Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work answering all parts and will give thumbs up. thank you! Q4 Sealed-Bid Auctions and Revenue Equivalence There are N risk-neutral bidders with valuations

show work answering all parts and will give thumbs up. thank you!

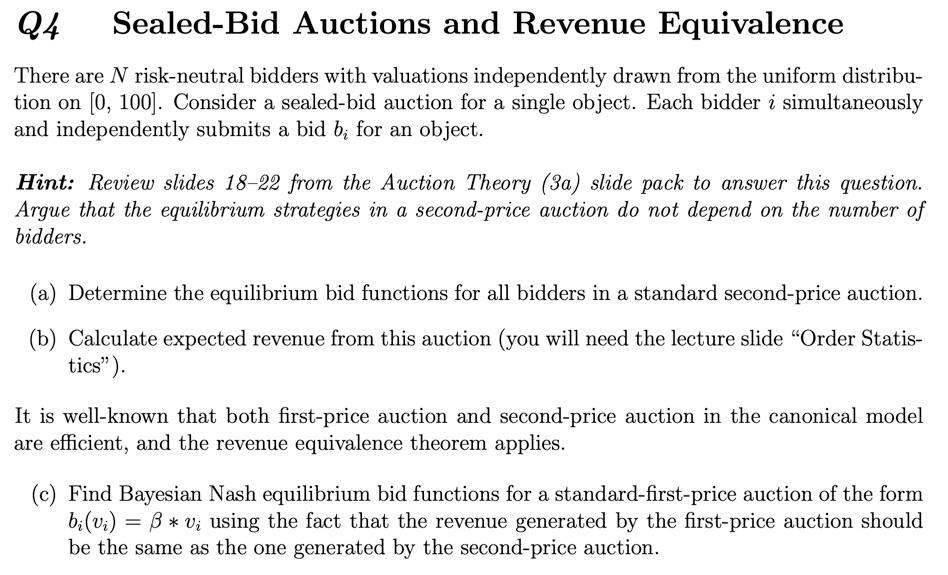

Q4 Sealed-Bid Auctions and Revenue Equivalence There are N risk-neutral bidders with valuations independently drawn from the uniform distribu- tion on (0, 100). Consider a sealed-bid auction for a single object. Each bidder i simultaneously and independently submits a bid b; for an object. Hint: Review slides 18-22 from the Auction Theory (3a) slide pack to answer this question. Argue that the equilibrium strategies in a second-price auction do not depend on the number of bidders. (a) Determine the equilibrium bid functions for all bidders in a standard second-price auction. (b) Calculate expected revenue from this auction (you will need the lecture slide Order Statis- tics"). It is well-known that both first-price auction and second-price auction in the canonical model are efficient, and the revenue equivalence theorem applies. (c) Find Bayesian Nash equilibrium bid functions for a standard-first-price auction of the form bi(vi) = B * V; using the fact that the revenue generated by the first-price auction should be the same as the one generated by the second-price auction. Q4 Sealed-Bid Auctions and Revenue Equivalence There are N risk-neutral bidders with valuations independently drawn from the uniform distribu- tion on (0, 100). Consider a sealed-bid auction for a single object. Each bidder i simultaneously and independently submits a bid b; for an object. Hint: Review slides 18-22 from the Auction Theory (3a) slide pack to answer this question. Argue that the equilibrium strategies in a second-price auction do not depend on the number of bidders. (a) Determine the equilibrium bid functions for all bidders in a standard second-price auction. (b) Calculate expected revenue from this auction (you will need the lecture slide Order Statis- tics"). It is well-known that both first-price auction and second-price auction in the canonical model are efficient, and the revenue equivalence theorem applies. (c) Find Bayesian Nash equilibrium bid functions for a standard-first-price auction of the form bi(vi) = B * V; using the fact that the revenue generated by the first-price auction should be the same as the one generated by the second-price auctionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started