Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show work please Job-Order problems 1. The University of Chicago Press uses job-order costing to cost each job. It allocates factory overhead on the basis

Show work please

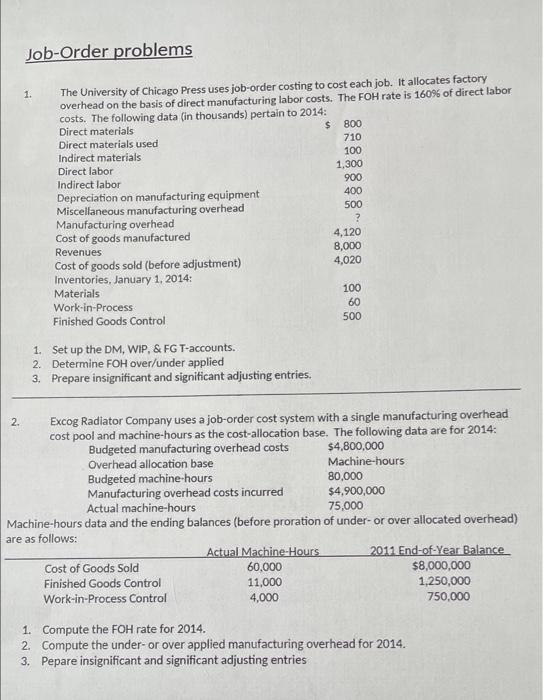

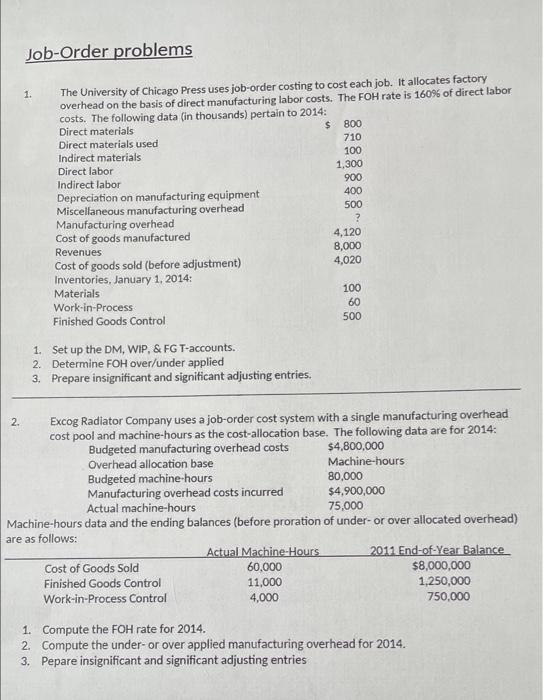

Job-Order problems 1. The University of Chicago Press uses job-order costing to cost each job. It allocates factory overhead on the basis of direct manufacturing labor costs. The FOH rate is 160% of direct labor costs. The following data (in thousands) pertain to 2014: Direct materials $ 800 Direct materials used 710 Indirect materials 100 Direct labor 1,300 Indirect labor 900 Depreciation on manufacturing equipment 400 Miscellaneous manufacturing overhead 500 Manufacturing overhead ? Cost of goods manufactured 4,120 Revenues 8,000 Cost of goods sold (before adjustment) 4,020 Inventories, January 1, 2014: Materials 100 Work-in-Process 60 Finished Goods Control 500 1. Set up the DM, WIP. & FG T-accounts. 2. Determine FOH over/under applied 3. Prepare insignificant and signiticant adjusting entries. 2. Excog Radiator Company uses a job-order cost system with a single manufacturing overhead cost pool and machine-hours as the cost-allocation base. The following data are for 2014: Budgeted manufacturing overhead costs $4,800,000 Overhead allocation base Machine-hours Budgeted machine hours 80,000 Manufacturing overhead costs incurred $4,900,000 Actual machine-hours 75,000 Machine-hours data and the ending balances (before proration of under-or over allocated overhead) are as follows: Actual Machine Hours 2011 End-of-Year Balance Cost of Goods Sold 60,000 $8,000,000 Finished Goods Control 11,000 1,250,000 Work-in-Process Control 4,000 750,000 1. Compute the FOH rate for 2014. 2. Compute the under-or over applied manufacturing overhead for 2014. 3. Pepare insignificant and significant adjusting entries

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started