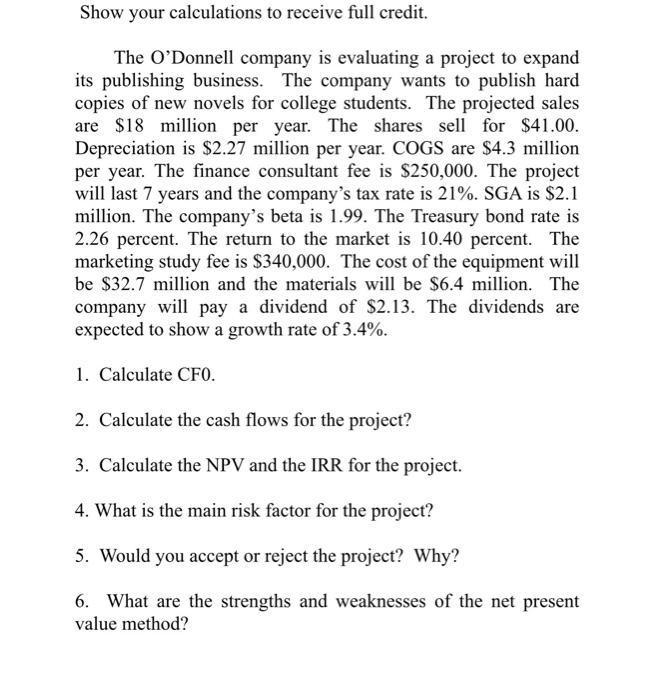

Show your calculations to receive full credit. The O'Donnell company is evaluating a project to expand its publishing business. The company wants to publish hard copies of new novels for college students. The projected sales are $18 million per year. The shares sell for $41.00. Depreciation is $2.27 million per year. COGS are $4.3 million per year. The finance consultant fee is $250,000. The project will last 7 years and the company's tax rate is 21%. SGA is $2.1 million. The company's beta is 1.99. The Treasury bond rate is 2.26 percent. The return to the market is 10.40 percent. The marketing study fee is $340,000. The cost of the equipment will be $32.7 million and the materials will be $6.4 million. The company will pay a dividend of $2.13. The dividends are expected to show a growth rate of 3.4%. 1. Calculate CFO. 2. Calculate the cash flows for the project? 3. Calculate the NPV and the IRR for the project. 4. What is the main risk factor for the project? 5. Would you accept or reject the project? Why? 6. What are the strengths and weaknesses of the net present value method? Show your calculations to receive full credit. The O'Donnell company is evaluating a project to expand its publishing business. The company wants to publish hard copies of new novels for college students. The projected sales are $18 million per year. The shares sell for $41.00. Depreciation is $2.27 million per year. COGS are $4.3 million per year. The finance consultant fee is $250,000. The project will last 7 years and the company's tax rate is 21%. SGA is $2.1 million. The company's beta is 1.99. The Treasury bond rate is 2.26 percent. The return to the market is 10.40 percent. The marketing study fee is $340,000. The cost of the equipment will be $32.7 million and the materials will be $6.4 million. The company will pay a dividend of $2.13. The dividends are expected to show a growth rate of 3.4%. 1. Calculate CFO. 2. Calculate the cash flows for the project? 3. Calculate the NPV and the IRR for the project. 4. What is the main risk factor for the project? 5. Would you accept or reject the project? Why? 6. What are the strengths and weaknesses of the net present value method