Answered step by step

Verified Expert Solution

Question

1 Approved Answer

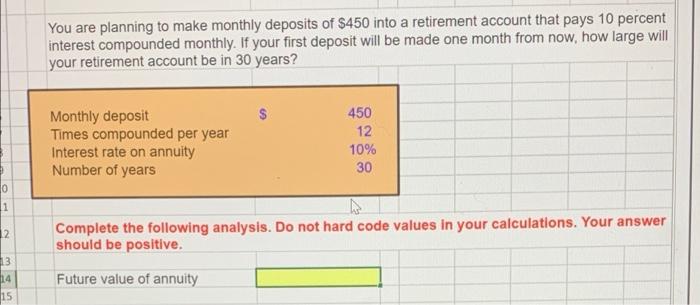

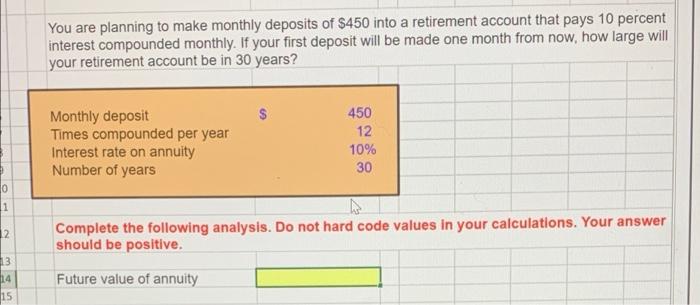

show with formulas and excel You are planning to make monthly deposits of $450 into a retirement account that pays 10 percent interest compounded monthly.

show with formulas and excel

You are planning to make monthly deposits of $450 into a retirement account that pays 10 percent interest compounded monthly. If your first deposit will be made one month from now, how large will your retirement account be in 30 years? Monthly deposit Times compounded per year Interest rate on annuity Number of years 450 12 10% 30 0 1 2. Complete the following analysis. Do not hard code values in your calculations. Your answer should be positive. 13 114 15 Future value of annuity

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started