Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work excel? Pixelworks has been working on advanced media tracking technology, which will be available for commercialization in a short period. If they don't

show work excel?

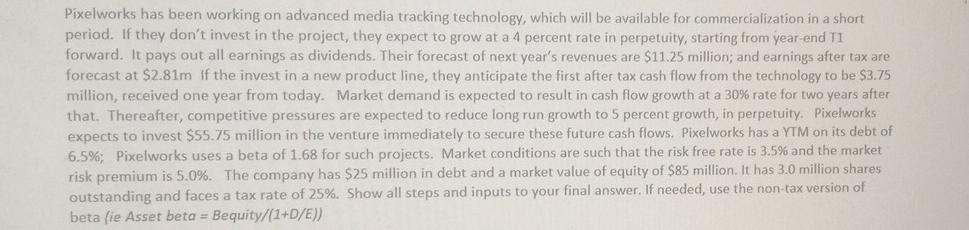

Pixelworks has been working on advanced media tracking technology, which will be available for commercialization in a short period. If they don't invest in the project, they expect to grow at a 4 percent rate in perpetuity, starting from year-end T1 forward. It pays out all earnings as dividends. Their forecast of next year's revenues are $11.25 million; and earnings after tax are forecast at $2.81m If the invest in a new product line, they anticipate the first after tax cash flow from the technology to be $3.75 million, received one year from today. Market demand is expected to result in cash flow growth at a 30% rate for two years after that. Thereafter, competitive pressures are expected to reduce long run growth to 5 percent growth, in perpetuity. Pixelworks expects to invest $55.75 million in the venture immediately to secure these future cash flows. Pixelworks has a YTM on its debt of 6.5%; Pixelworks uses a beta of 1.68 for such projects. Market conditions are such that the risk free rate is 3.5% and the market risk premium is 5.0%. The company has $25 million in debt and a market value of equity of $85 million. It has 3.0 million shares outstanding and faces a tax rate of 25%. Show all steps and inputs to your final answer. If needed, use the non-tax version of beta (ie Asset beta = Bequity/(1+D/E)) b. What is the value of the company WITHOUT the project? The price per share? Assume all cash flows are received at year's end. - Value per Share, w/o investmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started