Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show work and calculations : Assume you are creating portfolios at the start of 2005 and then selling them at the end of 2010 (i.e.

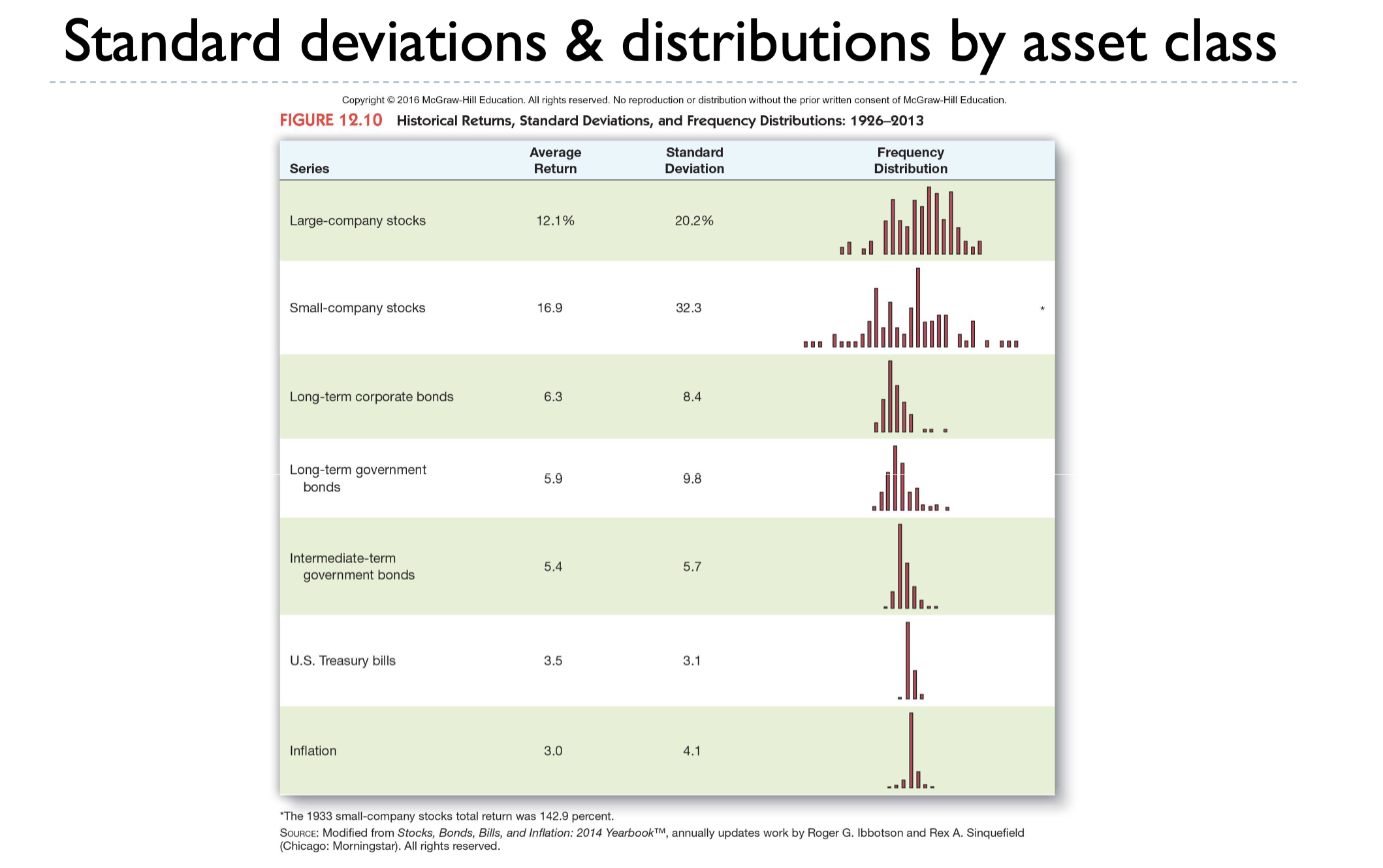

Show work and calculations : Assume you are creating portfolios at the start of 2005 and then selling them at the end of 2010 (i.e. they will be held for six years). Calculate the arithmetic and geometric average returns for each of the following three portfolios. Assuming you started with $1,000 in each portfolio, what will the final value of each portfolio be? (Ignore any taxes.) A. 100% in large company stocks B. 100% in long term government bonds C. 60% in large company stocks & 40% in long term government bonds

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started