Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work please Accounts Payable at January 1, 2020 were $347,000. Accounts Payable at December 31, 2020 were $382,000. How would this change in Accounts

show work please

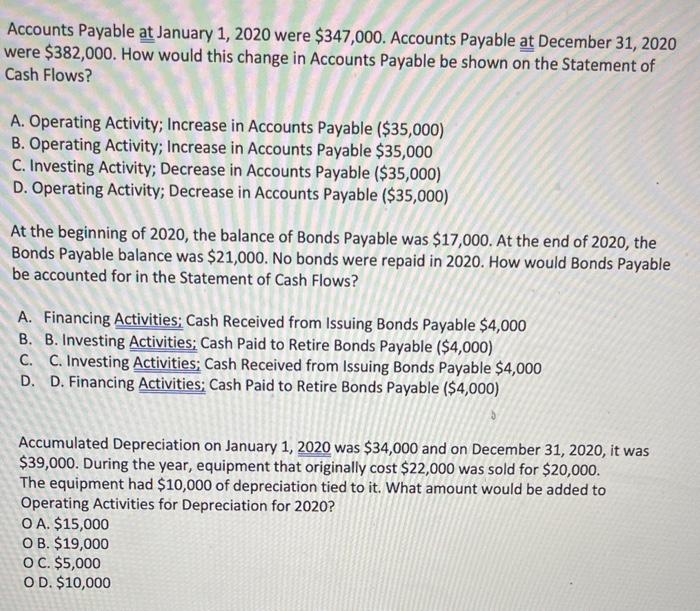

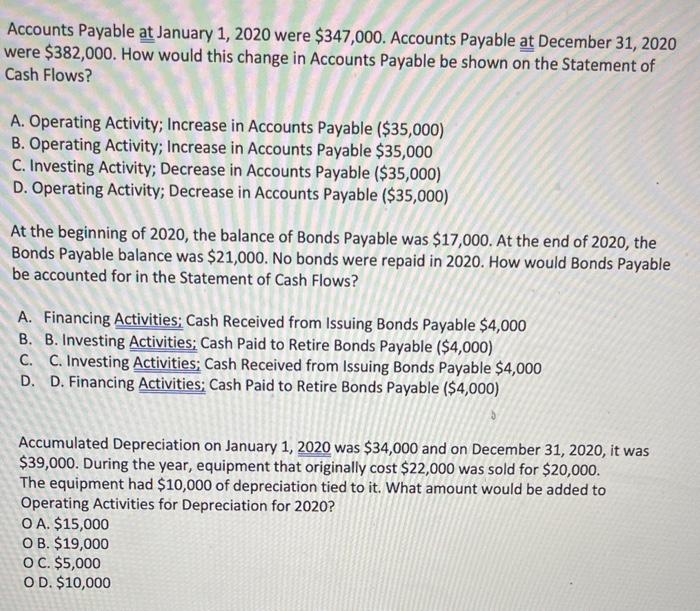

Accounts Payable at January 1, 2020 were $347,000. Accounts Payable at December 31, 2020 were $382,000. How would this change in Accounts Payable be shown on the Statement of Cash Flows? A. Operating Activity; Increase in Accounts Payable ($35,000) B. Operating Activity; Increase in Accounts Payable $35,000 C. Investing Activity; Decrease in Accounts Payable ($35,000) D. Operating Activity; Decrease in Accounts Payable ($35,000) At the beginning of 2020 , the balance of Bonds Payable was $17,000. At the end of 2020 , the Bonds Payable balance was $21,000. No bonds were repaid in 2020 . How would Bonds Payable be accounted for in the Statement of Cash Flows? A. Financing Activities; Cash Received from Issuing Bonds Payable $4,000 B. B. Investing Activities; Cash Paid to Retire Bonds Payable ($4,000) C. C. Investing Activities; Cash Received from Issuing Bonds Payable $4,000 D. D. Financing Activities; Cash Paid to Retire Bonds Payable ($4,000) Accumulated Depreciation on January 1,2020 was $34,000 and on December 31,2020 , it was $39,000. During the year, equipment that originally cost $22,000 was sold for $20,000. The equipment had $10,000 of depreciation tied to it. What amount would be added to Operating Activities for Depreciation for 2020? O A. \$15,000 O B. $19,000 OC. $5,000 D. $10,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started