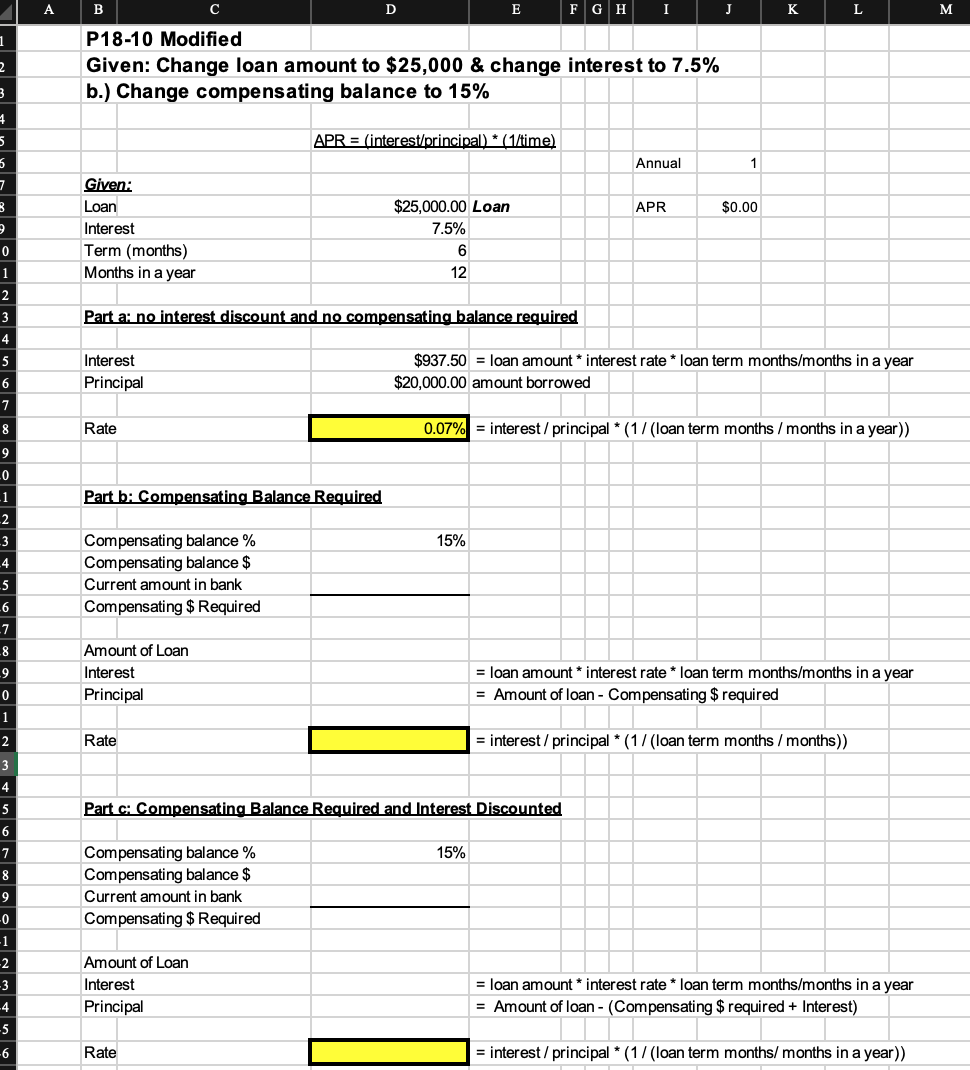

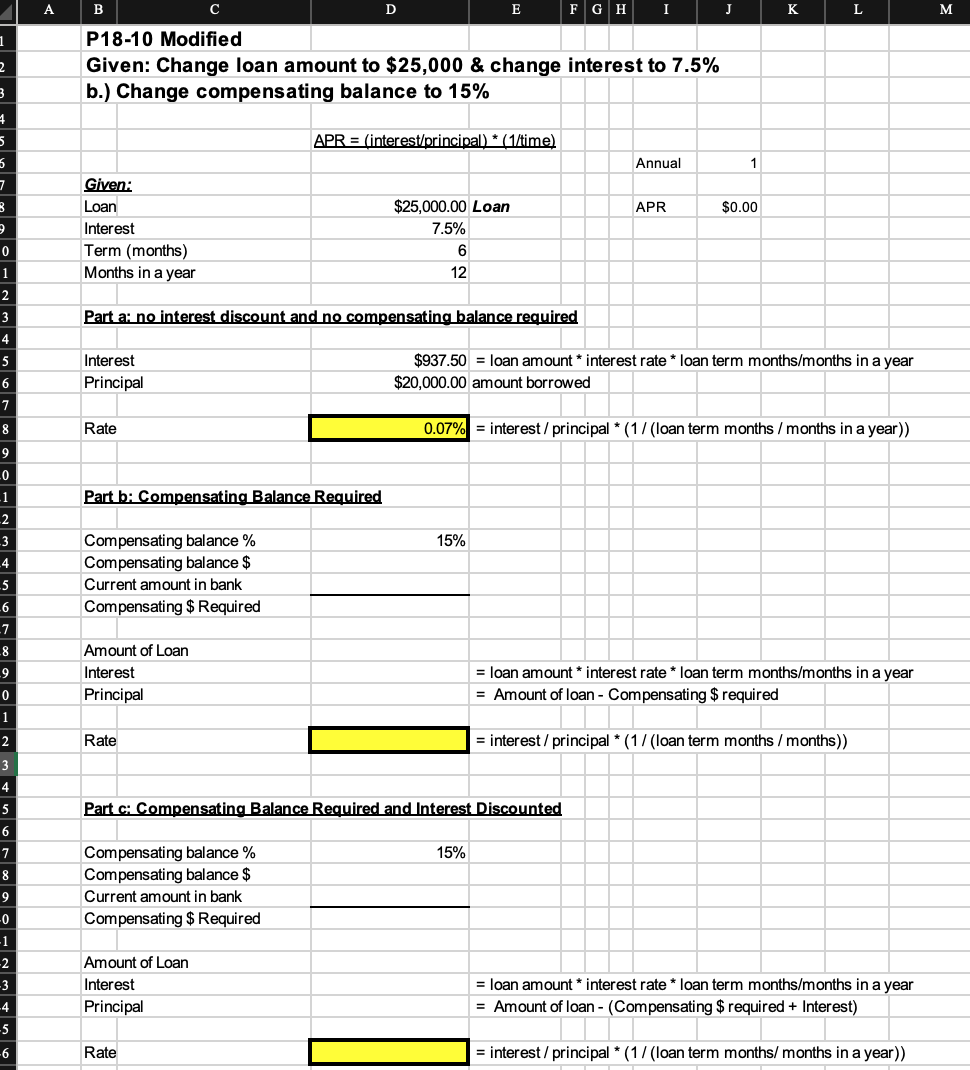

show using excel and fill out template as showed in the image please and you also show all formulas used.

One image is the original problem and the template on top in both shows the modifications. Thank you

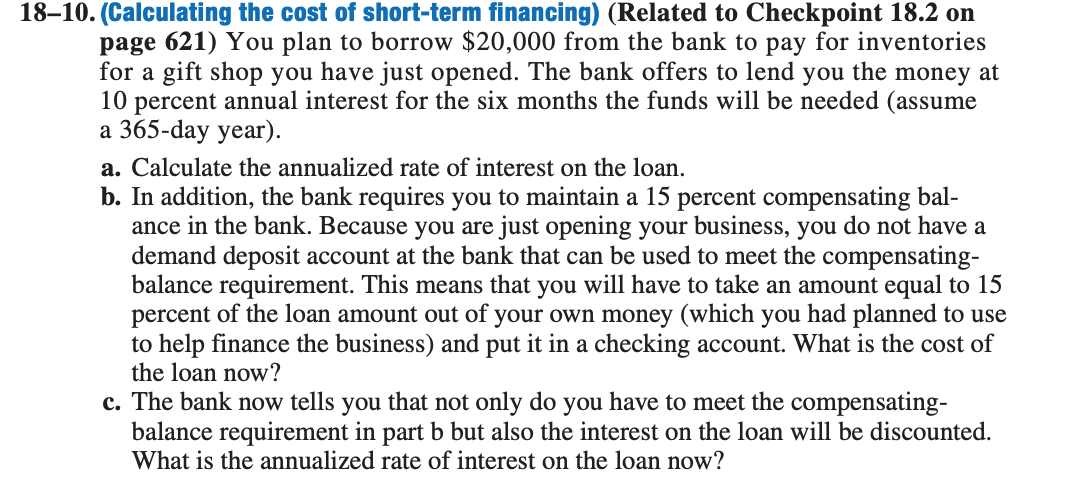

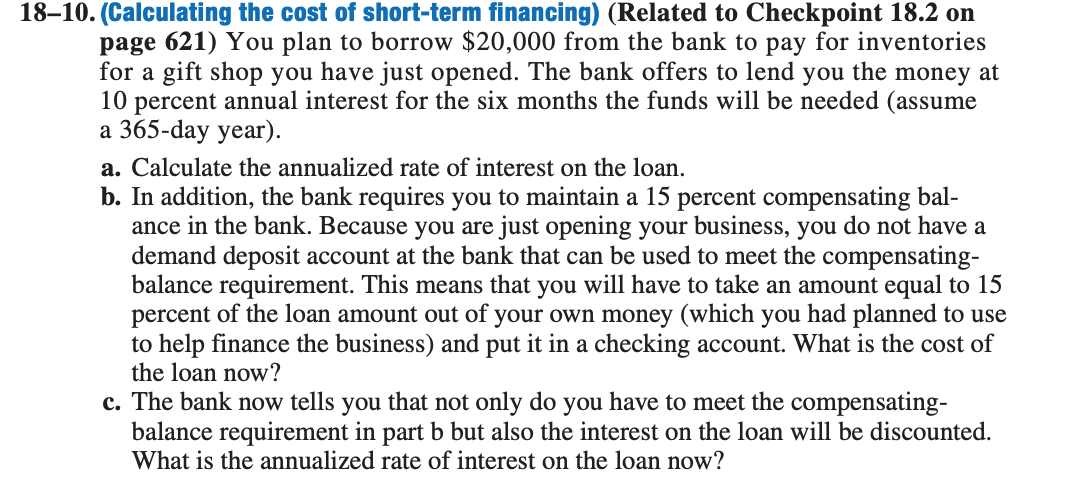

1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 -0 _1 2 3 4 -5 -6 -7 8 9 0 1 2 3 4 5 6 7 8 9 -0 -1 -2 -3 4 5 -6 A B C D E FGH I J P18-10 Modified Given: Change loan amount to $25,000 & change interest to 7.5% b.) Change compensating balance to 15% APR = (interest/principal) * (1/time) Annual 1 Given: Loan $25,000.00 Loan APR $0.00 Interest 7.5% Term (months) 6 Months in a year 12 Part a: no interest discount and no compensating balance required Interest $937.50 = loan amount * interest rate * loan term months/months in a year $20,000.00 amount borrowed Principal Rate 0.07% = interest / principal * (1/(loan term months / months in a year)) Part b: Compensating Balance Required Compensating balance % 15% Compensating balance $ Current amount in bank Compensating $ Required Amount of Loan Interest = loan amount * interest rate * loan term months/months in a year = Amount of loan - Compensating $ required Principal Rate = interest / principal * (1 / (loan term months / months)) Part c: Compensating Balance Required and Interest Discounted Compensating balance % 15% Compensating bal Current amount in bank Compensating $ Required Amount of Loan Interest = loan amount * interest rate * loan term months/months in a year = Amount of loan - (Compensating $ required + Interest) Principal Rate = interest / principal * (1 / (loan term months/ months in a year)) K L M 18-10. (Calculating the cost of short-term financing) (Related to Checkpoint 18.2 on page 621) You plan to borrow $20,000 from the bank to pay for inventories for a gift shop you have just opened. The bank offers to lend you the money at 10 percent annual interest for the six months the funds will be needed (assume a 365-day year). a. Calculate the annualized rate of interest on the loan. b. In addition, the bank requires you to maintain a 15 percent compensating bal- ance in the bank. Because you are just opening your business, you do not have a demand deposit account at the bank that can be used to meet the compensating- balance requirement. This means that you will have to take an amount equal to 15 percent of the loan amount out of your own money (which you had planned to use to help finance the business) and put it in a checking account. What is the cost of the loan now? c. The bank now tells you that not only do you have to meet the compensating- balance requirement in part b but also the interest on the loan will be discounted. What is the annualized rate of interest on the loan now? 1 2 3 4 5 6 7 8 9 0 1 2 3 4 5 6 7 8 9 -0 _1 2 3 4 -5 -6 -7 8 9 0 1 2 3 4 5 6 7 8 9 -0 -1 -2 -3 4 5 -6 A B C D E FGH I J P18-10 Modified Given: Change loan amount to $25,000 & change interest to 7.5% b.) Change compensating balance to 15% APR = (interest/principal) * (1/time) Annual 1 Given: Loan $25,000.00 Loan APR $0.00 Interest 7.5% Term (months) 6 Months in a year 12 Part a: no interest discount and no compensating balance required Interest $937.50 = loan amount * interest rate * loan term months/months in a year $20,000.00 amount borrowed Principal Rate 0.07% = interest / principal * (1/(loan term months / months in a year)) Part b: Compensating Balance Required Compensating balance % 15% Compensating balance $ Current amount in bank Compensating $ Required Amount of Loan Interest = loan amount * interest rate * loan term months/months in a year = Amount of loan - Compensating $ required Principal Rate = interest / principal * (1 / (loan term months / months)) Part c: Compensating Balance Required and Interest Discounted Compensating balance % 15% Compensating bal Current amount in bank Compensating $ Required Amount of Loan Interest = loan amount * interest rate * loan term months/months in a year = Amount of loan - (Compensating $ required + Interest) Principal Rate = interest / principal * (1 / (loan term months/ months in a year)) K L M 18-10. (Calculating the cost of short-term financing) (Related to Checkpoint 18.2 on page 621) You plan to borrow $20,000 from the bank to pay for inventories for a gift shop you have just opened. The bank offers to lend you the money at 10 percent annual interest for the six months the funds will be needed (assume a 365-day year). a. Calculate the annualized rate of interest on the loan. b. In addition, the bank requires you to maintain a 15 percent compensating bal- ance in the bank. Because you are just opening your business, you do not have a demand deposit account at the bank that can be used to meet the compensating- balance requirement. This means that you will have to take an amount equal to 15 percent of the loan amount out of your own money (which you had planned to use to help finance the business) and put it in a checking account. What is the cost of the loan now? c. The bank now tells you that not only do you have to meet the compensating- balance requirement in part b but also the interest on the loan will be discounted. What is the annualized rate of interest on the loan now