Answered step by step

Verified Expert Solution

Question

1 Approved Answer

**SHOW WORK FOR ALL PROBLEMS** Problems 4, 6, 7 & 10. 4) If you deposit $1,000 in an account that compounds quarterly at 8 percent

**SHOW WORK FOR ALL PROBLEMS**

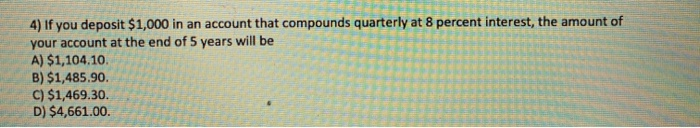

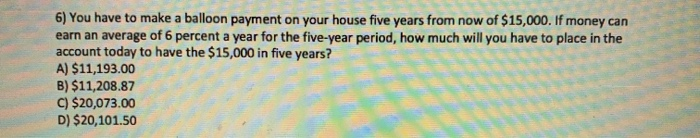

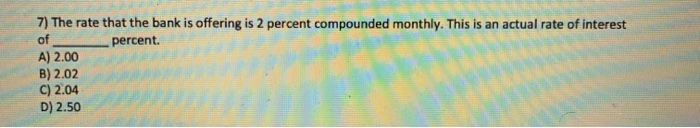

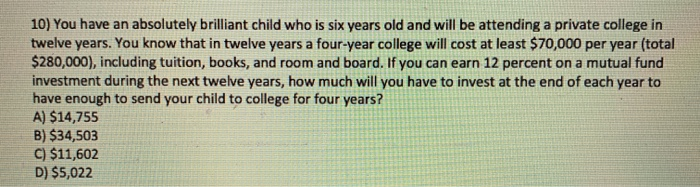

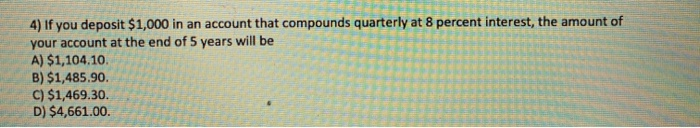

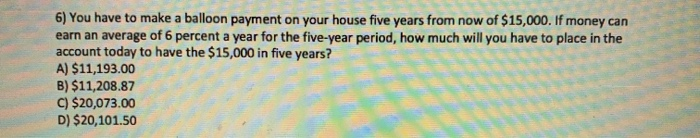

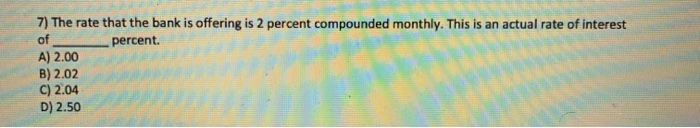

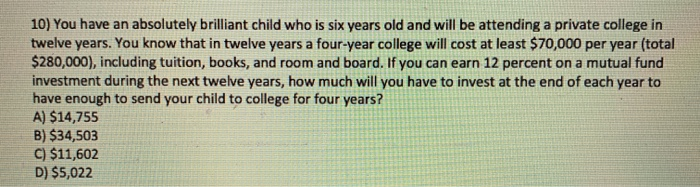

4) If you deposit $1,000 in an account that compounds quarterly at 8 percent interest, the amount of your account at the end of 5 years will be A) $1,104.10. B) $1,485.90 C) $1,469.30. D) $4,661.00. 6) You have to make a balloon payment on your house five years from now of $15,000. If money can earn an average of 6 percent a year for the five-year period, how much will you have to place in the account today to have the $15,000 in five years? A) $11,193.00 B) $11,208.87 C) $20,073.00 D) $20,101.50 7) The rate that the bank is offering is 2 percent compounded monthly. This is an actual rate of interest of percent. A) 2.00 B) 2.02 C) 2.04 D) 2.50 10) You have an absolutely brilliant child who is six years old and will be attending a private college in twelve years. You know that in twelve years a four-year college will cost at least $70,000 per year (total $280,000), including tuition, books, and room and board. If you can earn 12 percent on a mutual fund investment during the next twelve years, how much will you have to invest at the end of each year to have enough to send your child to college for four years? A) $14,755 B) $34,503 C) $11,602 D) $5,022 Problems 4, 6, 7 & 10.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started