Question

SHOW YOUR CALCULATIONS 1.What was MMIs after-tax profit margin in 2014? 2.How much in dividends was paid out by MMI in 2014? 3.What was MMIs

SHOW YOUR CALCULATIONS

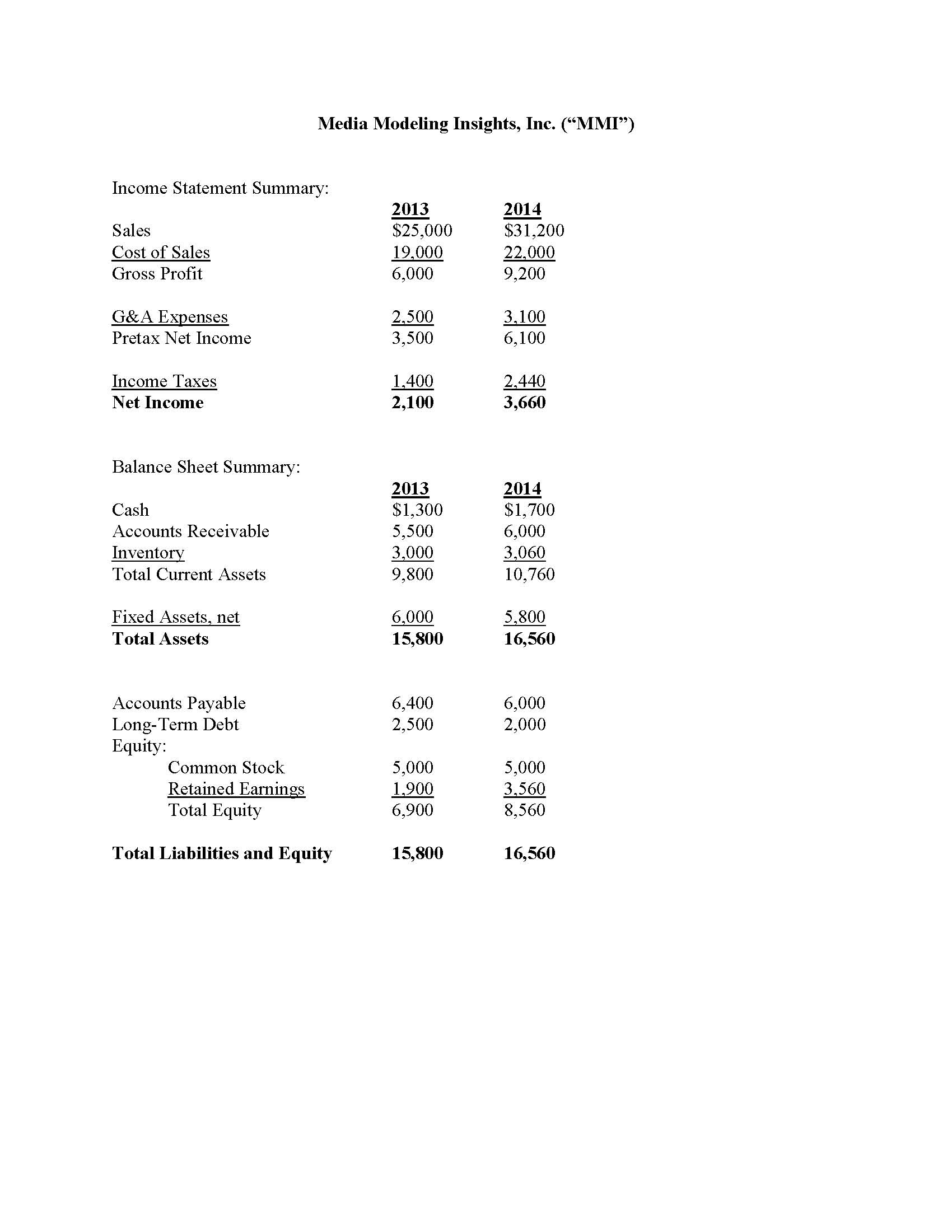

1.What was MMIs after-tax profit margin in 2014?

2.How much in dividends was paid out by MMI in 2014?

3.What was MMIs dividend payout ratio in 2014?

4.What was MMIs after-tax return on equity in 2014 (for balance sheet calculations, use the average of the beginning and end-of-year balances)?

5.What was MMIs after-tax return on assets in 2014 (for balance sheet calculations, use the average of the beginning and end-of-year balances)?

6.Based on your answers above, what is MMIs sustainable growth rate?

7.Based on your answers above, what is MMIs internal growth rate?

8.What was MMIs debt-equity ratio at the end of 2014?

9.Assuming that all sales were on credit, how much did MMI collect from its customers during 2014?

10.If MMI borrowed $750 from its bank at some point during 2014, how much of its debt did it repay during 2014?

11.If you expect MMIs sales to grow by 5% in 2015 with no change in profit margins or effective tax rate, what are you projecting for its net income?

12.If net working capital varies directly with sales, based on your answer to the previous question, what are you projecting for accounts receivable at the end of 2015?

13.If the dividend payout ratio is kept the same from 2014 to 2015, based on your answer to #15, what are you projecting for retained earnings at the end of 2015?

14.If MMI is operating at 75% capacity, based on FY2014 sales, what is MMIs full-capacity level of sales?

15.Based on your answer to the last question, what is MMIs 2014 capital intensity ratio at full-capacity sales?

16.Which one of the following capital intensity ratios indicates the largest need for fixed assets per dollar of sales?

A. 0.50

B. 1.00

C. 1.50

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started