Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show work please PROBLEM SET ON OPTIMAL CAPITAL STRUCTURE ACB Inc. is examining its capital structure with the intent of arriving at an optimal debt

show work please

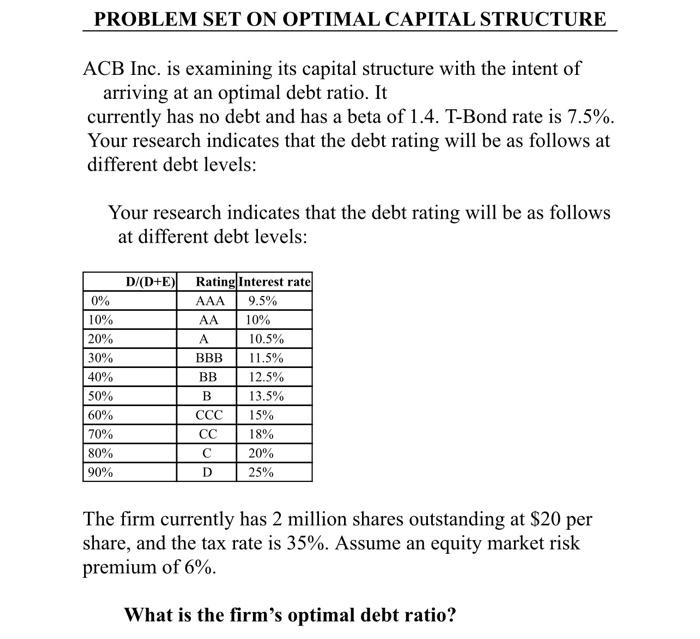

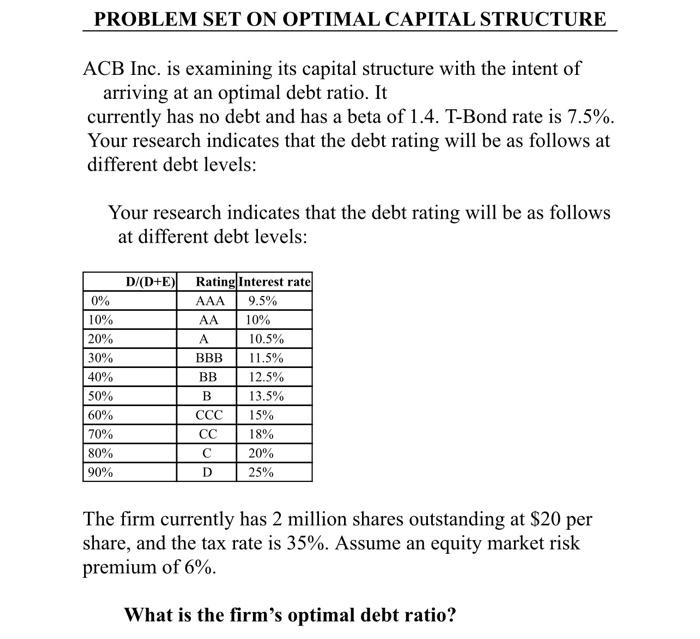

PROBLEM SET ON OPTIMAL CAPITAL STRUCTURE ACB Inc. is examining its capital structure with the intent of arriving at an optimal debt ratio. It currently has no debt and has a beta of 1.4. T-Bond rate is 7.5%. Your research indicates that the debt rating will be as follows at different debt levels: Your research indicates that the debt rating will be as follows at different debt levels: D/(D+E) 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% Rating Interest rate AAA 9.5% AA 10% A 10.5% BBB 11.5% BB 12.5% B 13.5% CCC 15% CC 18% 20% D 25% The firm currently has 2 million shares outstanding at $20 per share, and the tax rate is 35%. Assume an equity market risk premium of 6%. What is the firm's optimal debt ratio

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started