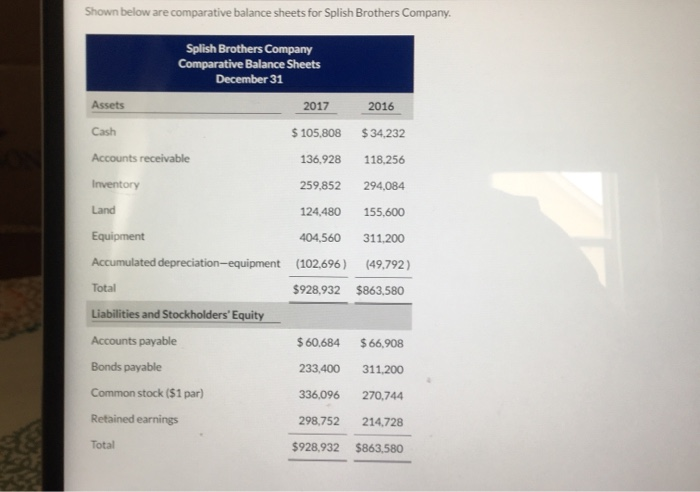

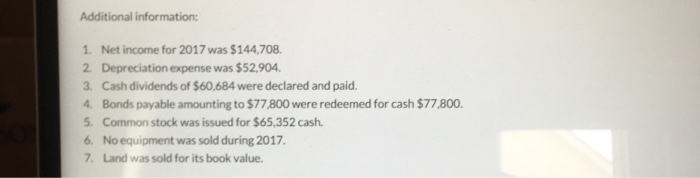

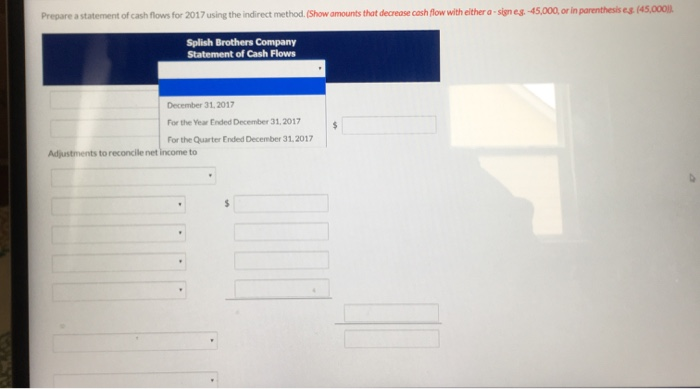

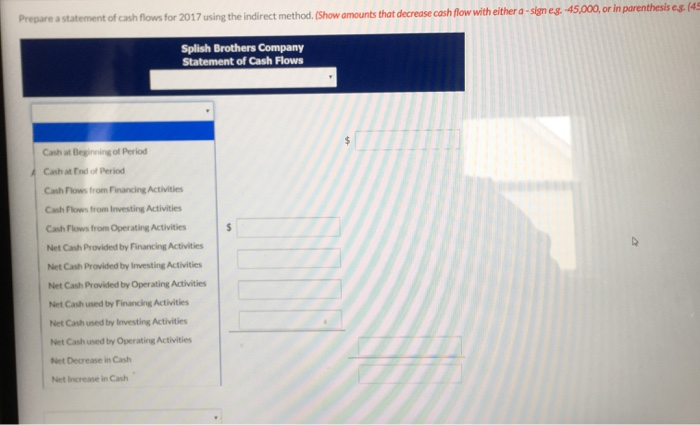

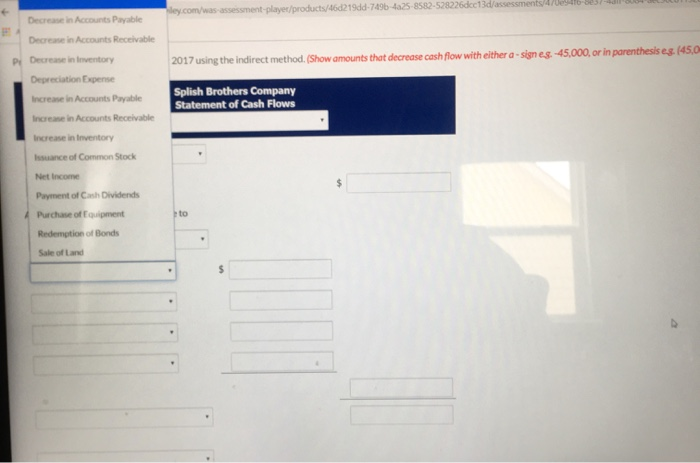

Shown below are comparative balance sheets for Splish Brothers Company. Splish Brothers Company Comparative Balance Sheets December 31 Assets 2017 2016 $34.232 Cash $ 105,808 Accounts receivable 136,928 Inventory 259,852 Land 118,256 294,084 155,600 311,200 (49,792) $863,580 124.480 404,560 (102,696) $928,932 Equipment Accumulated depreciation-equipment Total Liabilities and Stockholders' Equity $ 60.684 $66,908 Accounts payable Bonds payable Common stock ($1 par) 233,400 336,096 298,752 311,200 270,744 214.728 Retained earnings Total $928,932 $863,580 Additional information: 1. Net income for 2017 was $144,708. 2. Depreciation expense was $52,904. 3. Cash dividends of $60,684 were declared and paid. 4. Bonds payable amounting to $77 800 were redeemed for cash $77,800. 5. Common stock was issued for $65,352 cash. 6. No equipment was sold during 2017. 7. Land was sold for its book value. Prepare a statement of cash flows for 2017 using the indirect method. (Show amounts that decrease cash flow with either asics-45,000, or in parenthesis es 145.000 Splish Brothers Company Statement of Cash Flows December 31, 2017 For the Year Ended December 31, 2017 For the Quarter Ended December 31, 2017 Adjustments to reconcile net income to Prepare a statement of cash flows for 2017 using the indirect method. (Show amounts that decrease cash flow with either a -sign es. -45,000, or in parenthesis e.g. (45 Splish Brothers Company Statement of Cash Flows Cash at Beginning of Period Cash at End of Period Cash Flows from Financing Activities Cash Flows from investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash used by Financing Activities Net Cash used by Investing Activities Net Cash used by Operating Activities Net Decrease in Cash Net increase in Cash ley.com/was assessment-player/products/460219dd-749b-4a25-8582-528226dc13d/assessments/4/0916-03- Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory 2017 using the Indirect method. (Show amounts that decrease cash flow with either a signes -45,000, or in parenthesis es. (45,0 Depreciation Expense Increase in Accounts Payable Splish Brothers Company Statement of Cash Flows Increase in Accounts Receivable Increase in Inventory Issuance of Common Stock Net Income Payment of Cash Dividends Purchase of Equipment Redemption of Bonds Sale of land