..Show workings and proper explanation..

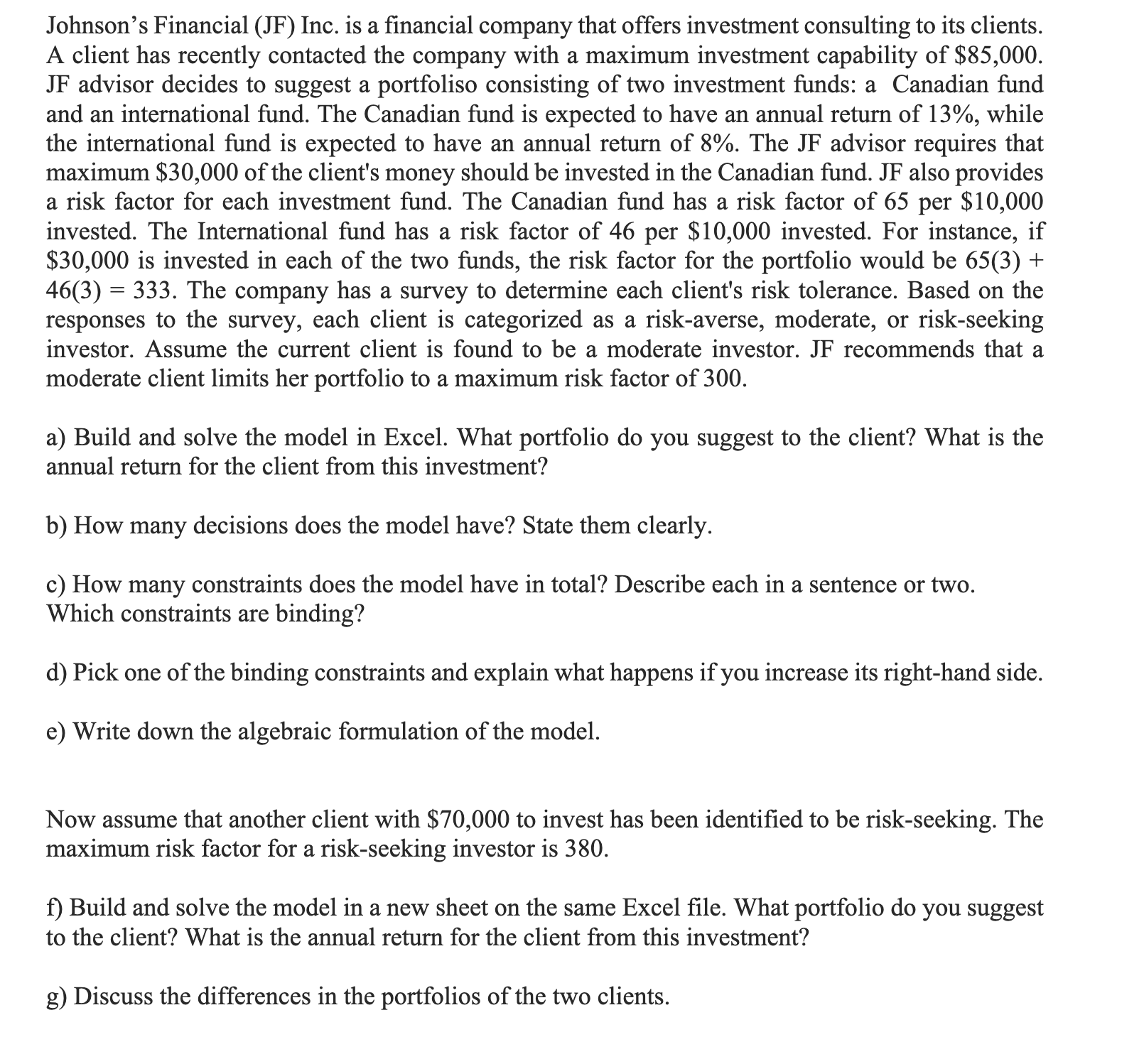

Johnson's Financial (JF) Inc. is a nancial company that offers investment consulting to its clients. A client has recently contacted the company with a maximum investment capability of $85,000. JF advisor decides to suggest a portfoliso consisting of two investment funds: a Canadian md and an international fund. The Canadian fund is expected to have an annual return of 13%, while the international fund is expected to have an annual return of 8%. The JF advisor requires that maximum $30,000 of the client's money should be invested in the Canadian fund. JF also provides a risk factor for each investment fund. The Canadian fund has a risk factor of 65 per $10,000 invested. The International fund has a risk factor of 46 per $10,000 invested. For instance, if $30,000 is invested in each of the two funds, the risk factor for the portfolio would be 65(3) + 46(3) = 333. The company has a survey to determine each client's risk tolerance. Based on the responses to the survey, each client is categorized as a risk-averse, moderate, or risk-seeking investor. Assume the current client is found to be a moderate investor. JF recommends that a moderate client limits her portfolio to a maximum risk factor of 300. a) Build and solve the model in Excel. What portfolio do you suggest to the client? What is the annual return for the client from this investment? b) How many decisions does the model have? State them clearly. c) How many constraints does the model have in total? Describe each in a sentence or two. Which constraints are binding? d) Pick one of the binding constraints and explain what happens if you increase its right-hand side. e) Write down the algebraic formulation of the model. Now assume that another client with $70,000 to invest has been identied to be risk-seeking. The maximum risk factor for a risk-seeking investor is 380. f) Build and solve the model in a new sheet on the same Excel file. What portfolio do you suggest to the client? What is the annual return for the client from this investment? g) Discuss the differences in the portfolios of the two clients. 4. One of the ways how Rent the Runway (RTR) is planning to acquire customers is Via online marketing (e.g., Google Ads). Given the information in the case, how much money can RTR spend in acquiring each customer (average customer acquisition cost, or CAC) if it does not want to lose money (i.e., if it does not want to spend more on acquiring customers than it earns from them)? 0 Use the information in case Exhibit 4, plus the following assumptions, to calculate the lifetime value (LTV) of each customer: 0 Once RTR acquires a customer, the customer will stay with the company ve years, and she will place two rental orders per year. 0 Suppose that RTR uses a 15% discount rate. 0 You will want to allocate the depreciation expense of the dresses to the cost associated with each rental (recall from case pg. 4 that RTR sends two dresses per rental). To do so, assume: I The lifecycle of a dress is one year (i.e., after a year a dress is no longer useful). . Each rental cycle lasts eight days (i.e., it takes eight days 'om the moment a dress is rented to the moment it can be used for another rental). ' RTR forecasts a 60% dress utilization rate (case pg. 9)