show work on how to get the answers provided

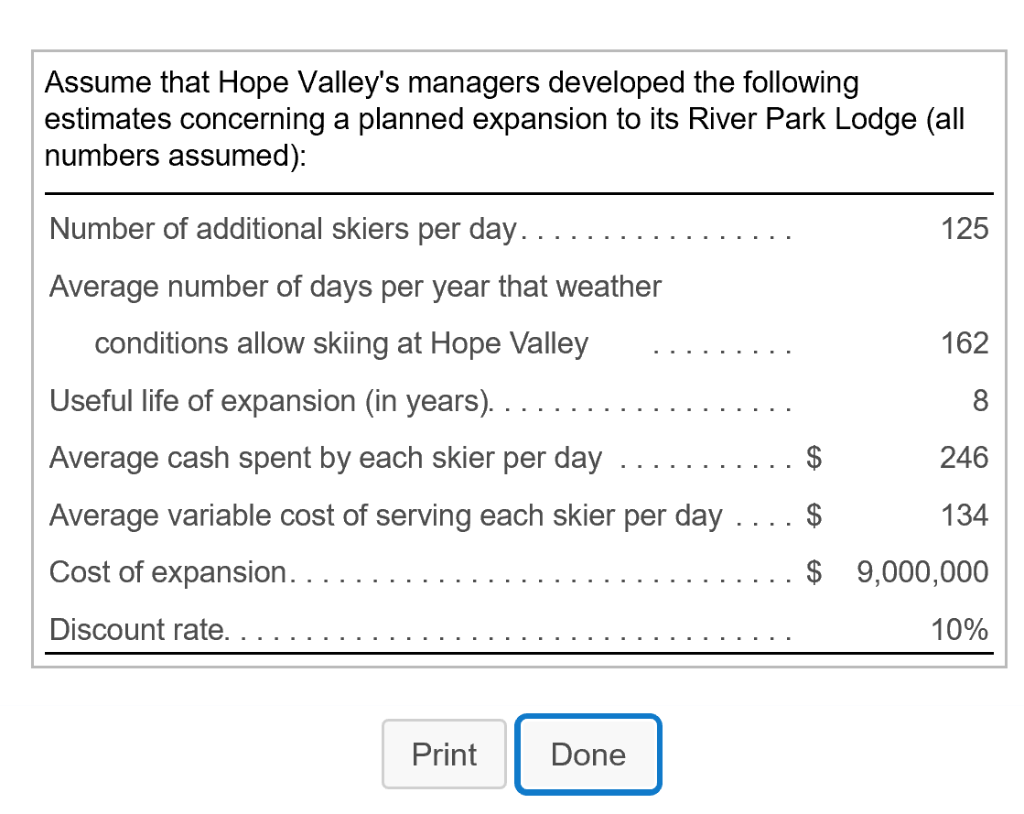

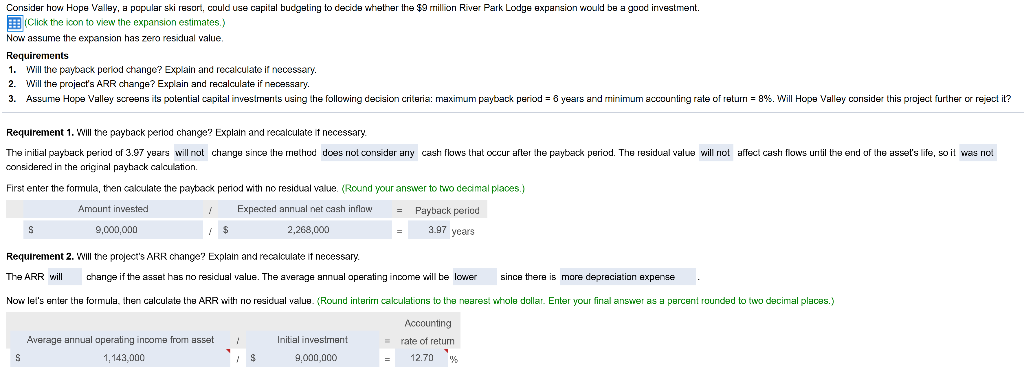

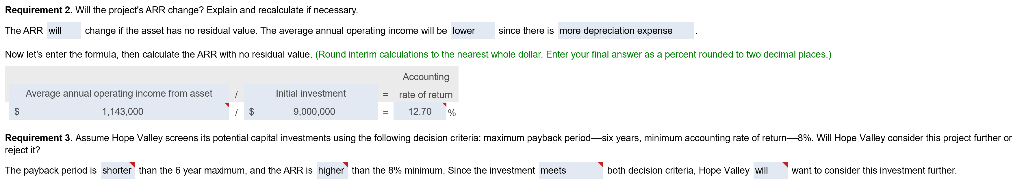

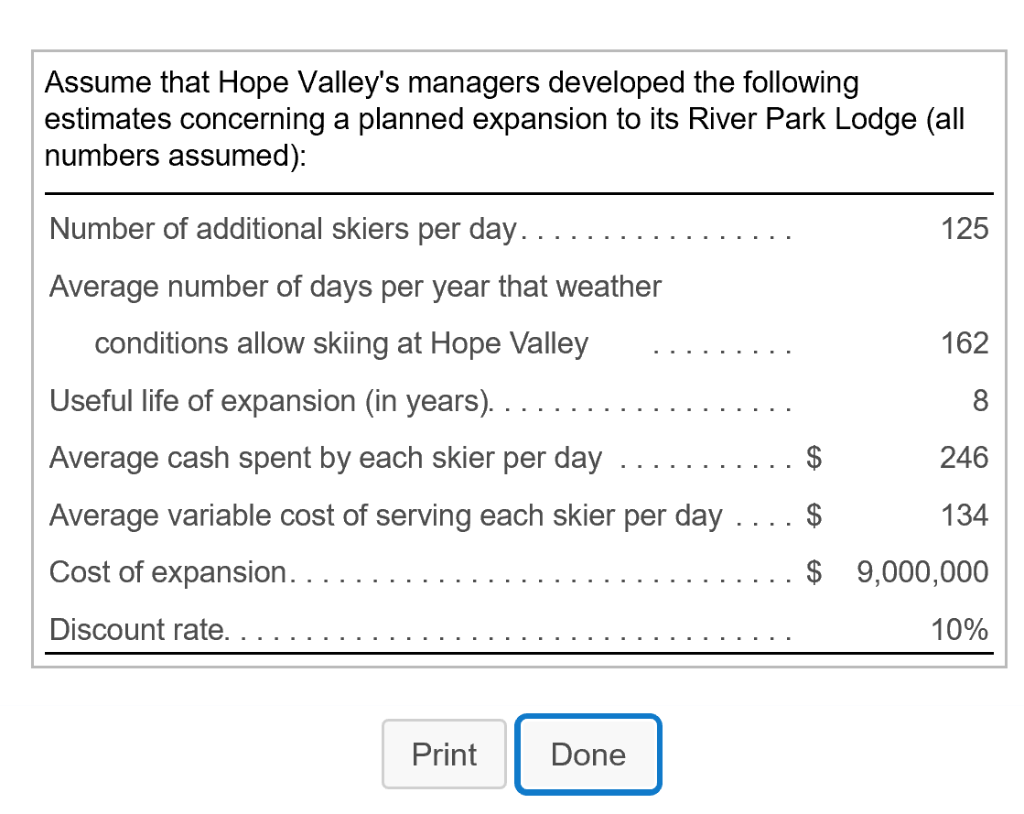

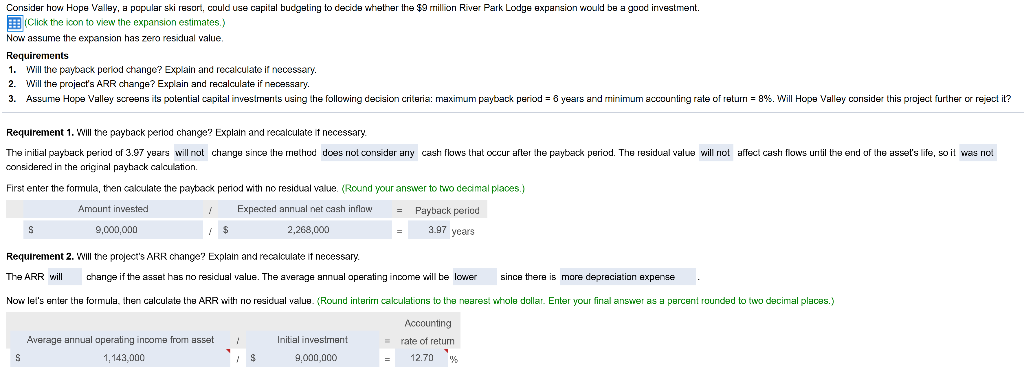

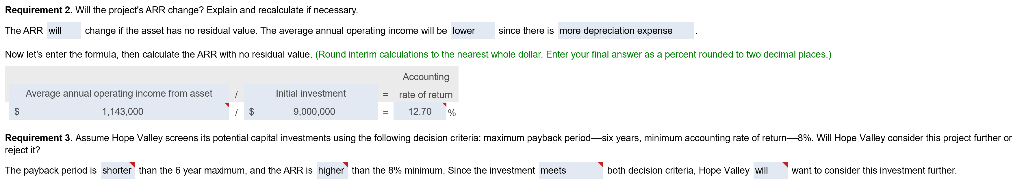

Assume that Hope Valley's managers developed the following estimates concerning a planned expansion to its River Park Lodge (all numbers assumed): Number of additional skiers per day. . . 125 Average number of days per year that weather conditions allow skiing at Hope Valley 162 Useful life of expansion (in years) 246 Average cash spent by each skier per day $ 134 Average variable cost of serving each skier per day Cost of expansion 9,000,000 Discount rate. 10% Print Done Consider how Hope Valley, a popular ski resort, could use capital budgeting to decide whether the $9 million River Park Lodge expansion would be a good investment. (Click the icon view the expansion estimates,) Now assume the expansion has zero residual value Requirements 1. Will the payback period change? Explain and recalculate if necessary. Will the project's ARR change? Explain and recalculate if necassary 2. s polential capital invesiments using the following decision criteria: maximum payback period 6 years and minimum accounling rale of return 8% . Will Hope Valley consider this project further or reject it? Assume Hope Valley screens Requirement 1. Will the payback perlod change? Explain and recalculate it necessary The inital payback period of 3.97 years will not change since the method does not consider aiy cash flows that occur after thee payback period. The residual value will not affect cash flows until the end the assol's life, so it was Io! considered in the ariginal payhack calculation First enter the formula, then caloulate the payback period with no residual value.. (Round your answer to two decimal places.) Amaunt invested Expected annual net cash inflow Payback periud 3.97 years 9,000,000 2,268,000 Requirement 2. WIII the project's ARR change? Explain and recalculate if necessary change if the asset has no residual value. The average annual operating inoome will be lower since there is mare depreciation expense The ARR will Now let's enter the formula, then calculate the ARR with no residual value. (Round interirm calculations to the nearesi whole dollar. Enter your final answer as a percent rounded fwo decimal places. Accounting Average annual operating inoome from asset Inital investment rate of return 1.143.000 9.000.000 12.70 Requirement 2. Will the praject's ARR change? Explain and recalculate if necessary The ARR will since there is muru depreciation experise change if the asset has no residual value. The average annual uperating income will be lower Now let's enter the tormula, then calculate the ARR with no residual value. (Round intenm calculations to the nearest whole dollar. Enter your final answer as a percent rounded to two decimal places.) Accounting Average annual operating income from asset Initial investment rate of retum 9.000,000 1,143,000 Requirement 3. Assume Hope Valley screens s potential capital investmentas using the following decision criteria: maximum payback period-six years, minimum accounting rate of return-%. Will Hope Valley consider this praject further or reiect it? The payback penod is shorterthan the 5 year maxmum, and the ARR Is higher than the B% minimum. Since the investment meets hoth decision cniteria, Hope Valley Will want to consider this Investment furthen