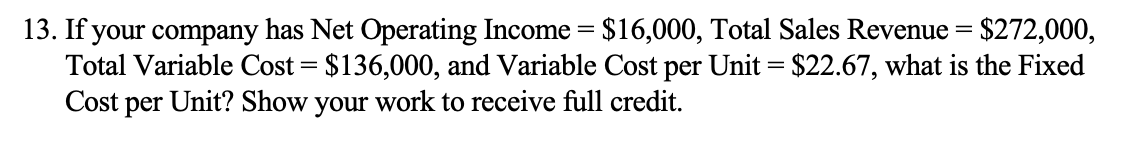

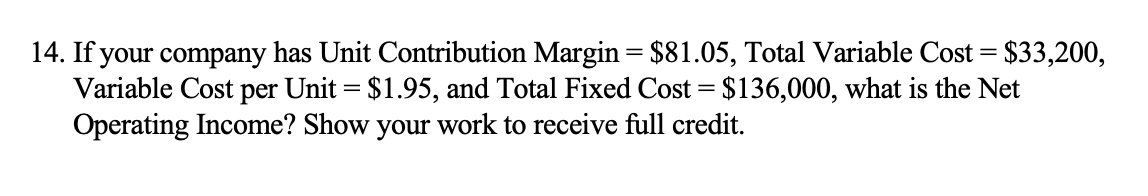

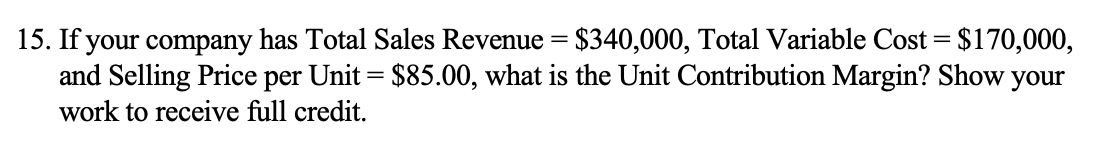

SHOW WORK

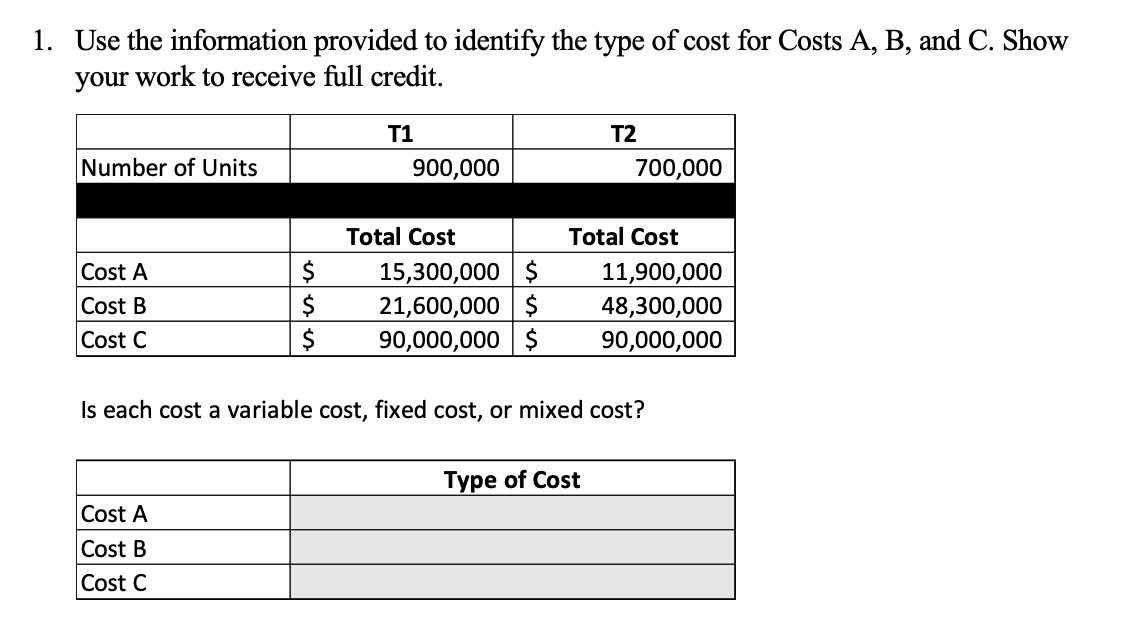

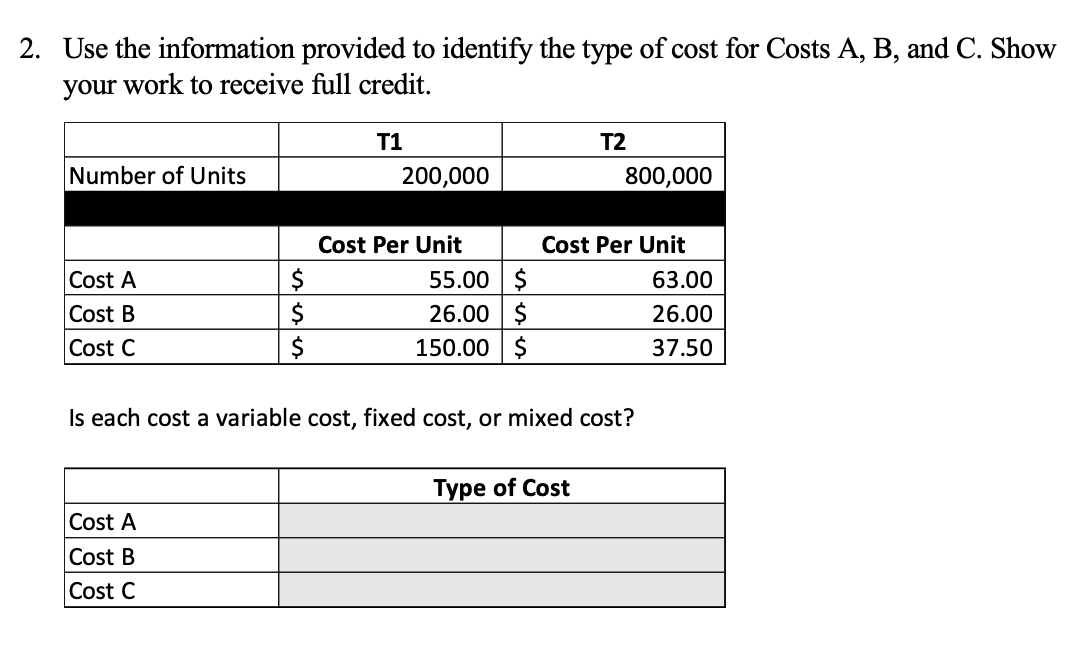

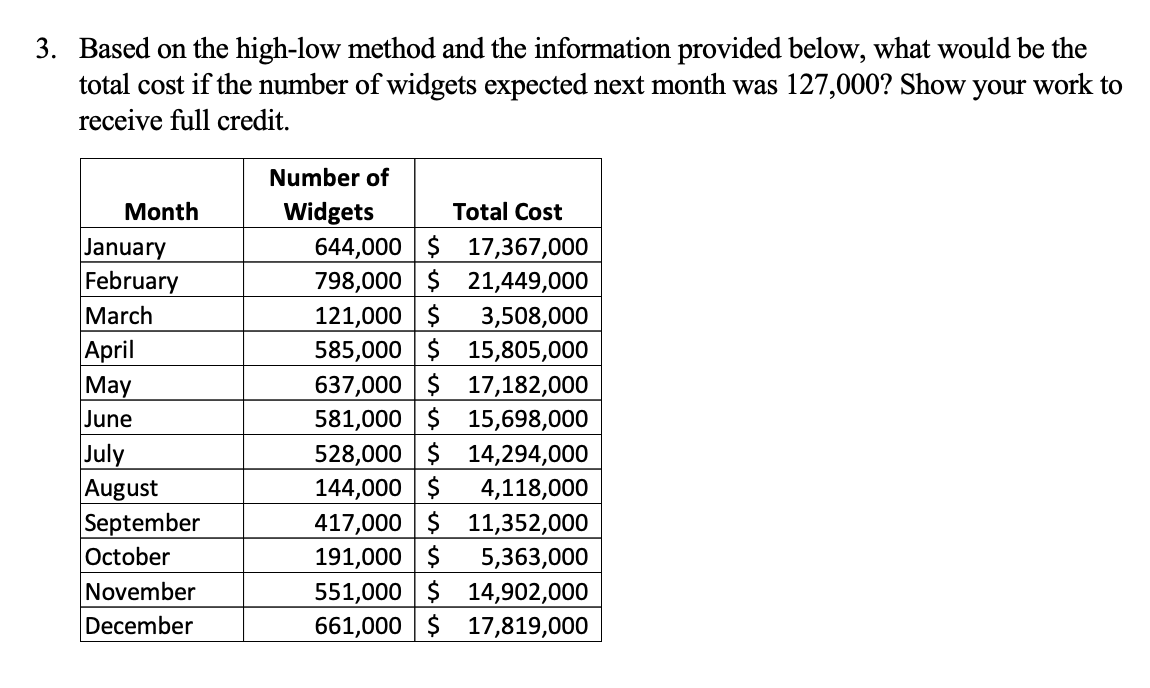

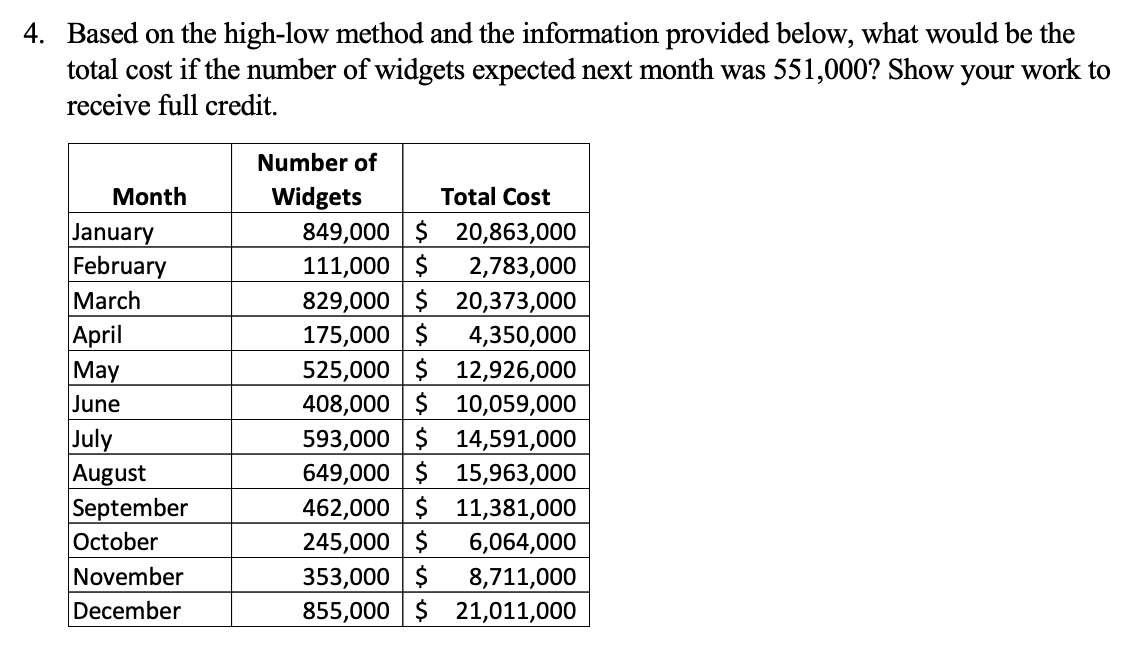

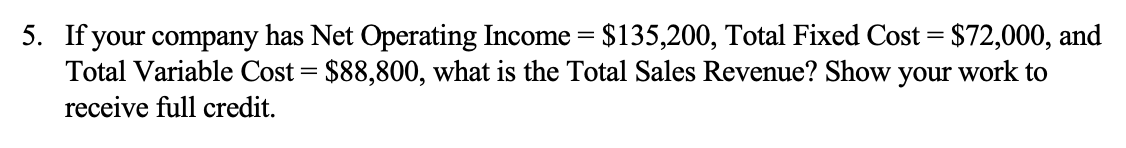

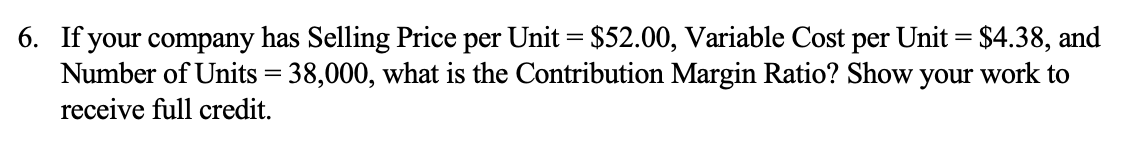

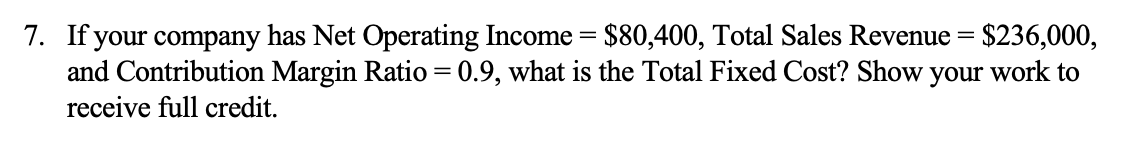

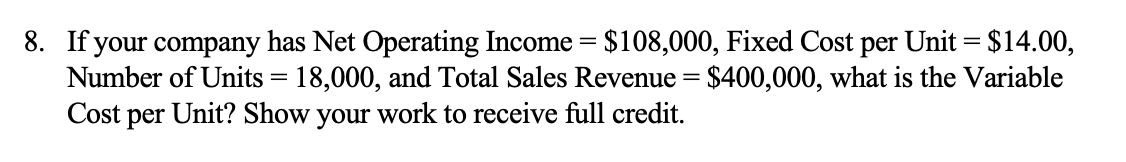

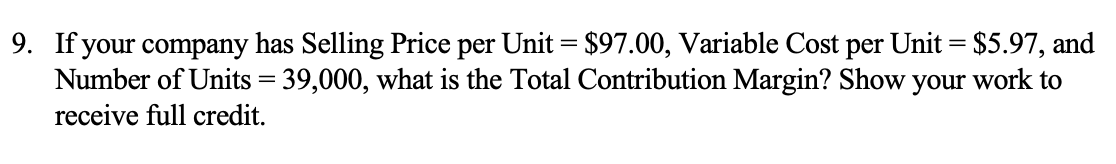

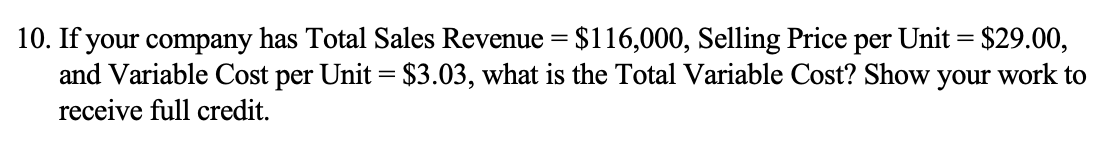

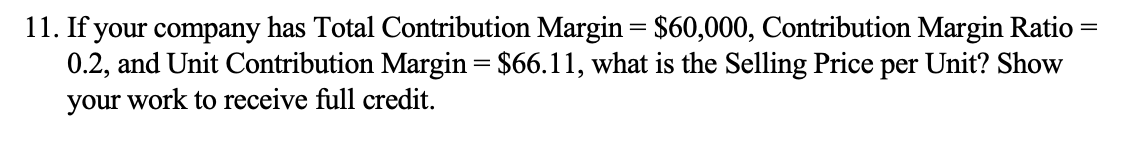

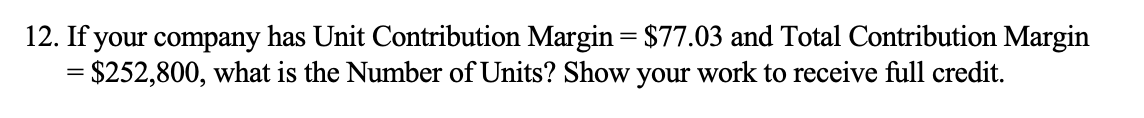

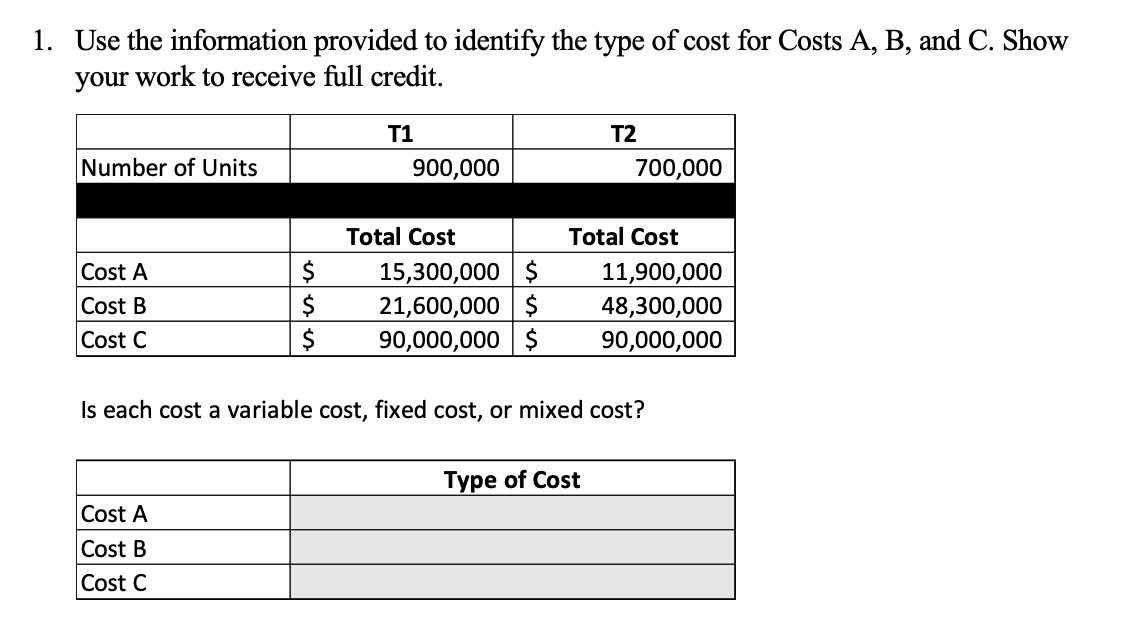

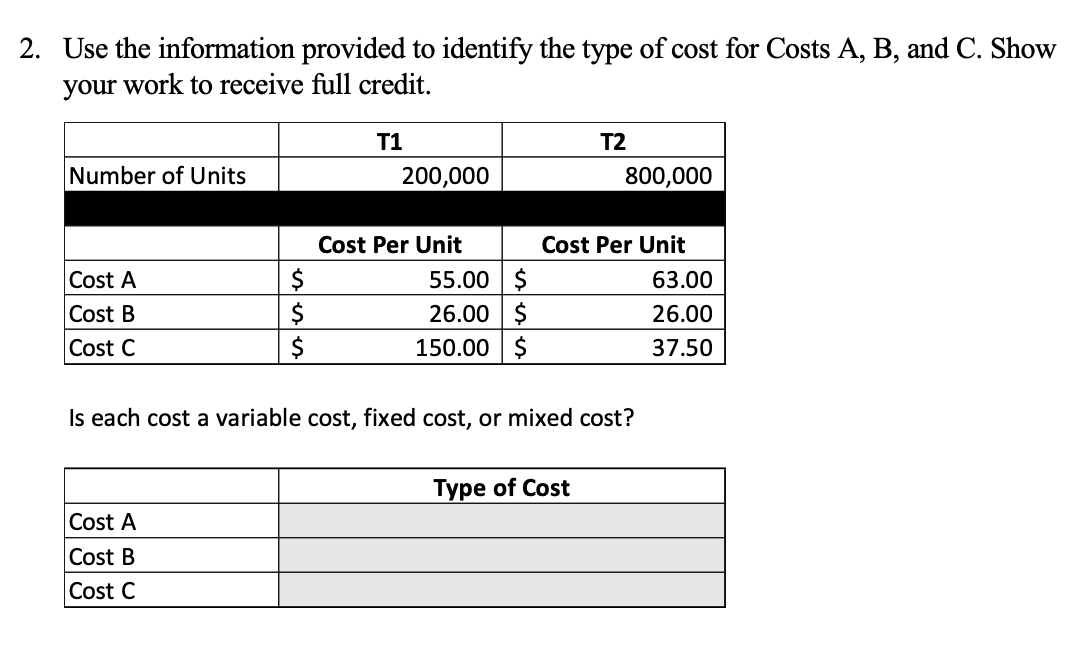

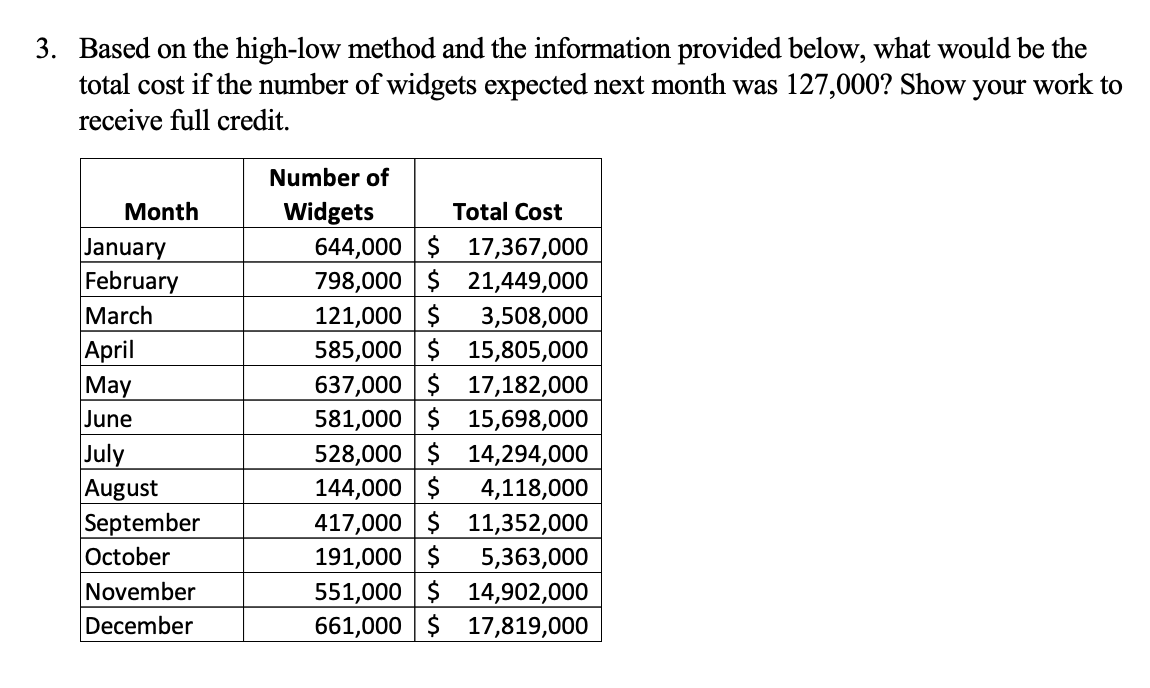

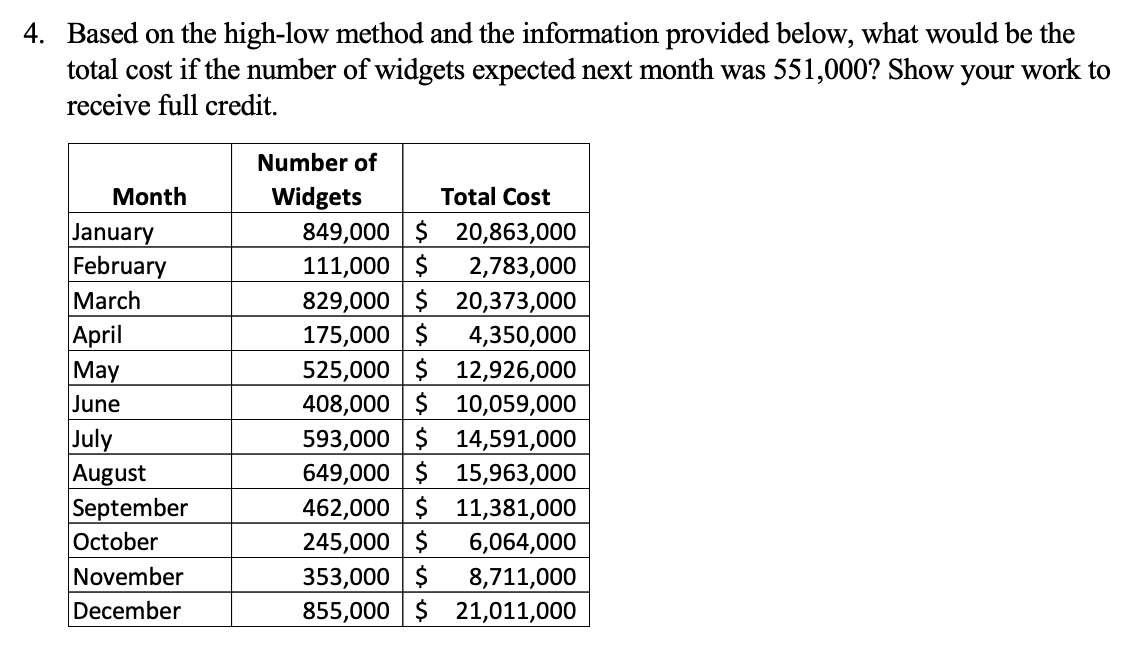

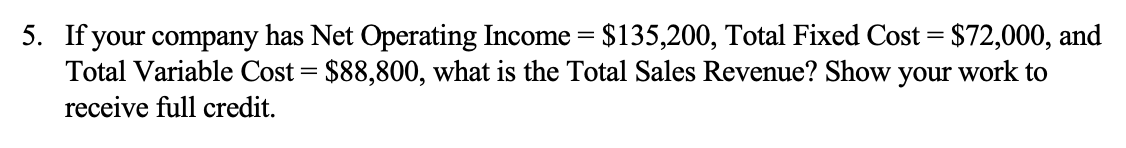

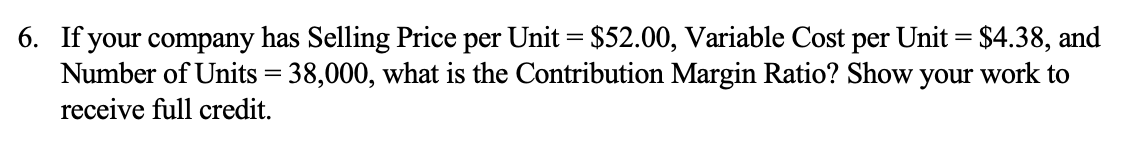

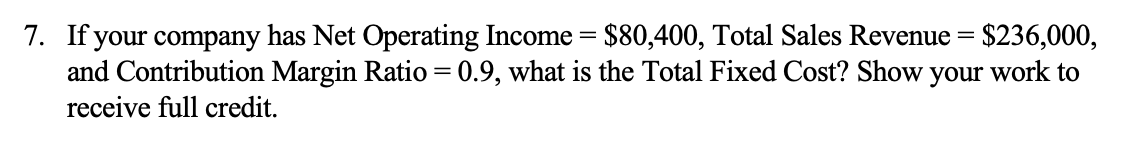

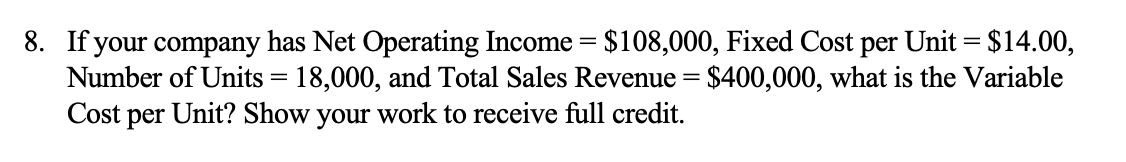

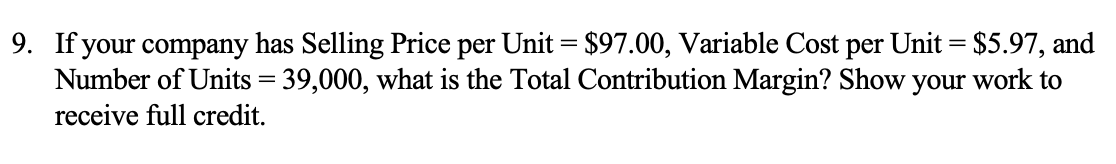

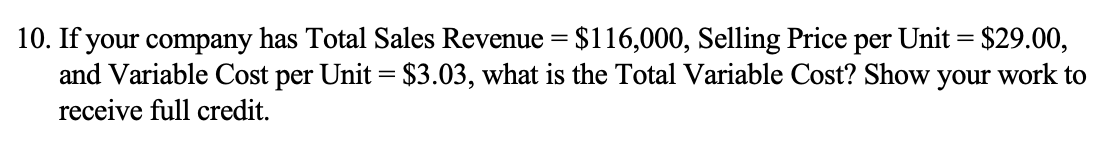

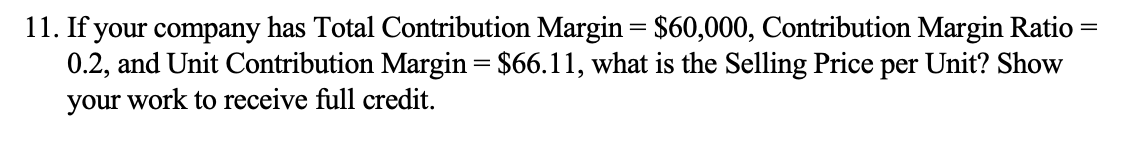

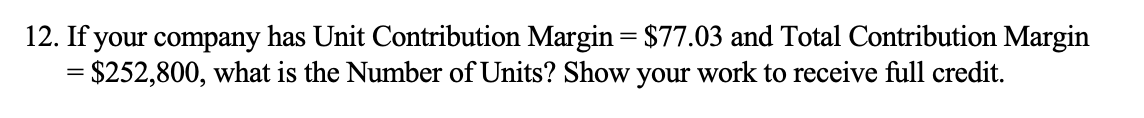

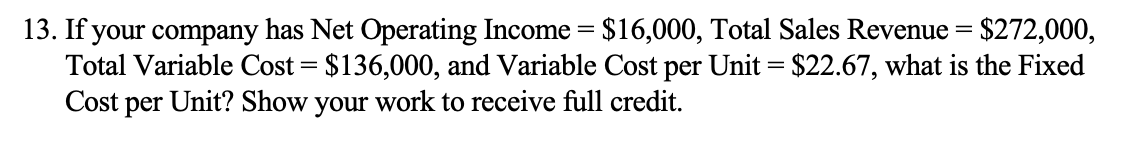

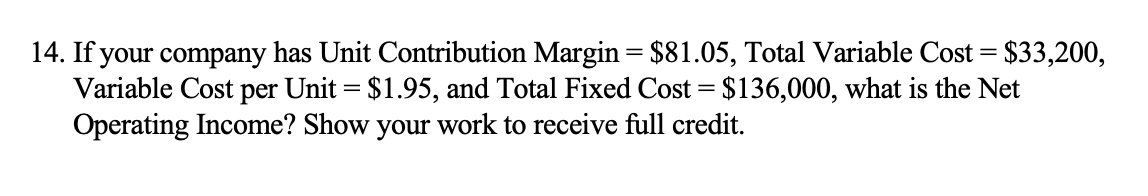

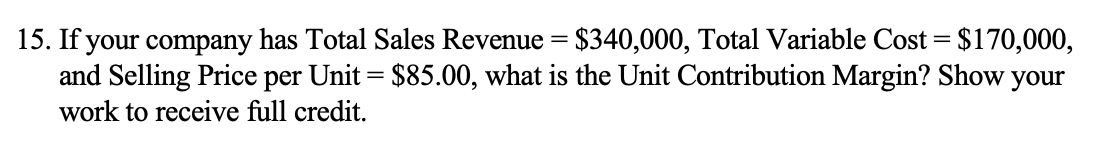

1. Use the information provided to identify the type of cost for Costs A, B, and C. Show your work to receive full credit. T1 T2 700,000 Number of Units 900,000 Cost A Cost B Cost C $ $ $ Total Cost 15,300,000 $ 21,600,000 $ 90,000,000 $ Total Cost 11,900,000 48,300,000 90,000,000 Is each cost a variable cost, fixed cost, or mixed cost? Type of Cost Cost A Cost B Cost C 2. Use the information provided to identify the type of cost for Costs A, B, and C. Show your work to receive full credit. T1 200,000 T2 800,000 Number of Units | $ Cost A Cost B Cost C Cost Per Unit 55.00 $ 26.00 $ 150.00 $ Cost Per Unit 63.00 26.00 37.50 $ Is each cost a variable cost, fixed cost, or mixed cost? Type of Cost Cost A Cost B Cost C 3. Based on the high-low method and the information provided below, what would be the total cost if the number of widgets expected next month was 127,000? Show your work to receive full credit Month January February March April May June July August September October November December Number of Widgets Total Cost 644,000 $ 17,367,000 798,000 $ 21,449,000 121,000 $ 3,508,000 585,000 $ 15,805,000 637,000 $ 17,182,000 581,000 $ 15,698,000 528,000 $ 14,294,000 144,000 $ 4,118,000 417,000 $ 11,352,000 191,000 $ 5,363,000 551,000 $ 14,902,000 661,000 $ 17,819,000 4. Based on the high-low method and the information provided below, what would be the total cost if the number of widgets expected next month was 551,000? Show your work to receive full credit. Month January February March April May June July Number of Widgets Total Cost 849,000 $ 20,863,000 111,000 $ 2,783,000 829,000 $ 20,373,000 175,000 $ 4,350,000 525,000 $ 12,926,000 408,000 $ 10,059,000 593,000 $ 14,591,000 649.000 649,000 $ $ 159 15,963,000 462,000 $ 11,381,000 245,000 $ 6,064,000 353,000 $ 8,711,000 855,000 $ 21,011,000 August September October November December 5. If your company has Net Operating Income = $135,200, Total Fixed Cost = $72,000, and Total Variable Cost = $88,800, what is the Total Sales Revenue? Show your work to receive full credit. 6. If your company has Selling Price per Unit = $52.00, Variable Cost per Unit = $4.38, and Number of Units = 38,000, what is the Contribution Margin Ratio? Show your work to receive full credit. 7. If your company has Net Operating Income = $80,400, Total Sales Revenue = $236,000, and Contribution Margin Ratio =0.9, what is the Total Fixed Cost? Show your work to receive full credit. 8. If your company has Net Operating Income = $108,000, Fixed Cost per Unit = $14.00, Number of Units = 18,000, and Total Sales Revenue = $400,000, what is the Variable Cost per Unit? Show your work to receive full credit. 9. If your company has Selling Price per Unit = $97.00, Variable Cost per Unit = $5.97, and Number of Units = 39,000, what is the Total Contribution Margin? Show your work to receive full credit. 10. If your company has Total Sales Revenue = $116,000, Selling Price per Unit = $29.00, and Variable Cost per Unit = $3.03, what is the Total Variable Cost? Show your work to receive full credit. 11. If your company has Total Contribution Margin = $60,000, Contribution Margin Ratio = 0.2, and Unit Contribution Margin = $66.11, what is the Selling Price per Unit? Show your work to receive full credit. 12. If your company has Unit Contribution Margin= $77.03 and Total Contribution Margin = $252,800, what is the Number of Units? Show your work to receive full credit. 13. If your company has Net Operating Income = $16,000, Total Sales Revenue = $272,000, Total Variable Cost = $136,000, and Variable Cost per Unit = $22.67, what is the Fixed Cost per Unit? Show your work to receive full credit. 14. If your company has Unit Contribution Margin = $81.05, Total Variable Cost = $33,200, Variable Cost per Unit = $1.95, and Total Fixed Cost = $136,000, what is the Net Operating Income? Show your work to receive full credit. 15. If your company has Total Sales Revenue = $340,000, Total Variable Cost = $170,000, and Selling Price per Unit = $85.00, what is the Unit Contribution Margin? Show your work to receive full credit