Question

Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write

Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write down your inputs for partial marks. Keep at least 4 decimal digits in all your calculation and answers unless specified otherwise. Make sure your work is legible.

Show your step-by-step work for part marks. Write down the equations you are using. For problems that you will be using a financial calculator, write down your inputs for partial marks. Keep at least 4 decimal digits in all your calculation and answers unless specified otherwise. Make sure your work is legible.

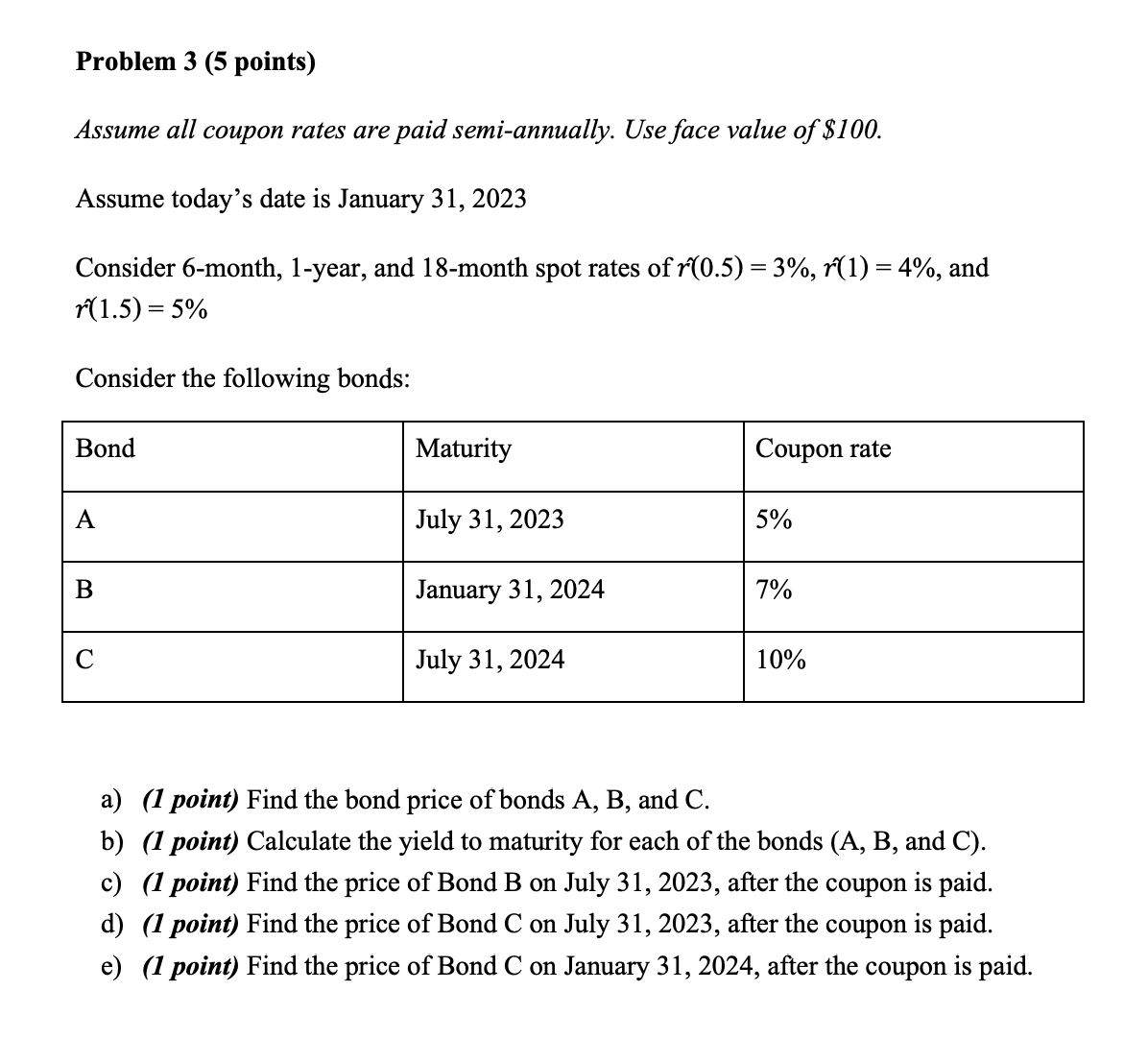

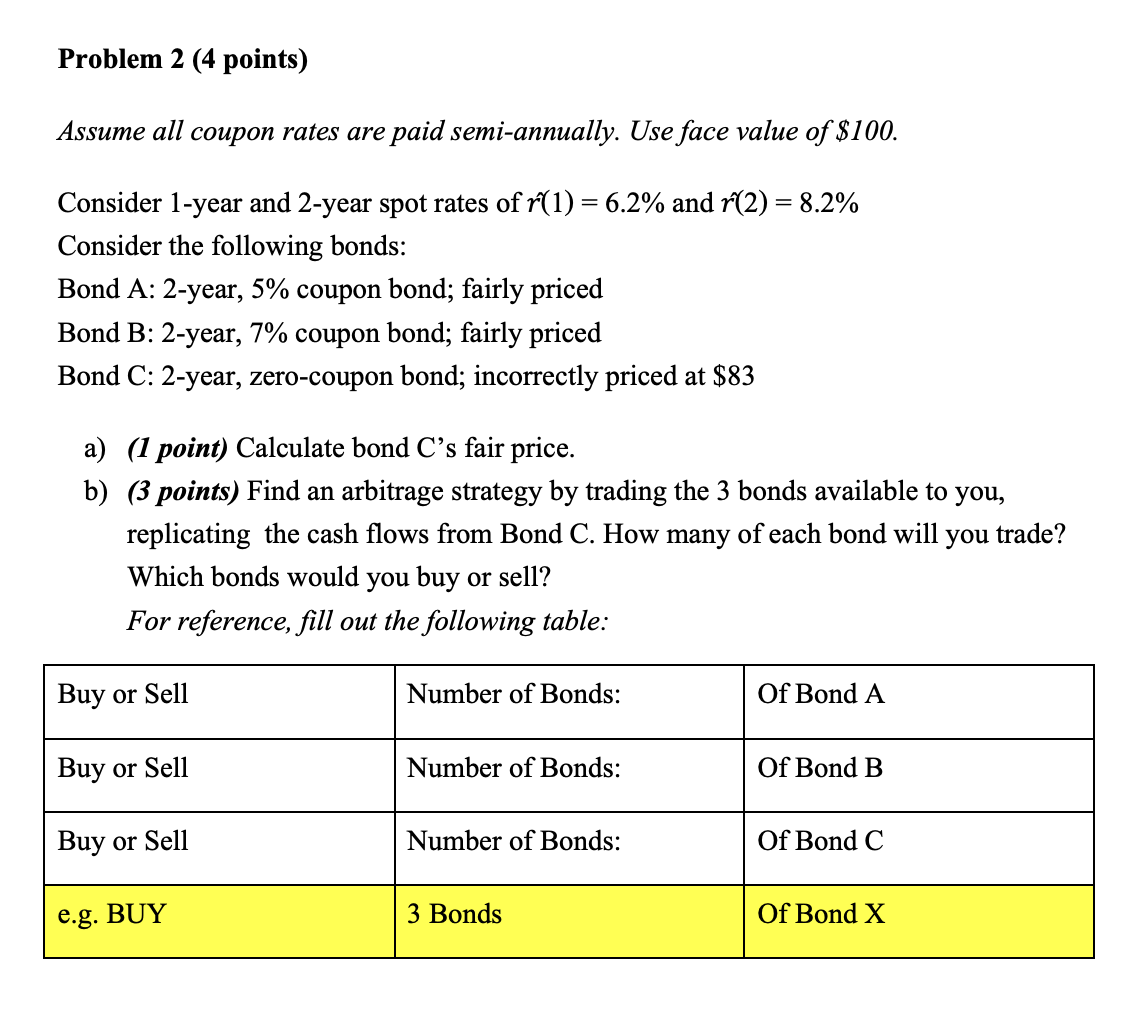

Assume all coupon rates are paid semi-annually. Use face value of $100. Assume today's date is January 31, 2023 Consider 6-month, 1-year, and 18-month spot rates of r(0.5)=3%,r(1)=4%, and r(1.5)=5% Consider the following bonds: a) (1 point) Find the bond price of bonds A,B, and C. b) (1 point) Calculate the yield to maturity for each of the bonds (A, B, and C ). c) (1 point) Find the price of Bond B on July 31, 2023, after the coupon is paid. d) (1 point) Find the price of Bond C on July 31, 2023, after the coupon is paid. e) (1 point) Find the price of Bond C on January 31, 2024, after the coupon is paid. Consider 1-year and 2-year spot rates of r(1)=6.2% and r(2)=8.2% Consider the following bonds: Bond A: 2-year, 5\% coupon bond; fairly priced Bond B: 2-year, 7\% coupon bond; fairly priced Bond C: 2-year, zero-coupon bond; incorrectly priced at $83 a) (1 point) Calculate bond C's fair price. b) (3 points) Find an arbitrage strategy by trading the 3 bonds available to you, replicating the cash flows from Bond C. How many of each bond will you trade? Which bonds would you buy or sell? For reference, fill out the following tableStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started