Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Show your work in detail with the original formula and steps, i.e. need to at least provide factor notation such as (F/A, i, N).

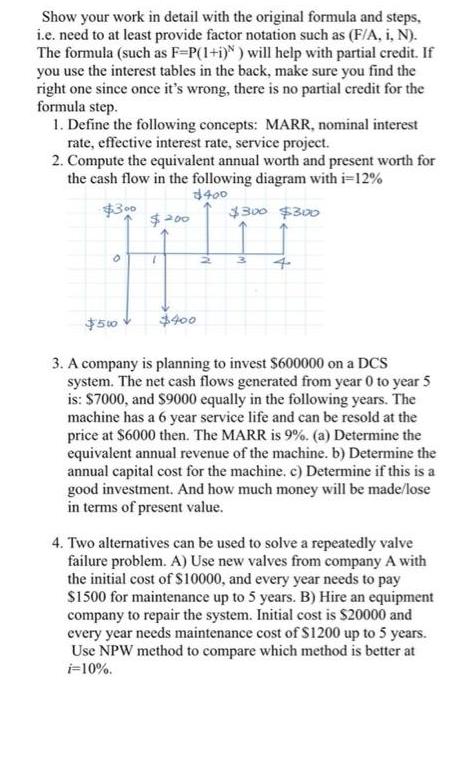

Show your work in detail with the original formula and steps, i.e. need to at least provide factor notation such as (F/A, i, N). The formula (such as F=P(1+i)") will help with partial credit. If you use the interest tables in the back, make sure you find the right one since once it's wrong, there is no partial credit for the formula step. 1. Define the following concepts: MARR, nominal interest rate, effective interest rate, service project. 2. Compute the equivalent annual worth and present worth for the cash flow in the following diagram with i=12% $400 $300 $300 $300 $200 O $500 1 $400 3 4 3. A company is planning to invest $600000 on a DCS system. The net cash flows generated from year 0 to year 5 is: $7000, and $9000 equally in the following years. The machine has a 6 year service life and can be resold at the price at $6000 then. The MARR is 9%. (a) Determine the equivalent annual revenue of the machine. b) Determine the annual capital cost for the machine. c) Determine if this is a good investment. And how much money will be made/lose in terms of present value. 4. Two alternatives can be used to solve a repeatedly valve failure problem. A) Use new valves from company A with the initial cost of $10000, and every year needs to pay $1500 for maintenance up to 5 years. B) Hire an equipment company to repair the system. Initial cost is $20000 and every year needs maintenance cost of $1200 up to 5 years. Use NPW method to compare which method is better at i-10%.

Step by Step Solution

★★★★★

3.47 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

1 MARR MARR stands for Minimum Attractive Rate of Return It is the minimum rate of return required t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started