Show works

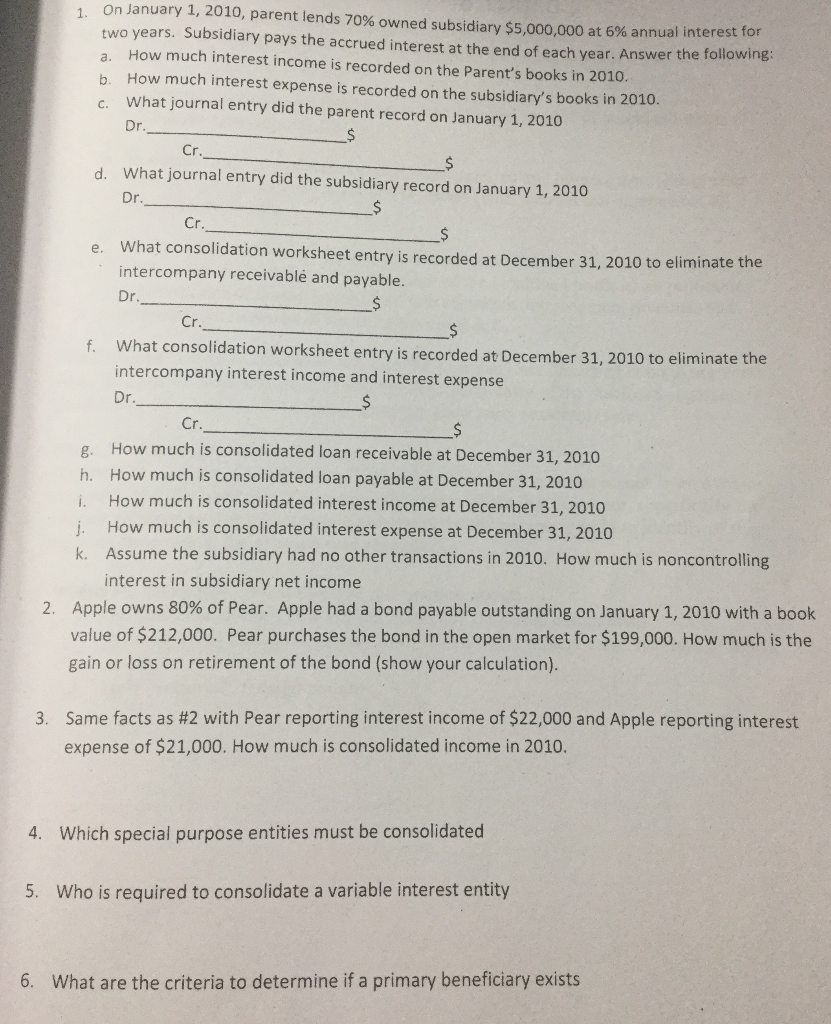

1 On January 1, 2010, parent lends 70% owned subsidiary $5,000,000 at 6% annual interest to two years. Subsidiary pays the accrued interest at the end of each year. Answer the following a. How much interest income is recorded on the Parent's books in 2010. b. How much interest expense is recorded on the subsidiary's books in 2010. C. What journal entry did the parent record on January 1, 2010 Dr. Cr. d. What journal entry did the subsidiary record on January 1, 2010 or e. What consolidation worksheet entry is recorded at December 31, 2010 to eliminate the intercompany receivable and payable. Dr. Cr. f. What consolidation worksheet entry is recorded at December 31, 2010 to eliminate the intercompany interest income and interest expense Dr. g. How much is consolidated loan receivable at December 31, 2010 h. How much is consolidated loan payable at December 31, 2010 How much is consolidated interest income at December 31, 2010 j. How much is consolidated interest expense at December 31, 2010 k. Assume the subsidiary had no other transactions in 2010. How much is noncontrolling interest in subsidiary net income 2. Apple owns 80% of Pear. Apple had a bond payable outstanding on January 1, 2010 with a book value of $212,000. Pear purchases the bond in the open market for $199,000. How much is the gain or loss on retirement of the bond (show your calculation). 3. Same facts as #2 with Pear reporting interest income of $22,000 and Apple reporting interest expense of $21,000. How much is consolidated income in 2010, 4. Which special purpose entities must be consolidated 5. Who is required to consolidate a variable interest entity 6. What are the criteria to determine if a primary beneficiary exists 1 On January 1, 2010, parent lends 70% owned subsidiary $5,000,000 at 6% annual interest to two years. Subsidiary pays the accrued interest at the end of each year. Answer the following a. How much interest income is recorded on the Parent's books in 2010. b. How much interest expense is recorded on the subsidiary's books in 2010. C. What journal entry did the parent record on January 1, 2010 Dr. Cr. d. What journal entry did the subsidiary record on January 1, 2010 or e. What consolidation worksheet entry is recorded at December 31, 2010 to eliminate the intercompany receivable and payable. Dr. Cr. f. What consolidation worksheet entry is recorded at December 31, 2010 to eliminate the intercompany interest income and interest expense Dr. g. How much is consolidated loan receivable at December 31, 2010 h. How much is consolidated loan payable at December 31, 2010 How much is consolidated interest income at December 31, 2010 j. How much is consolidated interest expense at December 31, 2010 k. Assume the subsidiary had no other transactions in 2010. How much is noncontrolling interest in subsidiary net income 2. Apple owns 80% of Pear. Apple had a bond payable outstanding on January 1, 2010 with a book value of $212,000. Pear purchases the bond in the open market for $199,000. How much is the gain or loss on retirement of the bond (show your calculation). 3. Same facts as #2 with Pear reporting interest income of $22,000 and Apple reporting interest expense of $21,000. How much is consolidated income in 2010, 4. Which special purpose entities must be consolidated 5. Who is required to consolidate a variable interest entity 6. What are the criteria to determine if a primary beneficiary exists