Answered step by step

Verified Expert Solution

Question

1 Approved Answer

show working and answers ASAP Which of the following statements is true? Select one: a. Neither systematic nor unsystematic risk can be reduced through diversification.

show working and answers ASAP

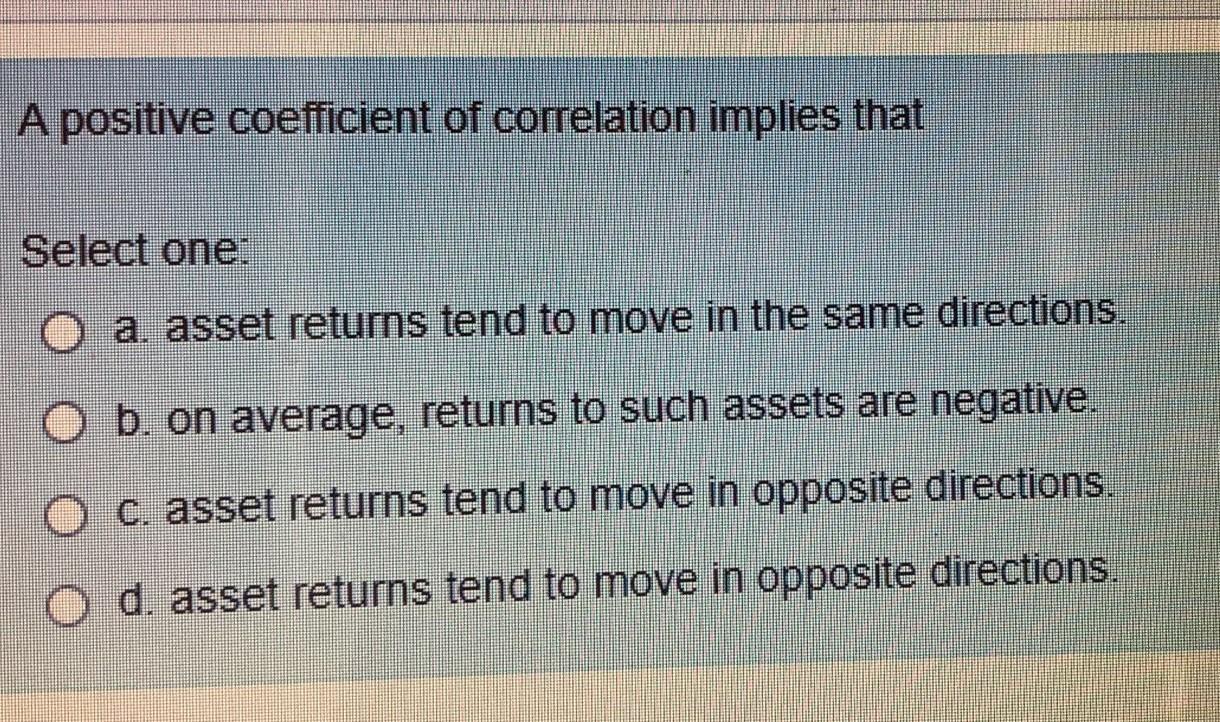

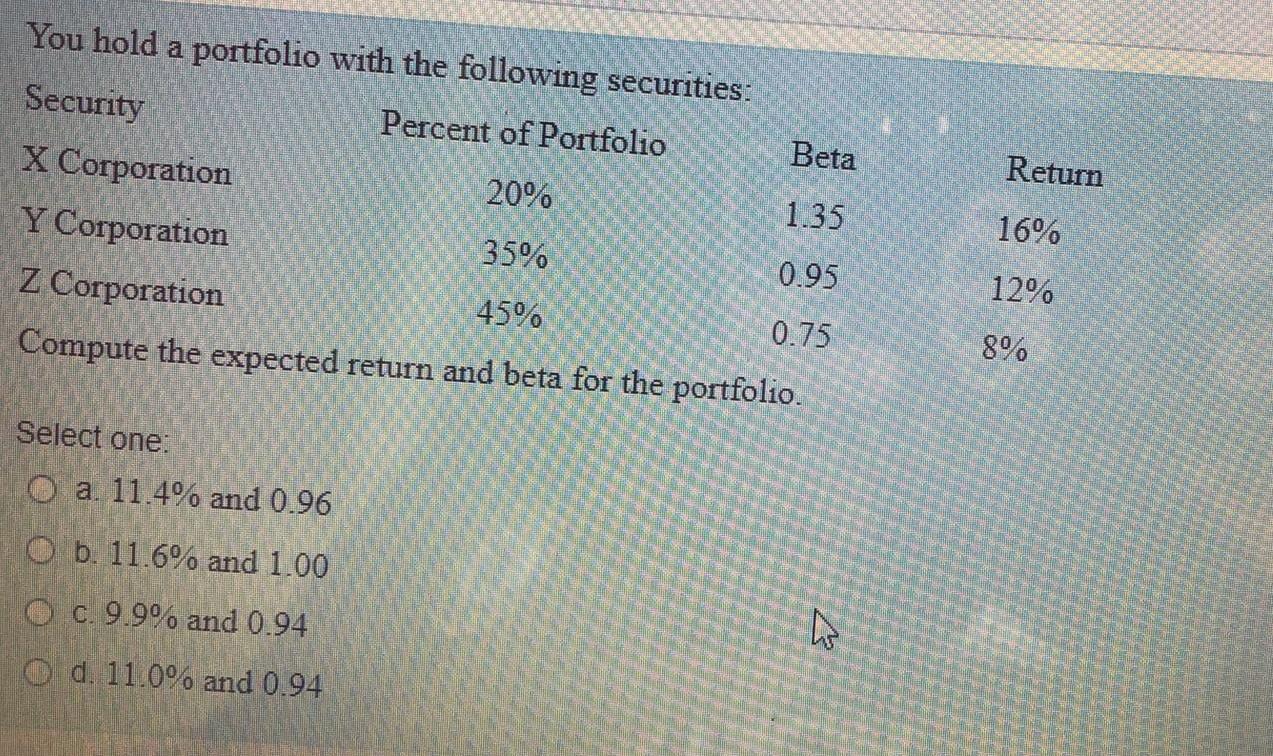

Which of the following statements is true? Select one: a. Neither systematic nor unsystematic risk can be reduced through diversification. b. Systematic, or market, risk can be reduced through diversification. c. Unsystematic, or company, risk can be reduced through diversification. d. Both systematic and unsystematic risk can be reduced through diversification. XYZ. Inc recently had earnings per share of $12.90. Their dividend payout ratio is 20% and the policy is to maintain the same payout ratio Earnings are expected to grow at an average rate of 6% per year. If investors require a 12% rate of return on this stock, what will they be willing to pay for one share? Select one: a. $45.58 b. $22.75 c. $21.50 d. $43.00 Calculate the yield to maturity of a bond a with nine years remaining that pays a coupon rate of 20% per year and has a $1,000 par value. It is currently selling for $1,407? Select one: a. 11.43% b. 21.81% c. 12.17% d. 6.14% Time value of money is derived from the Select one: O a existence of profitable investment alternatives and interest rates. O b. elimination of the opportunity cost as a consideration. O c. fact that the value of saving money for tomorrow could be more or less than spending it today O d. fact that the passing of time increases the value of money. A positive coefficient of correlation implies that Select one: O a. asset returns tend to move in the same directions. O b. on average, returns to such assets are negative. c. asset returns tend to move in opposite directions. O d. asset returns tend to move in opposite directions. Return You hold a portfolio with the following securities: Security Percent of Portfolio Beta X Corporation 20% 1.35 Y Corporation 35% 0.95 Z Corporation 45% 0.75 Compute the expected return and beta for the portfolio. 16% 12% 8% Select one: O a. 11.4% and 0.96 O b. 11.6% and 1.00 OC. 9.9% and 0.94 h d. 11.0% and 0.94

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started