Answered step by step

Verified Expert Solution

Question

1 Approved Answer

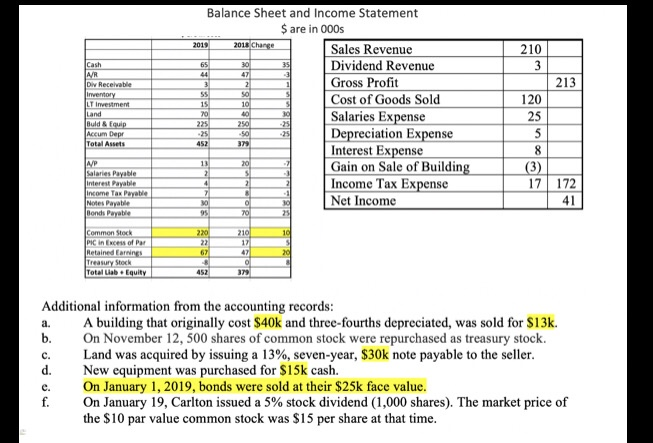

Show work please Use indirect Method use the direct method as stated in the problem. Sorry for confusion. 210 Balance Sheet and Income Statement $

Show work please

Show work please Use indirect Method

use the direct method as stated in the problem. Sorry for confusion.

210 Balance Sheet and Income Statement $ are in 000s 2018 Change Sales Revenue Dividend Revenue Gross Profit Cost of Goods Sold Salaries Expense Depreciation Expense Interest Expense Gain on Sale of Building Income Tax Expense Net Income 86999996 Buld & Equip Accum Depr Total Assets BARENTING 0 OP Salarles Payable Bonds Payable Common Stock PIC in Ece of Per Retained Earnings Treasury Stock Total Lab Equity 2 96 Additional information from the accounting records: A building that originally cost $40k and three-fourths depreciated, was sold for $13k. On November 12, 500 shares of common stock were repurchased as treasury stock. Land was acquired by issuing a 13%, seven-year, $30k note payable to the seller. New equipment was purchased for $15k cash. On January 1, 2019, bonds were sold at their $25k face value. On January 19, Carlton issued a 5% stock dividend (1,000 shares). The market price of the $10 par value common stock was $15 per share at that time. Required: Prepare the statement of cash flows of Carlton Company for the year ended December 31, 2019 Present cash flows from operating activities by the direct method. Follow FASBs preferred method of preparing presenting the statement of cash flows (check your textbook for this requirement) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started