Answered step by step

Verified Expert Solution

Question

1 Approved Answer

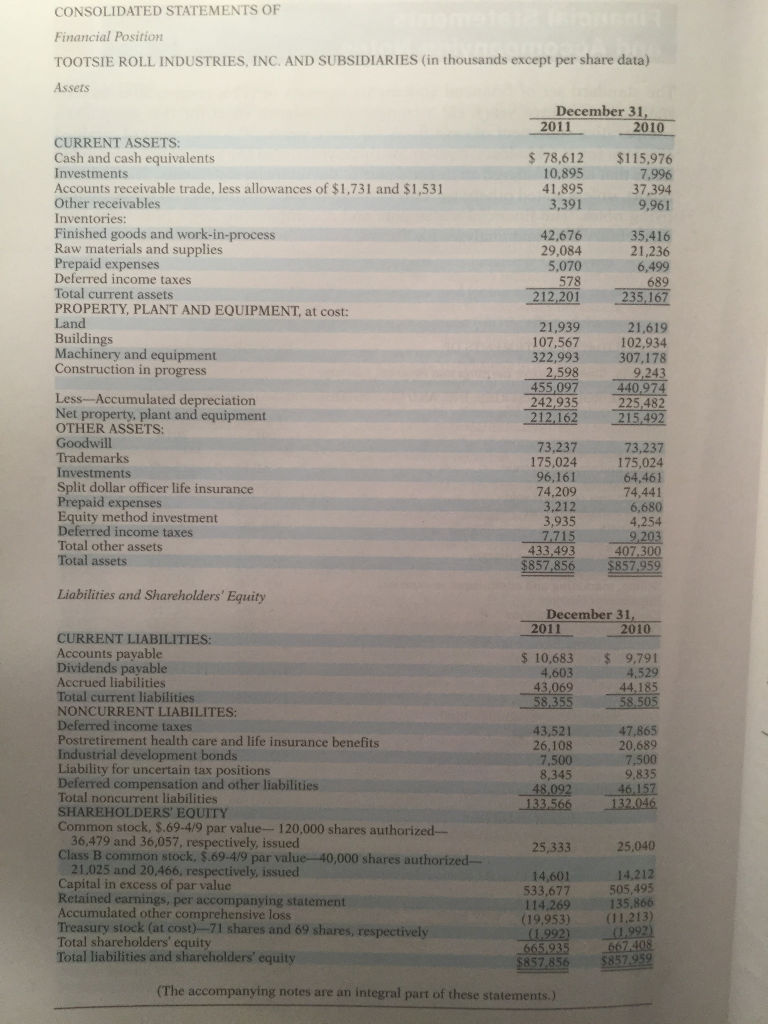

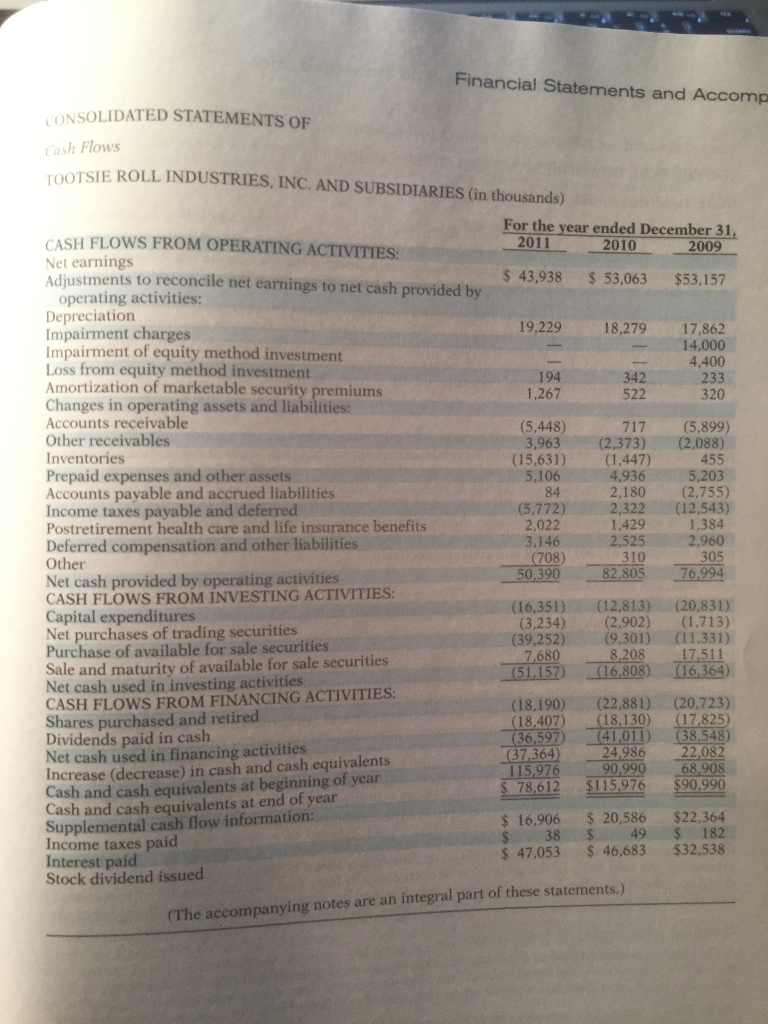

Show your calculations for the following ratios. Liquidity ratios: 1. Current Ratio 2. Acid test or quick ratio 3. Receivables turnover 4. Inventory turnover ary

Show your calculations for the following ratios.

Liquidity ratios:

1. Current Ratio 2. Acid test or quick ratio 3. Receivables turnover 4. Inventory turnover

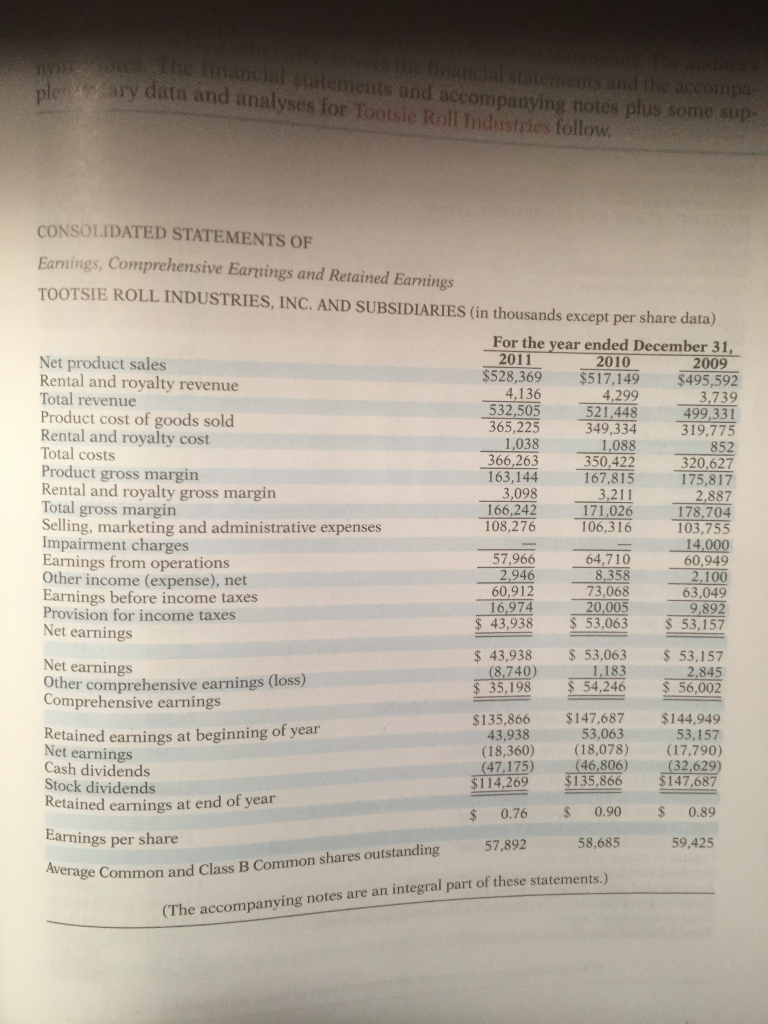

ary data and analyses for Tootsie Roll Industries g notes plus some sup CONSOLIDATED STATEMENTS OF Eamings, Comprehensive Earnings and Retained Earnings TOOTSIE ROLL INDUSTRIES, INC. AND SUBSIDIARIES (in thousands except per share data) For the year ended December 31, 2010 $528,369 $517,149 $495,592 2011 Net product sales Rental and royalty revenue Total revenue Product cost of goods sold Rental and royalty cost Total costs Product gross margin Rental and royalty gross margin Total gross margin Selling, marketing and administrative expenses Impairment charges Earnings from operations Other income (expense), net Earnings before income taxes Provision for income taxes Net earnings 2009 3,739 499,331 319,775 852 320,627 175,817 2.887 178,704 103,755 532,505 521,448 365,225 349,334 1,038 366,263 163,144 1088 350,422 167,815 166,242 108,276 171,026 106,316 1 -64,7 10-14.000 60,949 2,946 60,912 16,974 358 73,068 43,938 53,063 53,157 43,938 53,063 53,157 63,049 Net earnings Other comprehensive earnings (loss) Comprehensive earnings (8.740) 35,198 S54,246 56,002 2,845 Retained earnings at beginning of year $135,866 $147,687 $144,949 53,157 43,938 (18,360) (18,078) (17,790) 47,175) 114,269 53,063 Net earnings Cash dividends Stock dividends 46,806) 32,629 $147,687 Retained earnings at end of year 0.76 0.90 0.89 rnings per share 58,685 59,425 57,892 ge Common and Class B Common shares outstanding (The accompanying notes are an integral part of these statements.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started