Answered step by step

Verified Expert Solution

Question

1 Approved Answer

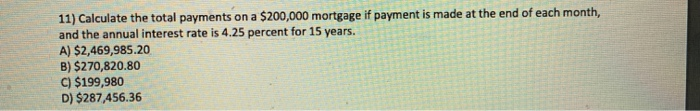

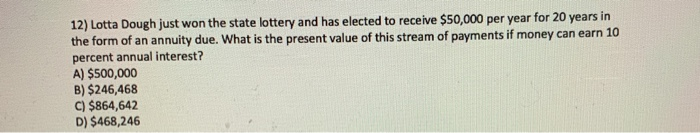

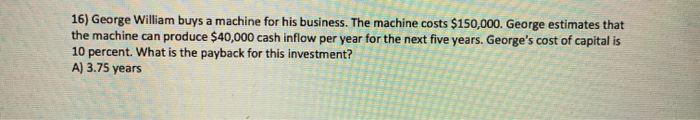

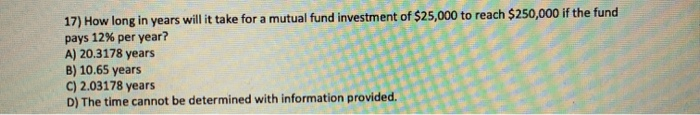

*SHOW WORK FOR ALL PROBLEMS* Problems 11, 12, 16, 17, & 18 11) Calculate the total payments on a $200,000 mortgage if payment is made

*SHOW WORK FOR ALL PROBLEMS*

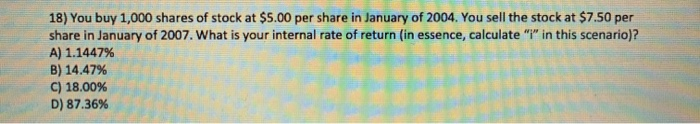

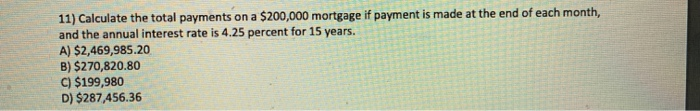

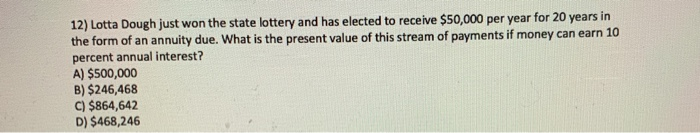

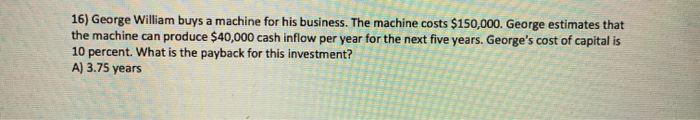

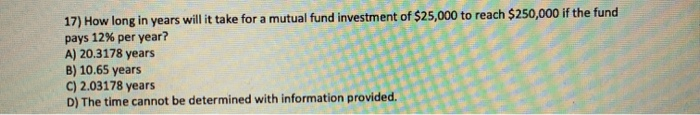

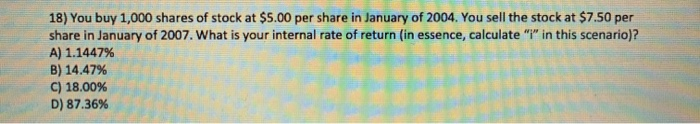

11) Calculate the total payments on a $200,000 mortgage if payment is made at the end of each month, and the annual interest rate is 4.25 percent for 15 years. A) $2,469,985.20 B) $270,820.80 C) $199,980 D) $287.456.36 12) Lotta Dough just won the state lottery and has elected to receive $50,000 per year for 20 years in the form of an annuity due. What is the present value of this stream of payments if money can earn 10 percent annual interest? A) $500,000 B) $246,468 C) $864,642 D) $468,246 16) George William buys a machine for his business. The machine costs $150,000. George estimates that the machine can produce $40,000 cash inflow per year for the next five years. George's cost of capital is 10 percent. What is the payback for this investment? A) 3.75 years 17) How long in years will it take for a mutual fund investment of $25,000 to reach $250,000 if the fund pays 12% per year? A) 20.3178 years B) 10.65 years C) 2.03178 years D) The time cannot be determined with information provided. 18) You buy 1,000 shares of stock at $5.00 per share in January of 2004. You sell the stock at $7.50 per share in January of 2007. What is your internal rate of return (in essence, calculate "l" in this scenario)? A) 1.1447% B) 14.47% C) 18.00% D) 87.36% Problems 11, 12, 16, 17, & 18

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started