Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show work in excel and use excel functions and formulas. Problem 1 1 . 9 : You recently went to work for Allied Components Company,

Show work in excel and use excel functions and formulas.

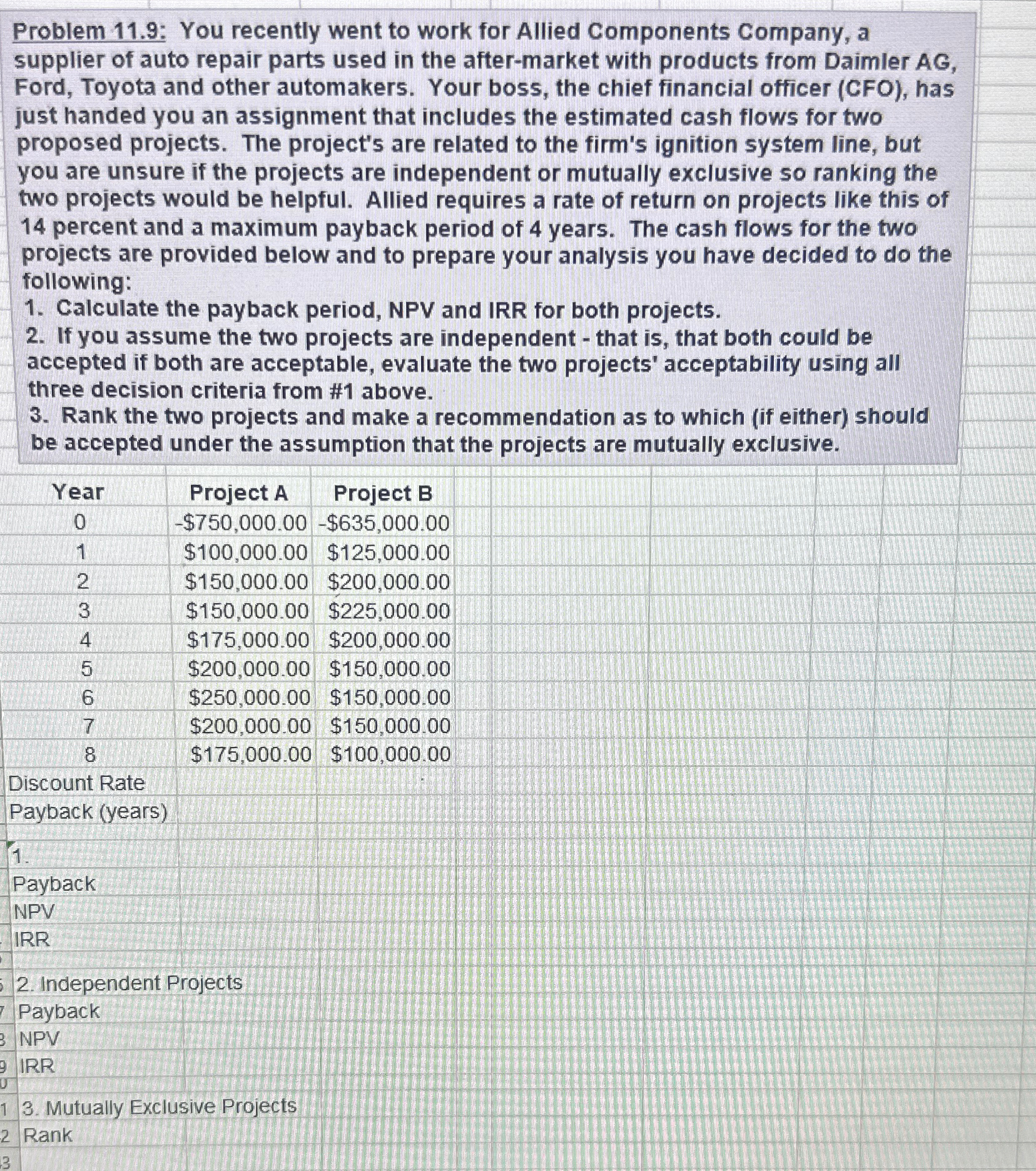

Problem : You recently went to work for Allied Components Company, a supplier of auto repair parts used in the aftermarket with products from Daimler AG Ford, Toyota and other automakers. Your boss, the chief financial officer CFO has just handed you an assignment that includes the estimated cash flows for two proposed projects. The project's are related to the firm's ignition system line, but you are unsure if the projects are independent or mutually exclusive so ranking the two projects would be helpful. Allied requires a rate of return on projects like this of percent and a maximum payback period of years. The cash flows for the two projects are provided below and to prepare your analysis you have decided to do the following:

Calculate the payback period, NPV and IRR for both projects.

If you assume the two projects are independent that is that both could be accepted if both are acceptable, evaluate the two projects' acceptability using all three decision criteria from # above.

Rank the two projects and make a recommendation as to which if either should be accepted under the assumption that the projects are mutually exclusive.

tableYearProject AProject B$$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started