show working how to calculate it pleases

show working how to calculate it pleases

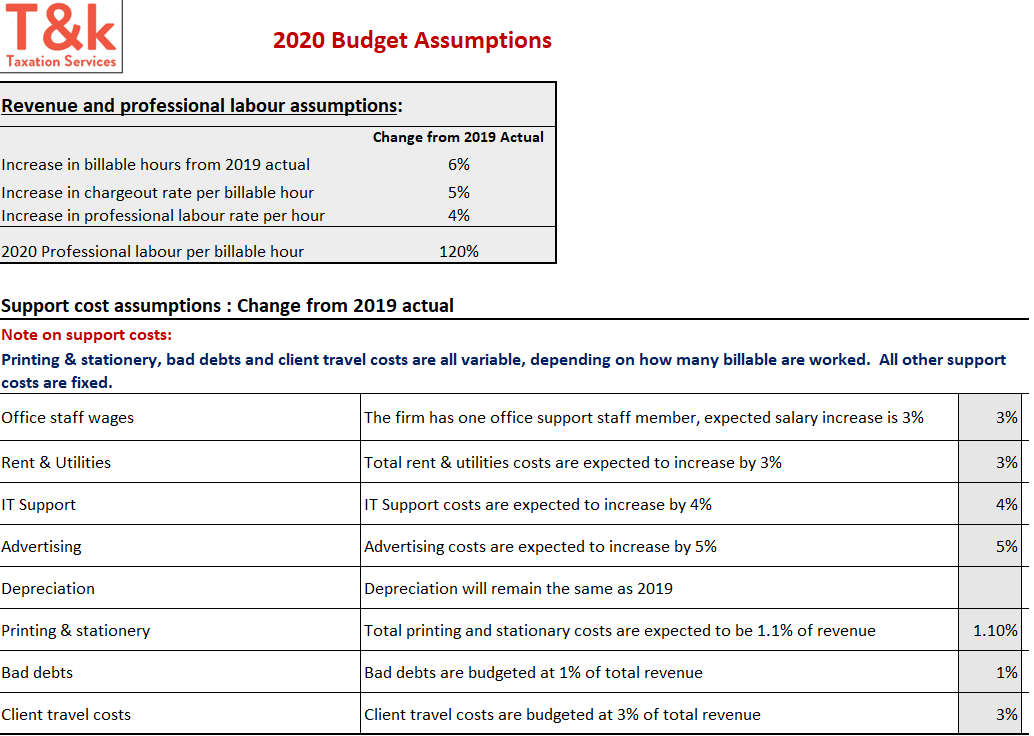

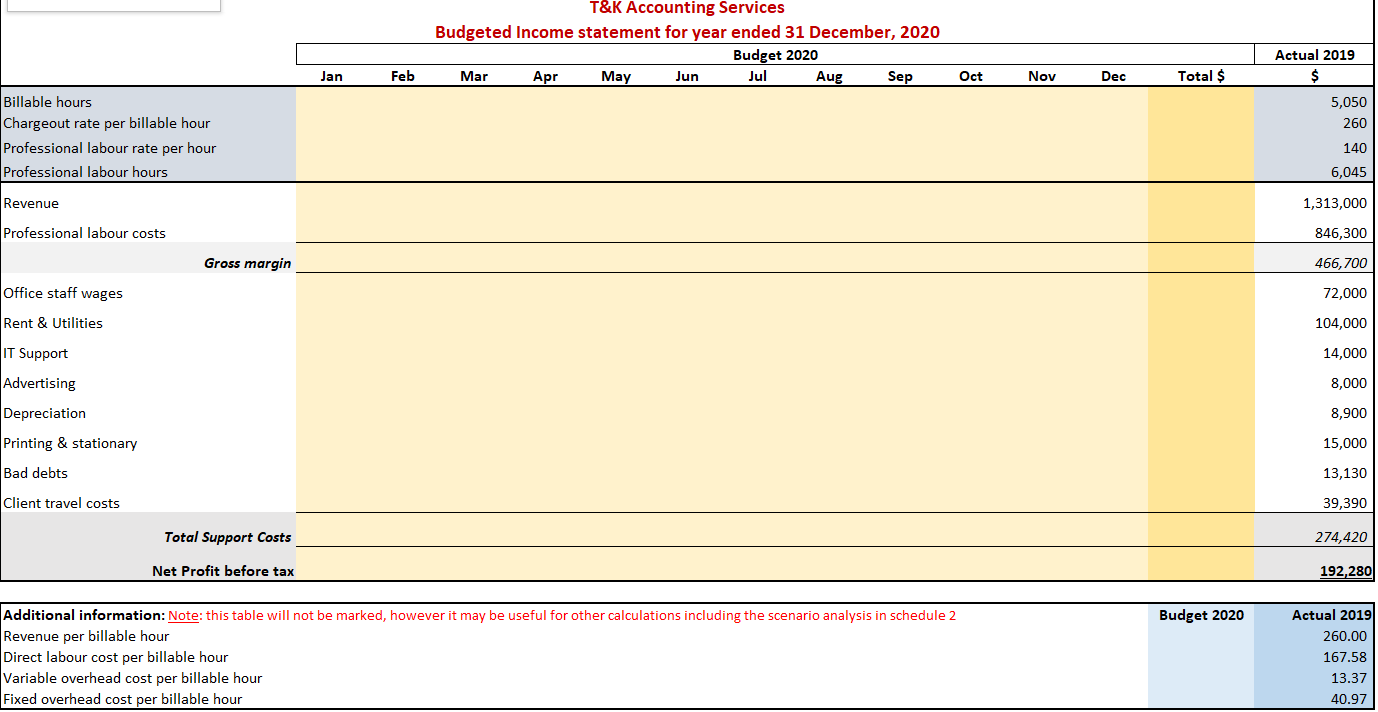

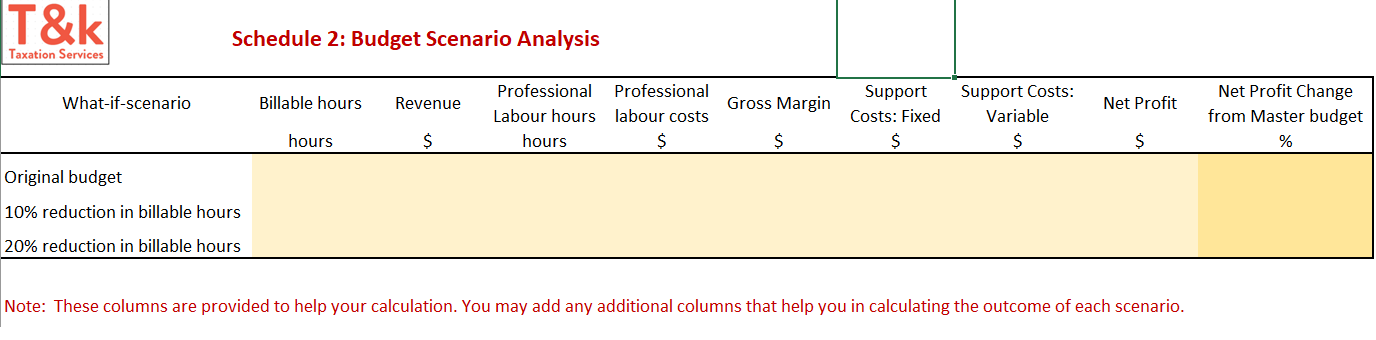

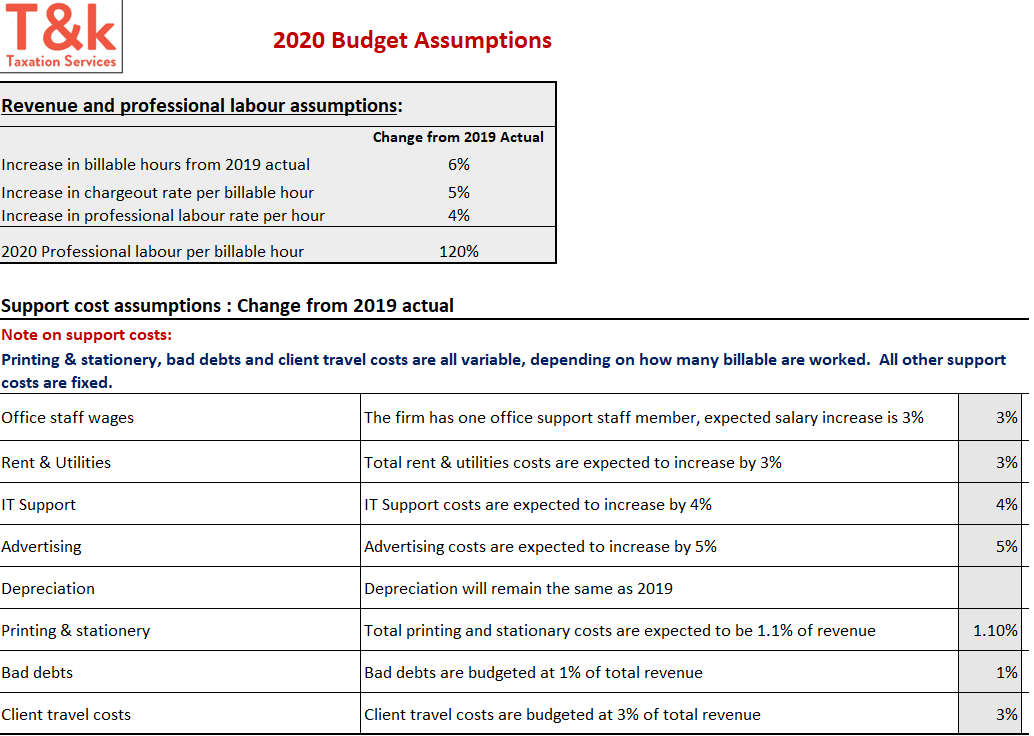

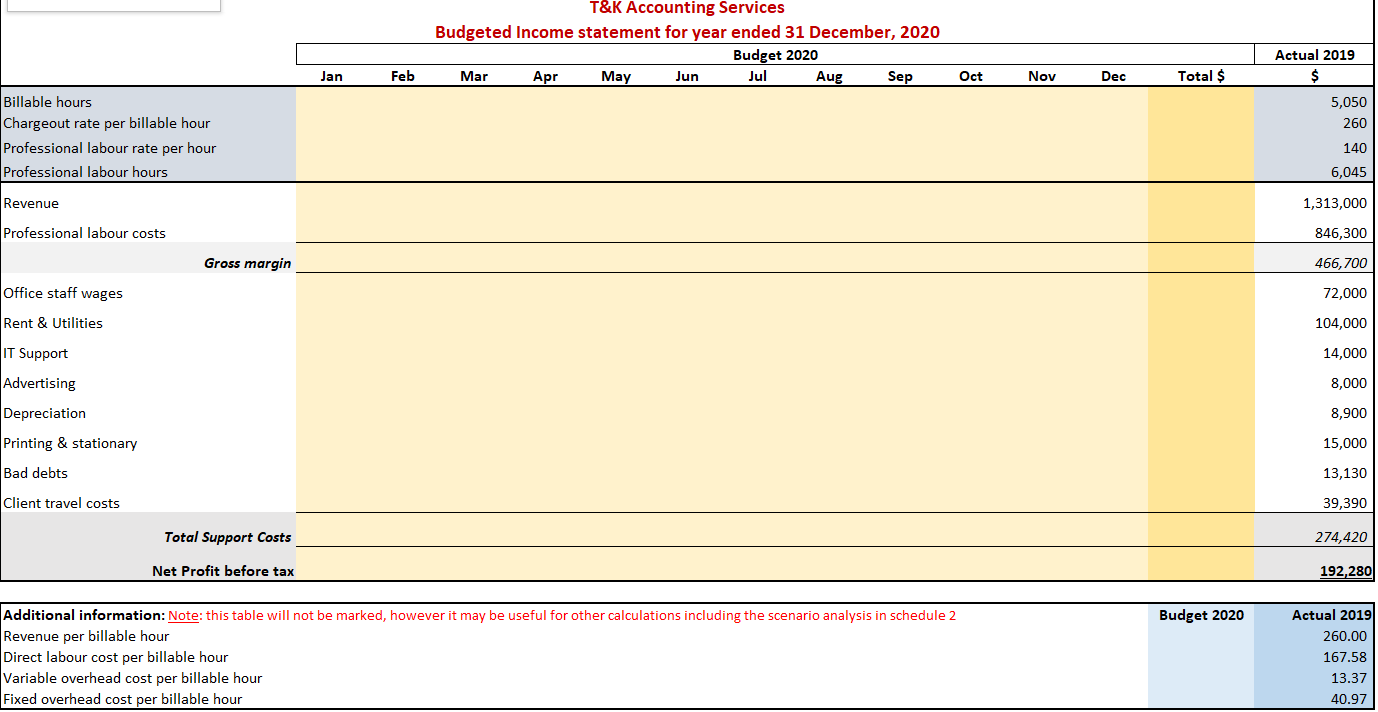

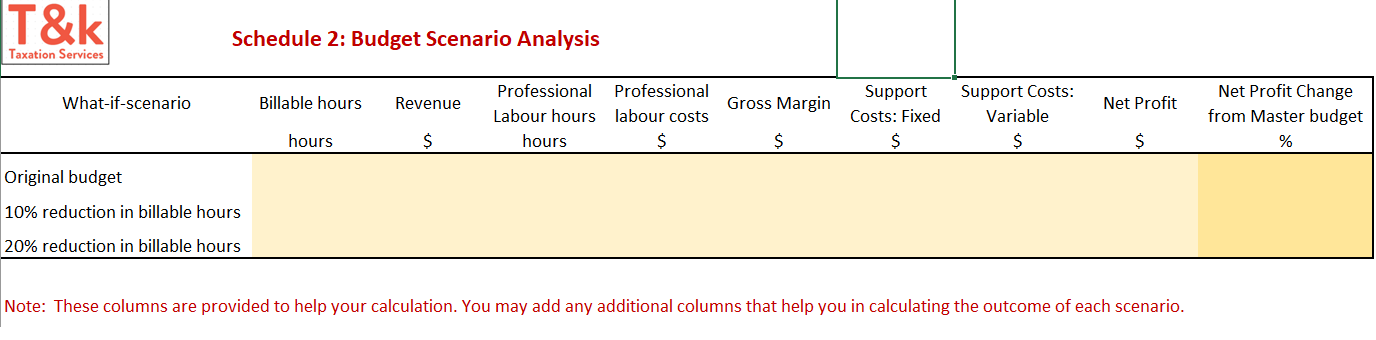

T&k 2020 Budget Assumptions Taxation Services Revenue and professional labour assumptions: Change from 2019 Actual Increase in billable hours from 2019 actual 6% Increase in chargeout rate per billable hour 5% Increase in professional labour rate per hour 4% 2020 Professional labour per billable hour 120% Support cost assumptions : Change from 2019 actual Note on support costs: Printing & stationery, bad debts and client travel costs are all variable, depending on how many billable are worked. All other support costs are fixed. Office staff wages The firm has one office support staff member, expected salary increase is 3% 3% Rent & Utilities Total rent & utilities costs are expected to increase by 3% 3% IT Support IT Support costs are expected to increase by 4% 4% Advertising Advertising costs are expected to increase by 5% 5% Depreciation Depreciation will remain the same as 2019 Printing & stationery Total printing and stationary costs are expected to be 1.1% of revenue 1.10% Bad debts Bad debts are budgeted at 1% of total revenue 1% Client travel costs Client travel costs are budgeted at 3% of total revenue T&K Accounting Services Budgeted Income statement for year ended 31 December, 2020 Budget 2020 Mar Apr May Jun Jul Aug Sep | Actual 2019 Jan Feb Oct Nov Dec Total $ Billable hours Chargeout rate per billable hour Professional labour rate per hour Professional labour hours 5,050 260 140 6,045 Revenue 1,313,000 Professional labour costs 846,300 Gross margin 466,700 Office staff wages 72,000 Rent & Utilities 104,000 IT Support 14,000 Advertising Depreciation Printing & stationary Bad debts Client travel costs 8,000 8,900 15,000 13,130 39,390 Total Support Costs 274,420 Net Profit before tax 192,280 Budget 2020 Additional information: Note: this table will not be marked, however it may be useful for other calculations including the scenario analysis in schedule 2 Revenue per billable hour Direct labour cost per billable hour Variable overhead cost per billable hour Fixed overhead cost per billable hour Actual 2019 260.00 167.58 13.37 40.97 T&k. Schedule 2: Budget Scenario Analysis Taxation Services What-if-scenario Billable hours Revenue Net Profit Professional Professional Labour hours labour costs hours Gross Margin $ Support Costs: Fixed $ Support Costs: Variable $ Net Profit Change from Master budget % hours $ Original budget 10% reduction in billable hours 20% reduction in billable hours Note: These columns are provided to help your calculation. You may add any additional columns that help you in calculating the outcome of each scenario. T&k 2020 Budget Assumptions Taxation Services Revenue and professional labour assumptions: Change from 2019 Actual Increase in billable hours from 2019 actual 6% Increase in chargeout rate per billable hour 5% Increase in professional labour rate per hour 4% 2020 Professional labour per billable hour 120% Support cost assumptions : Change from 2019 actual Note on support costs: Printing & stationery, bad debts and client travel costs are all variable, depending on how many billable are worked. All other support costs are fixed. Office staff wages The firm has one office support staff member, expected salary increase is 3% 3% Rent & Utilities Total rent & utilities costs are expected to increase by 3% 3% IT Support IT Support costs are expected to increase by 4% 4% Advertising Advertising costs are expected to increase by 5% 5% Depreciation Depreciation will remain the same as 2019 Printing & stationery Total printing and stationary costs are expected to be 1.1% of revenue 1.10% Bad debts Bad debts are budgeted at 1% of total revenue 1% Client travel costs Client travel costs are budgeted at 3% of total revenue T&K Accounting Services Budgeted Income statement for year ended 31 December, 2020 Budget 2020 Mar Apr May Jun Jul Aug Sep | Actual 2019 Jan Feb Oct Nov Dec Total $ Billable hours Chargeout rate per billable hour Professional labour rate per hour Professional labour hours 5,050 260 140 6,045 Revenue 1,313,000 Professional labour costs 846,300 Gross margin 466,700 Office staff wages 72,000 Rent & Utilities 104,000 IT Support 14,000 Advertising Depreciation Printing & stationary Bad debts Client travel costs 8,000 8,900 15,000 13,130 39,390 Total Support Costs 274,420 Net Profit before tax 192,280 Budget 2020 Additional information: Note: this table will not be marked, however it may be useful for other calculations including the scenario analysis in schedule 2 Revenue per billable hour Direct labour cost per billable hour Variable overhead cost per billable hour Fixed overhead cost per billable hour Actual 2019 260.00 167.58 13.37 40.97 T&k. Schedule 2: Budget Scenario Analysis Taxation Services What-if-scenario Billable hours Revenue Net Profit Professional Professional Labour hours labour costs hours Gross Margin $ Support Costs: Fixed $ Support Costs: Variable $ Net Profit Change from Master budget % hours $ Original budget 10% reduction in billable hours 20% reduction in billable hours Note: These columns are provided to help your calculation. You may add any additional columns that help you in calculating the outcome of each scenario

show working how to calculate it pleases

show working how to calculate it pleases