Answered step by step

Verified Expert Solution

Question

1 Approved Answer

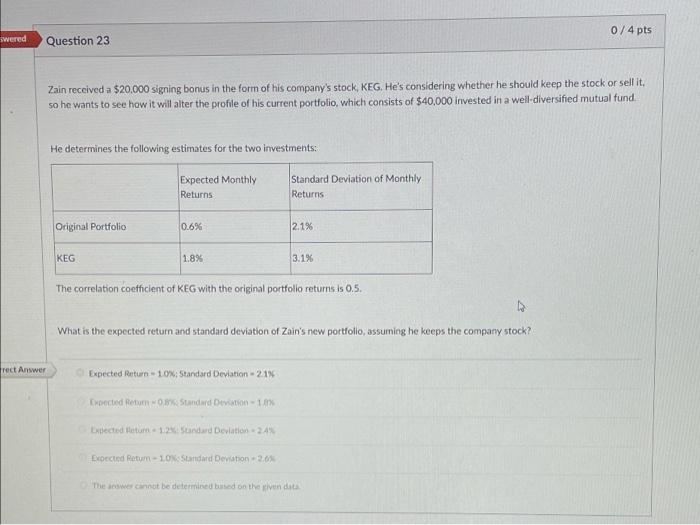

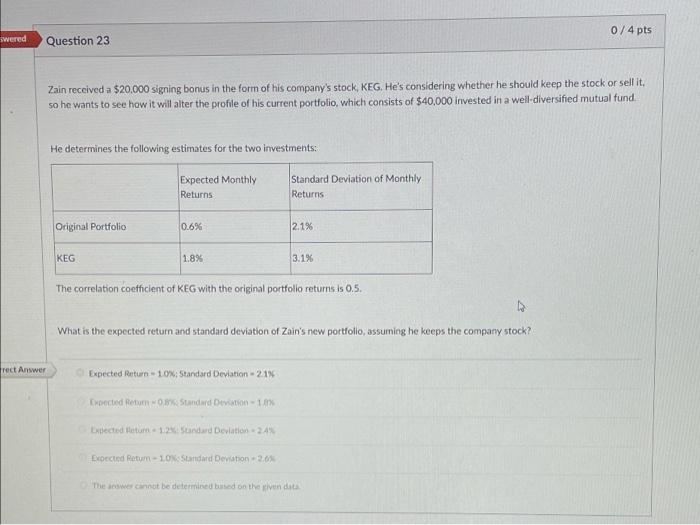

show work on paper please Zain received a $20.000 signing bonus in the form of his company's stock, KEG. He's considering whether he should keep

show work on paper please

Zain received a $20.000 signing bonus in the form of his company's stock, KEG. He's considering whether he should keep the stock or sell it. so he wants to see how it will alter the profile of his current portfolio, which consists of $40,000 invested in a well-diversified mutual fund. He determines the following estimates for the two investments: The correlation coefficient of KEG with the original portfolio returns is 0.5. What is the expected return and standard deviation of Zain's new portfolio, assuming he keeps the company stock? Expected Retien - 10x: 5tandard Deviation - 21s Lnifected fleturn + 1225 Standard Deviation =24A

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started