Show your work

Show your work

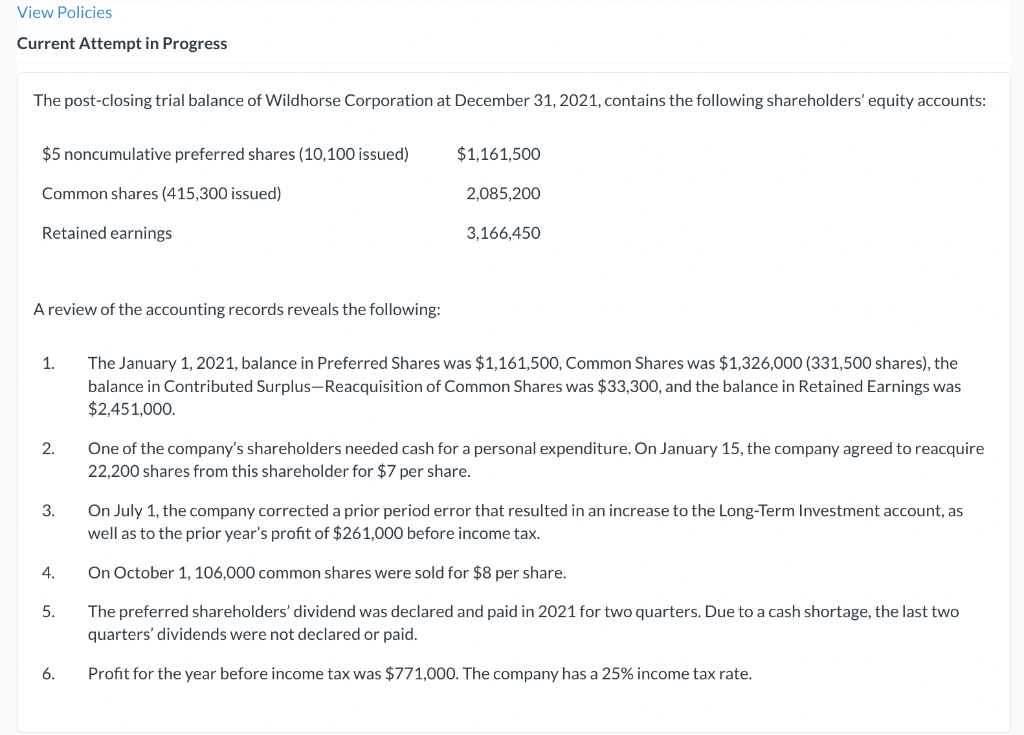

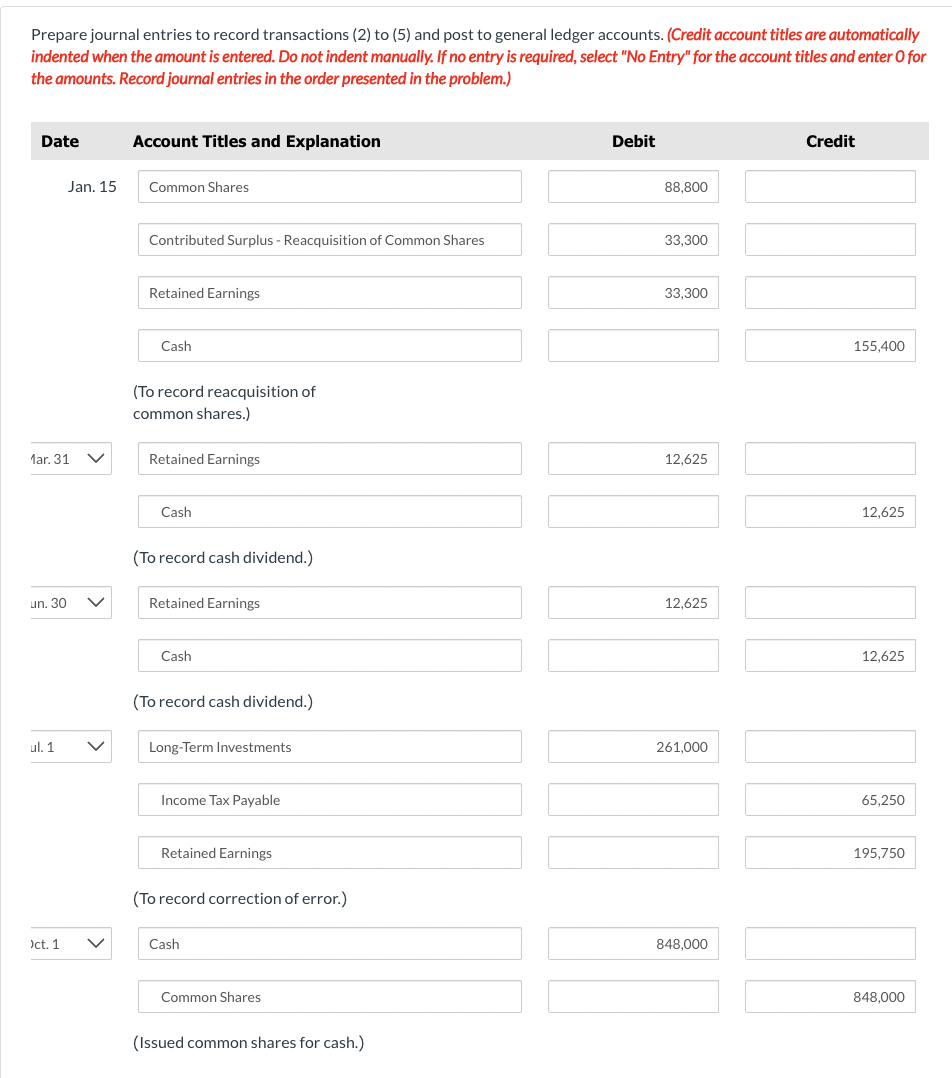

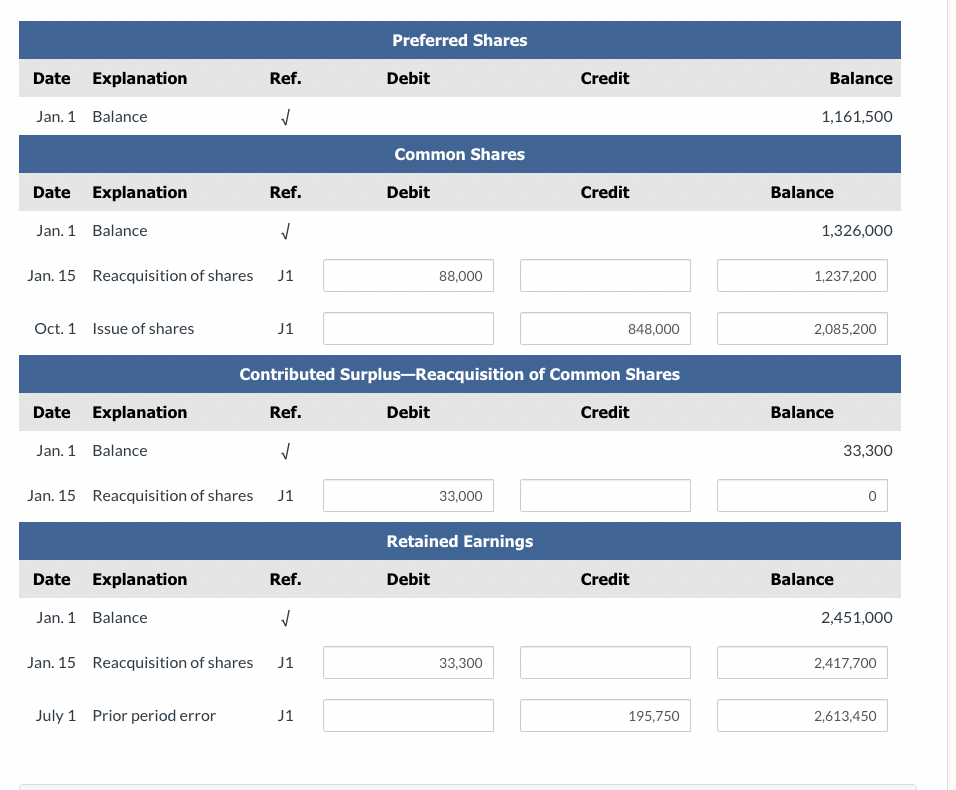

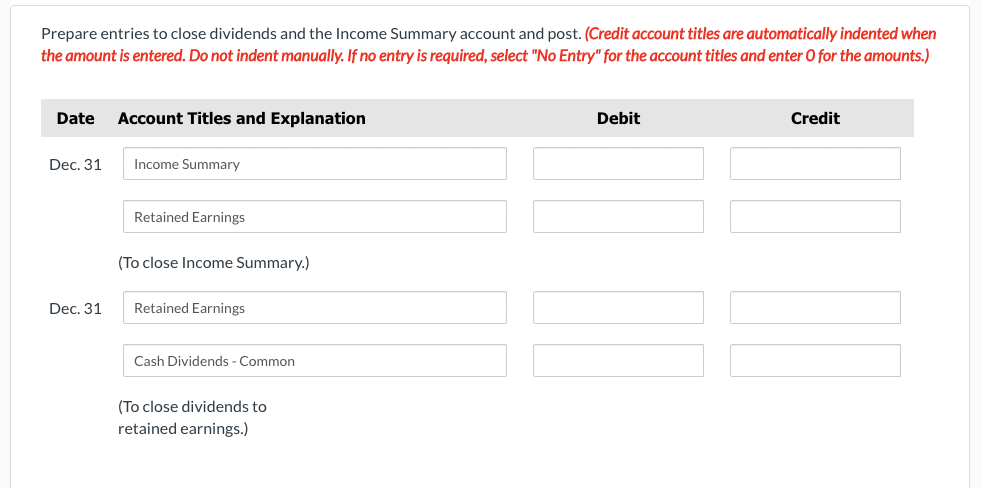

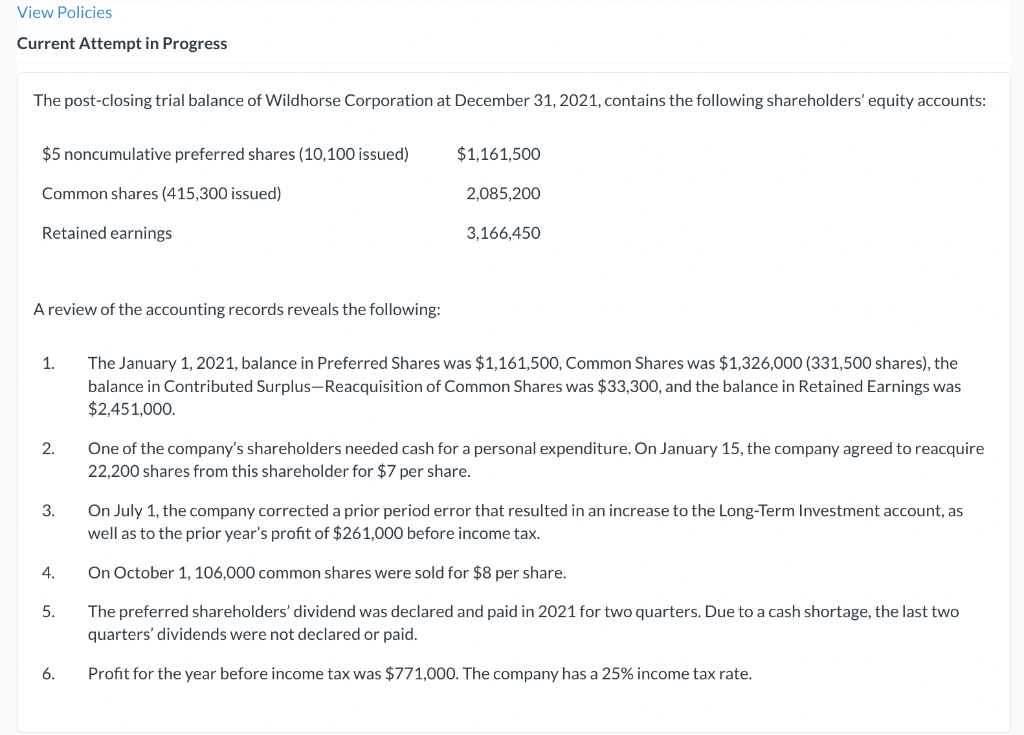

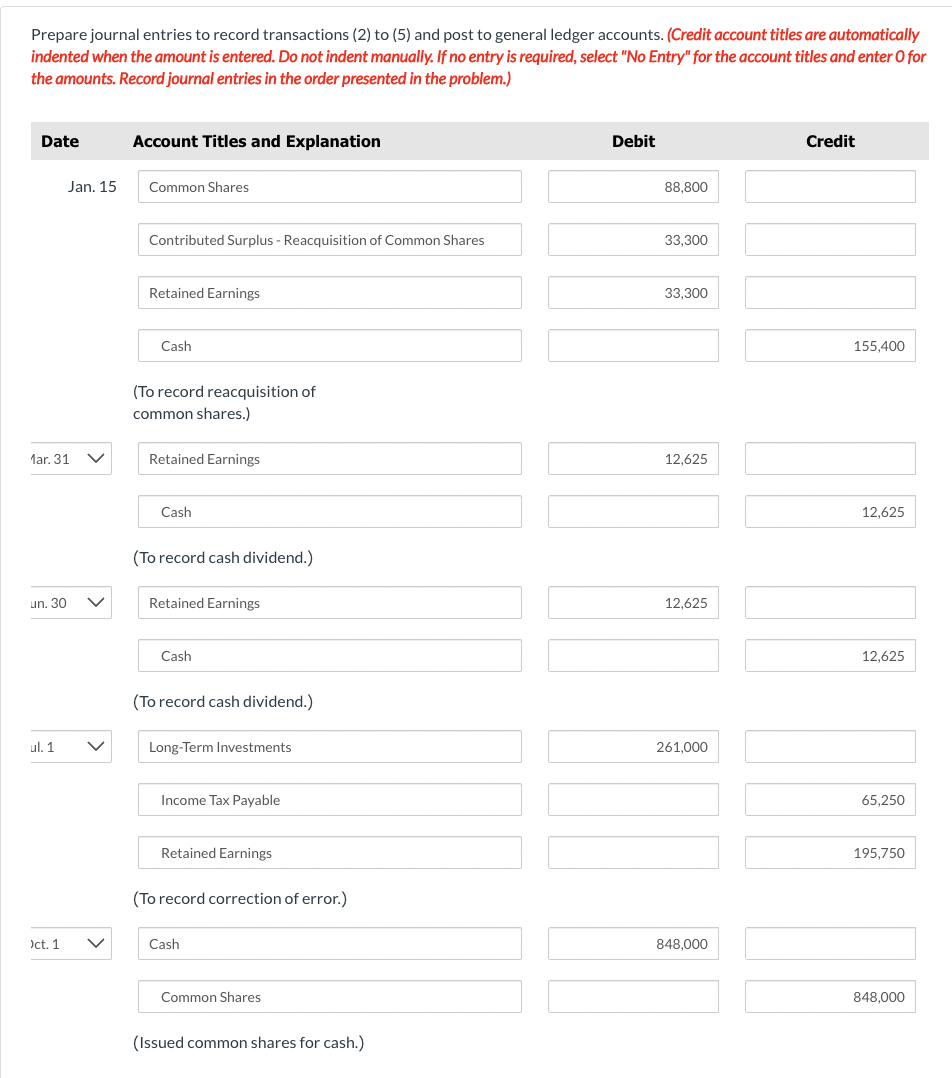

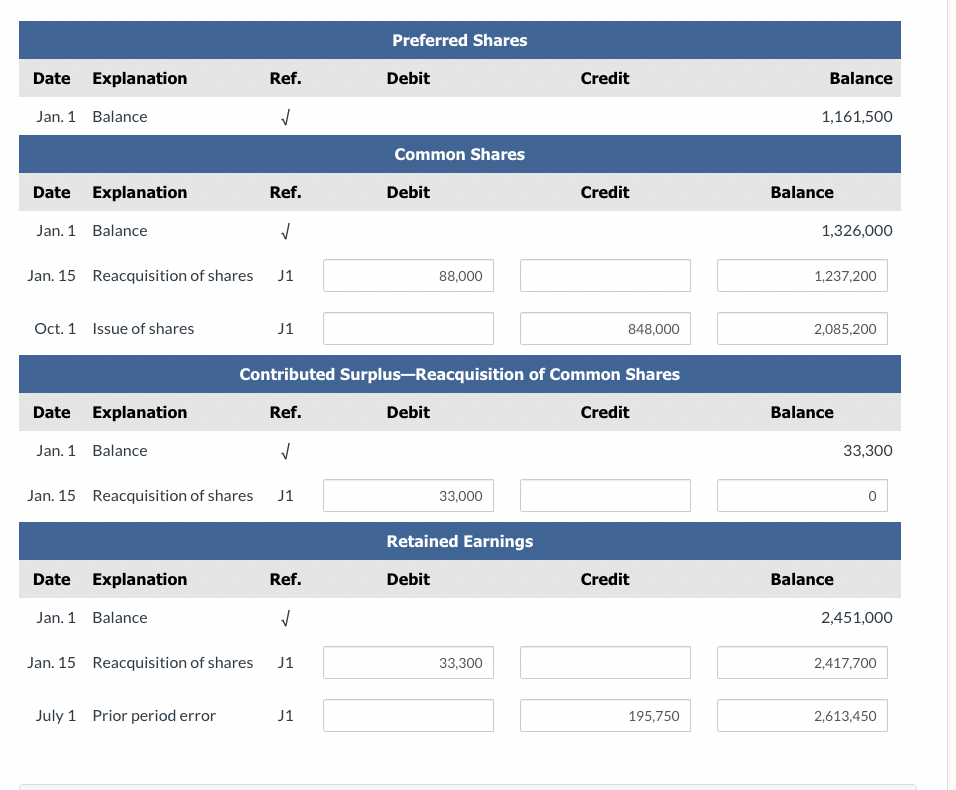

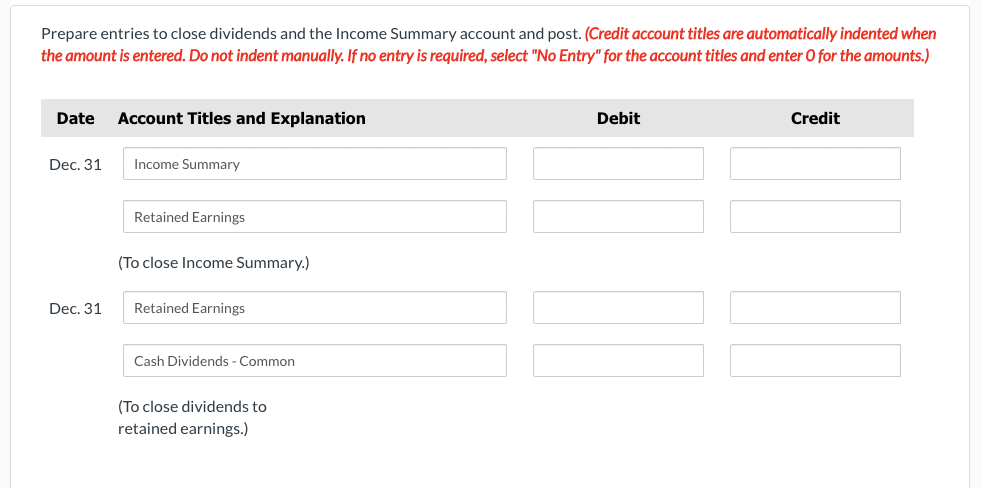

View Policies Current Attempt in Progress The post-closing trial balance of Wildhorse Corporation at December 31, 2021, contains the following shareholders' equity accounts: $5 noncumulative preferred shares (10,100 issued) $1,161,500 Common shares (415,300 issued) 2,085,200 Retained earnings 3,166,450 A review of the accounting records reveals the following: 1. The January 1, 2021, balance in Preferred Shares was $1,161,500, Common Shares was $1,326,000 (331,500 shares), the balance in Contributed Surplus-Reacquisition of Common Shares was $33,300, and the balance in Retained Earnings was $2,451,000. 2. One of the company's shareholders needed cash for a personal expenditure. On January 15, the company agreed to reacquire 22,200 shares from this shareholder for $7 per share. 3. On July 1, the company corrected a prior period error that resulted in an increase to the Long-Term Investment account, as well as to the prior year's profit of $261,000 before income tax. 4. On October 1, 106,000 common shares were sold for $8 per share. 5. The preferred shareholders' dividend was declared and paid in 2021 for two quarters. Due to a cash shortage, the last two quarters' dividends were not declared or paid. 6. Profit for the year before income tax was $771,000. The company has a 25% income tax rate. Prepare journal entries to record transactions (2) to (5) and post to general ledger accounts. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit Jan. 15 Common Shares 88,800 Contributed Surplus - Reacquisition of Common Shares 33,300 Retained Earnings 33,300 Cash 155,400 (To record reacquisition of common shares.) 1ar. 31 Retained Earnings 12,625 Cash 12,625 (To record cash dividend.) un. 30 Retained Earnings 12.625 Cash 12,625 (To record cash dividend.) ul. 1 V Long-Term Investments 261,000 Income Tax Payable 65,250 Retained Earnings 195,750 (To record correction of error.) Oct. 1 Cash 848,000 Common Shares 848,000 (Issued common shares for cash.) Preferred Shares Date Explanation Ref. Debit Credit Balance Jan. 1 Balance 1,161,500 Common Shares Date Explanation Ref. Debit Credit Balance Jan. 1 Balance 1,326,000 Jan. 15 Reacquisition of shares J1 88,000 1,237,200 Oct. 1 Issue of shares J1 848,000 2,085,200 Contributed Surplus-Reacquisition of Common Shares Date Explanation Ref. Debit Credit Balance Jan. 1 Balance 33,300 Jan. 15 Reacquisition of shares J1 33,000 0 Retained Earnings Date Explanation Ref. Debit Credit Balance Jan. 1 Balance 2,451,000 Jan. 15 Reacquisition of shares J1 33,300 2,417,700 July 1 Prior period error J1 195,750 2,613,450 Prepare entries to close dividends and the Income Summary account and post. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 Income Summary Retained Earnings (To close Income Summary.) Dec. 31 Retained Earnings Cash Dividends - Common (To close dividends to retained earnings.)

Show your work

Show your work