Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show your solution clearly. Choices: a. 528,376; 262,468 b. 428,376; 262,468 c. 499,716; 282,566 d. 499,716; 392,566 6. On Jan. 1, 20x1, Ginger Bank extended

Show your solution clearly.

Choices:

a. 528,376; 262,468

b. 428,376; 262,468

c. 499,716; 282,566

d. 499,716; 392,566

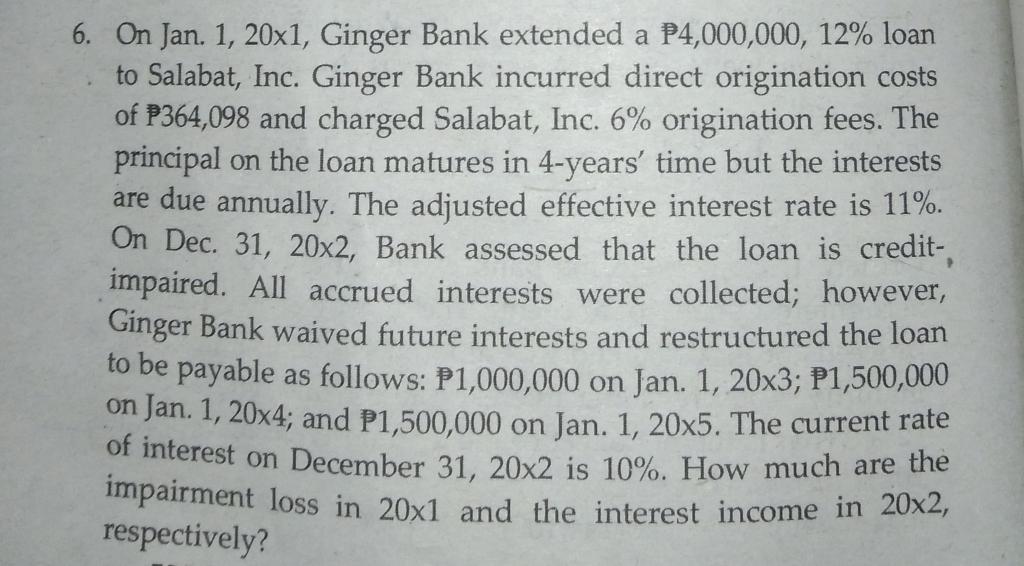

6. On Jan. 1, 20x1, Ginger Bank extended a P4,000,000, 12% loan to Salabat, Inc. Ginger Bank incurred direct origination costs of P364,098 and charged Salabat, Inc. 6% origination fees. The principal on the loan matures in 4-years' time but the interests are due annually. The adjusted effective interest rate is 11%. On Dec. 31, 20x2, Bank assessed that the loan is credit-, impaired. All accrued interests were collected; however, Ginger Bank waived future interests and restructured the loan to be payable as follows: P1,000,000 on Jan. 1, 20x3; P1,500,000 on Jan. 1, 20x4; and P1,500,000 on Jan. 1, 20x5. The current rate of interest on December 31, 20x2 is 10%. How much are the impairment loss in 20x1 and the interest income in 20x2, respectivelyStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started