Answered step by step

Verified Expert Solution

Question

1 Approved Answer

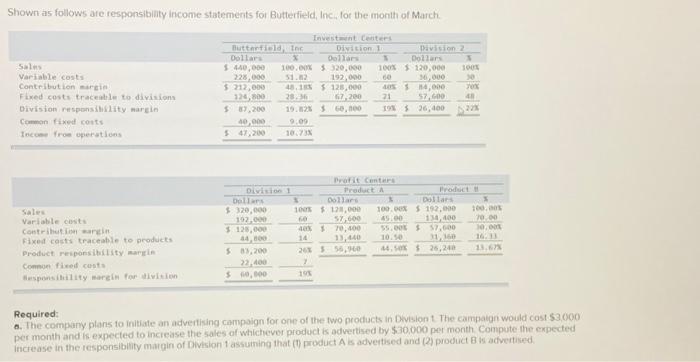

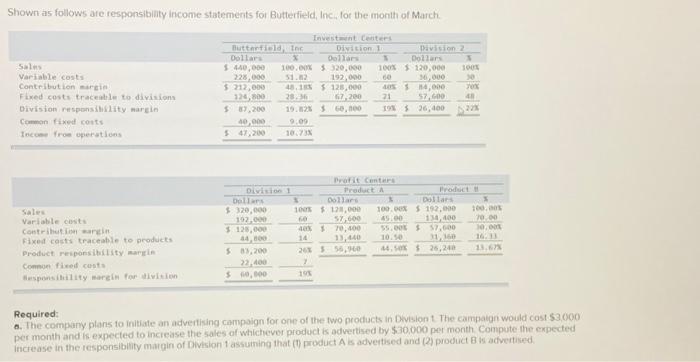

Shown as follows are responsibility income statements for Butterfield, Inc., for the month of March. $ 440,000 Investment Centers Butterfield, Inc. Division 1 Dollars %

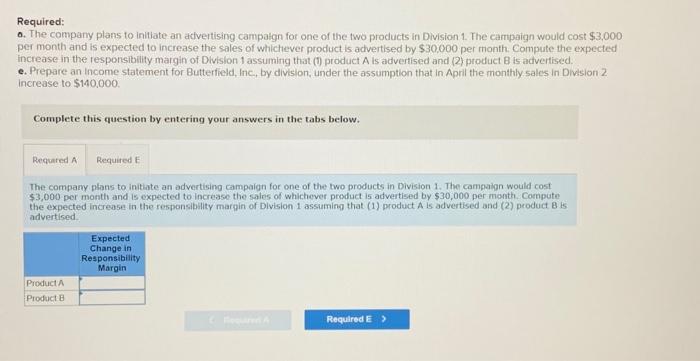

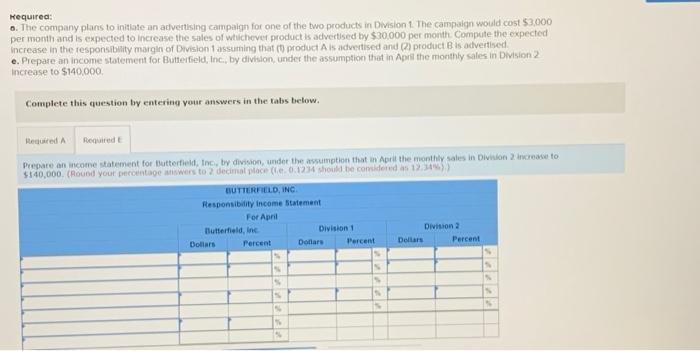

Shown as follows are responsibility income statements for Butterfield, Inc., for the month of March. $ 440,000 Investment Centers Butterfield, Inc. Division 1 Dollars % Dollars 100.00% $ 320,000 51.82 192,000 48.18% $ 128,000 28.36 67,200 19.82% $ 60,800 228,000 $ 212,000 124,800 $ 87,200 40,000 $ 47,200 Sales Variable costs Contribution margin Fixed costs traceable to divisions Division responsibility margin Common fixed costs Income from operations Sales Variable costs Contribution margin Fixed costs traceable to products Product responsibility margin Common fixed costs Responsibility margin for division Division 1 Dollars $ 320,000 192,000 $ 128,000 44,800 9.09 10.73% $ 83,200 22,400 $ 60,800 Division 2 % Dollars 100% $ 120,000 60 36,000 40% $ 84,000 21 57,600 19% 26,400 $ Profit Centers Product A $ % Dollars % Dollars 100% $ 128,000 100.00% $ 192,000 60 40% 14 26% $ 7 19% 57,600 70,400 13,440 56,960 45.00 134,400 55.00% $ 57,600 10.50 31,360 44.50% $ 26,240 % 100% 30 70% 48 22% Product B % 100.00% 70.00 30.00% 16.33 13.67% Required: a. The company plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichever product is advertised by $30,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised.

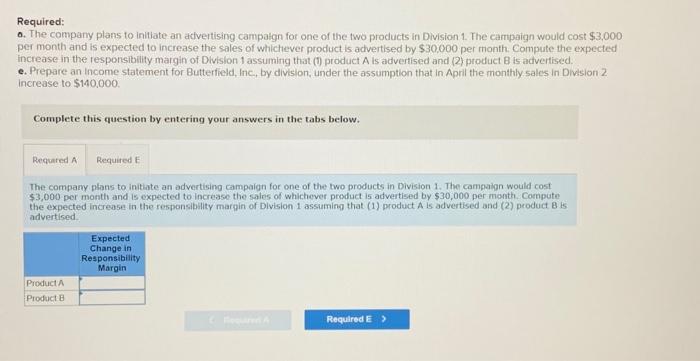

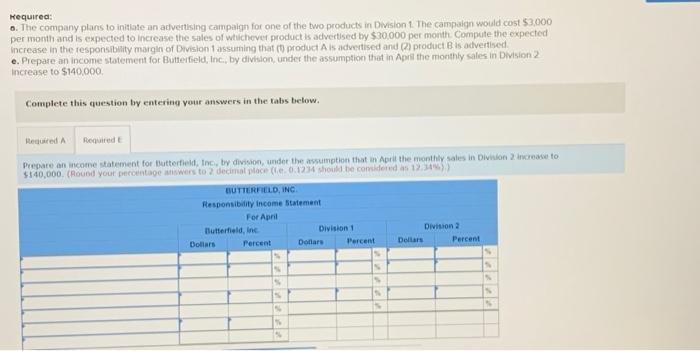

Shown as follows are responsibiaty income statements for Butterfield, Inc., for the month of March. Required: Q. The company plans to initiate an advertising campaign for one of the two products in Division t The campatge would cost 53.000 per month and is expected to increase the sales of whichever product is advertised by $30,000 per month Conpute ine expected increase in the responsibility margin of Division 1 assuming that (T) product A is advertised and (2) product B is advertised. Required: o. The company plans to inlitate an advertising campatgn for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichever product is advertised by $30,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised. e. Prepare an income statement for Butterfield, Inc, by division, under the assumption that in April the monthly sales in Division 2 increase to $140,000 Complete this question by entering your answers in the tabs below. The compary plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichover product is advertised by $30,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised. Kequired: 6. The company plans to initiate an advertising campaign for one of the two products in Division 1 . The campaiqn would cost $3 oog per month and is expected to increase the sales of whichovet product is advettsed by $30,000 per month Compute the expected increase in the responsibility margin of Bivision 1 assurning that (D) product A is advectised and (A) product B is advertised. e. Prepare an income statement for Butterfeld, inc, by divfison, under the assumption that in Aprit the mionthly sales in Dovision 2 increase to $140,000. Complete this question by entering your answers in the rabs below. Peosere an incorne satement for Dutterfieli, InC, by division, under the assumption that in Aprit the monthir sales in Division 2 increace to

Shown as follows are responsibiaty income statements for Butterfield, Inc., for the month of March. Required: Q. The company plans to initiate an advertising campaign for one of the two products in Division t The campatge would cost 53.000 per month and is expected to increase the sales of whichever product is advertised by $30,000 per month Conpute ine expected increase in the responsibility margin of Division 1 assuming that (T) product A is advertised and (2) product B is advertised. Required: o. The company plans to inlitate an advertising campatgn for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichever product is advertised by $30,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised. e. Prepare an income statement for Butterfield, Inc, by division, under the assumption that in April the monthly sales in Division 2 increase to $140,000 Complete this question by entering your answers in the tabs below. The compary plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichover product is advertised by $30,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised. Kequired: 6. The company plans to initiate an advertising campaign for one of the two products in Division 1 . The campaiqn would cost $3 oog per month and is expected to increase the sales of whichovet product is advettsed by $30,000 per month Compute the expected increase in the responsibility margin of Bivision 1 assurning that (D) product A is advectised and (A) product B is advertised. e. Prepare an income statement for Butterfeld, inc, by divfison, under the assumption that in Aprit the mionthly sales in Dovision 2 increase to $140,000. Complete this question by entering your answers in the rabs below. Peosere an incorne satement for Dutterfieli, InC, by division, under the assumption that in Aprit the monthir sales in Division 2 increace to

Shown as follows are responsibility income statements for Butterfield, Inc., for the month of March. $ 440,000 Investment Centers Butterfield, Inc. Division 1 Dollars % Dollars 100.00% $ 320,000 51.82 192,000 48.18% $ 128,000 28.36 67,200 19.82% $ 60,800 228,000 $ 212,000 124,800 $ 87,200 40,000 $ 47,200 Sales Variable costs Contribution margin Fixed costs traceable to divisions Division responsibility margin Common fixed costs Income from operations Sales Variable costs Contribution margin Fixed costs traceable to products Product responsibility margin Common fixed costs Responsibility margin for division Division 1 Dollars $ 320,000 192,000 $ 128,000 44,800 9.09 10.73% $ 83,200 22,400 $ 60,800 Division 2 % Dollars 100% $ 120,000 60 36,000 40% $ 84,000 21 57,600 19% 26,400 $ Profit Centers Product A $ % Dollars % Dollars 100% $ 128,000 100.00% $ 192,000 60 40% 14 26% $ 7 19% 57,600 70,400 13,440 56,960 45.00 134,400 55.00% $ 57,600 10.50 31,360 44.50% $ 26,240 % 100% 30 70% 48 22% Product B % 100.00% 70.00 30.00% 16.33 13.67% Required: a. The company plans to initiate an advertising campaign for one of the two products in Division 1. The campaign would cost $3,000 per month and is expected to increase the sales of whichever product is advertised by $30,000 per month. Compute the expected increase in the responsibility margin of Division 1 assuming that (1) product A is advertised and (2) product B is advertised.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started