Answered step by step

Verified Expert Solution

Question

1 Approved Answer

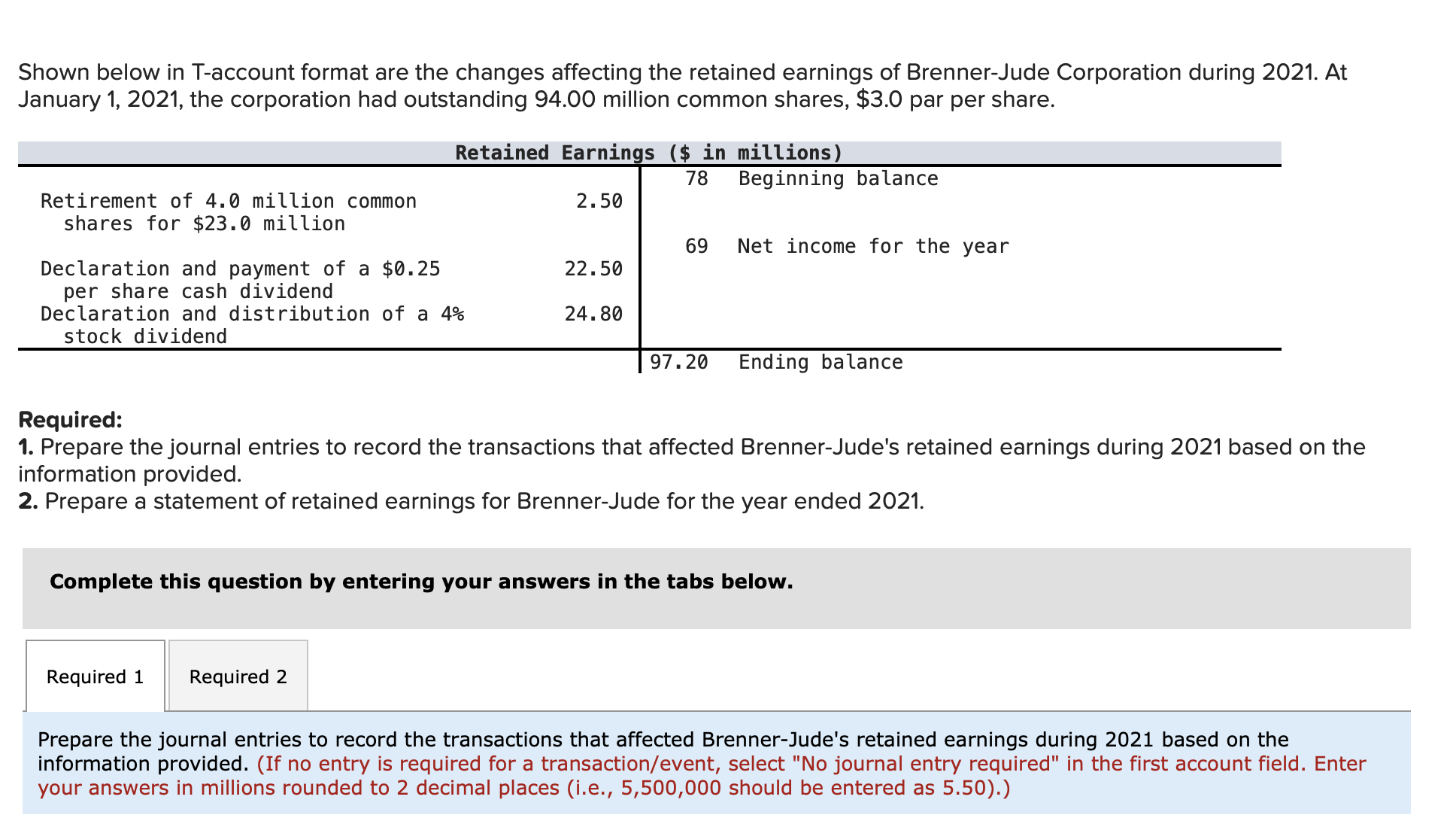

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2021 . At January 1, 2021, the corporation had

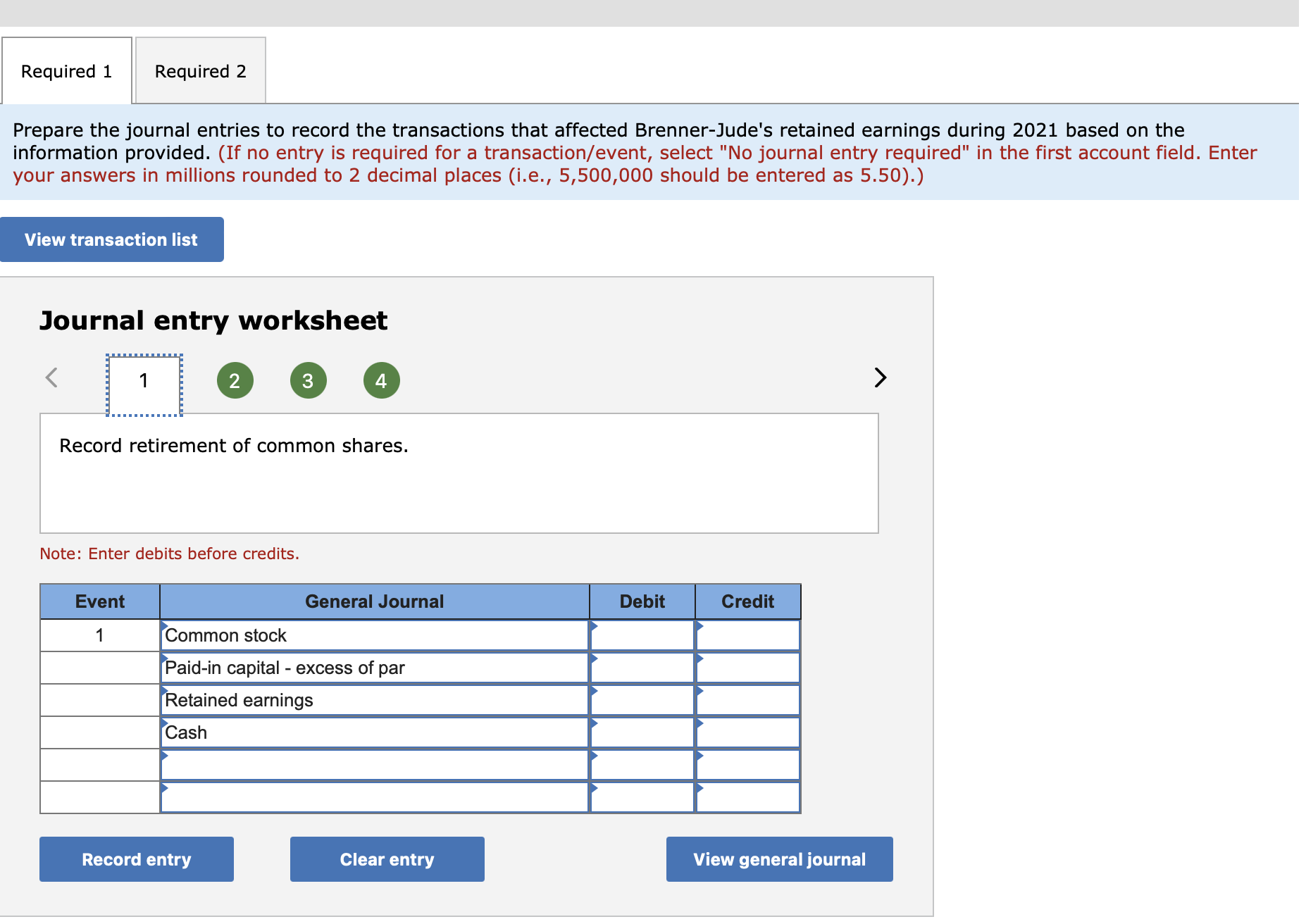

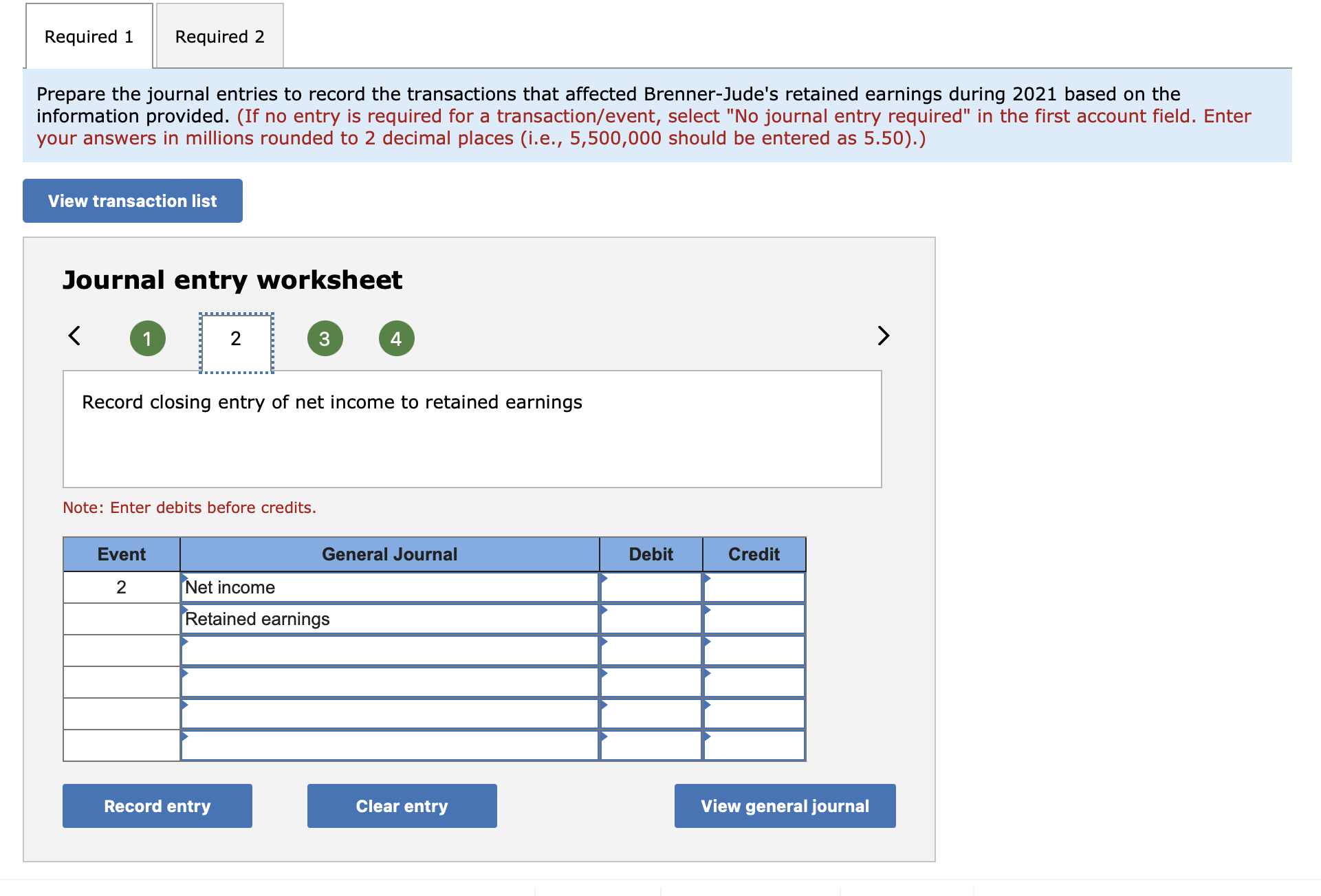

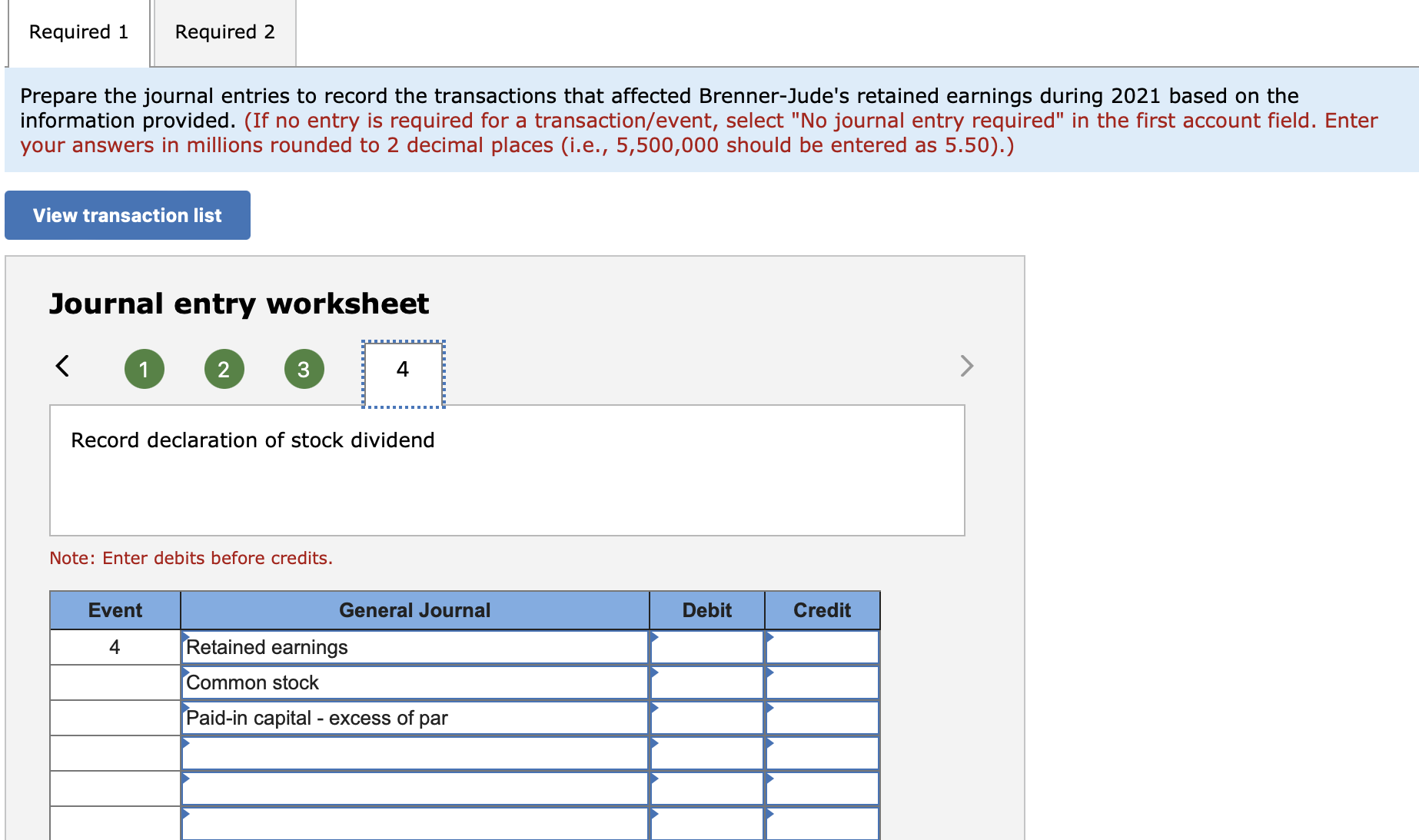

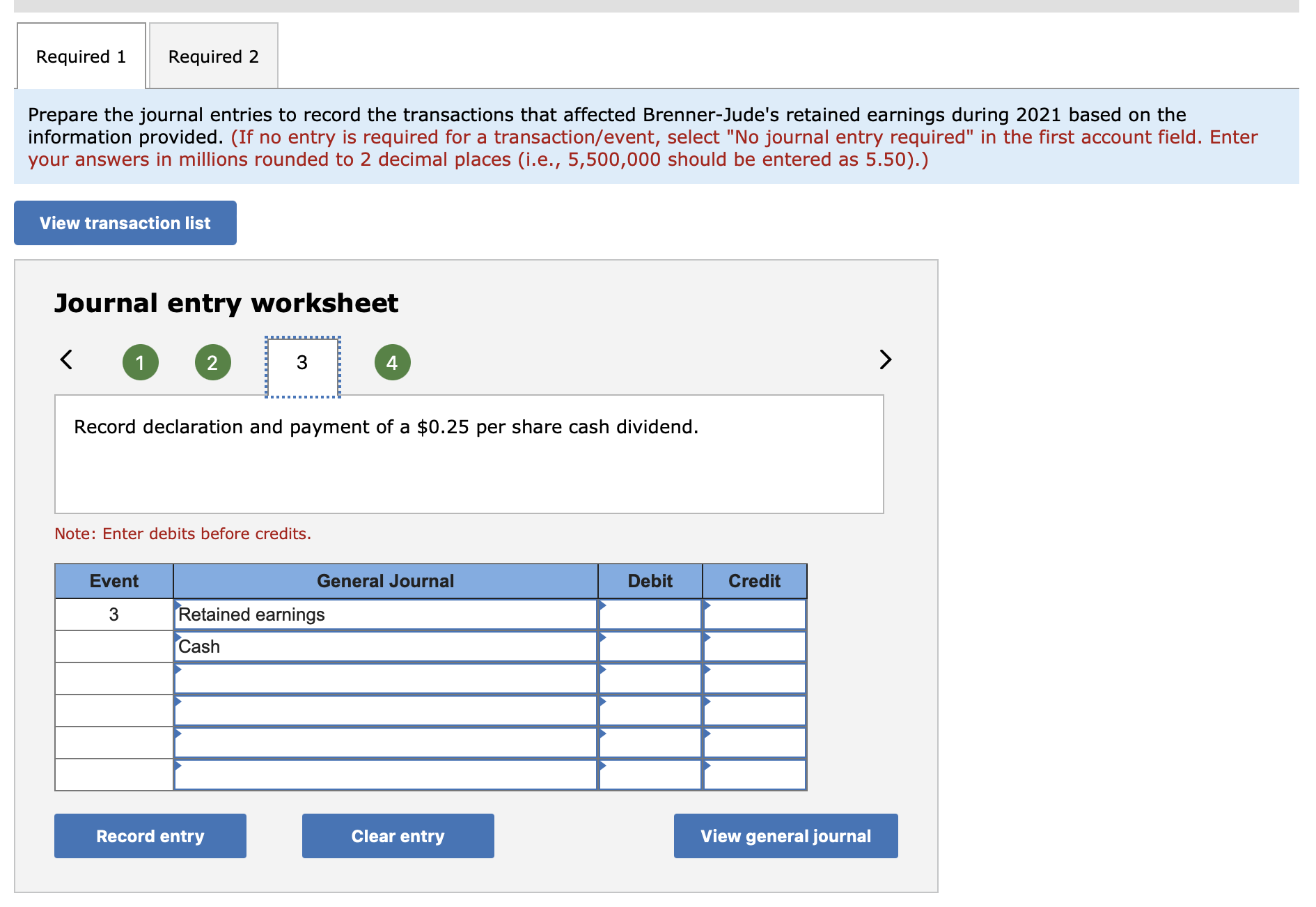

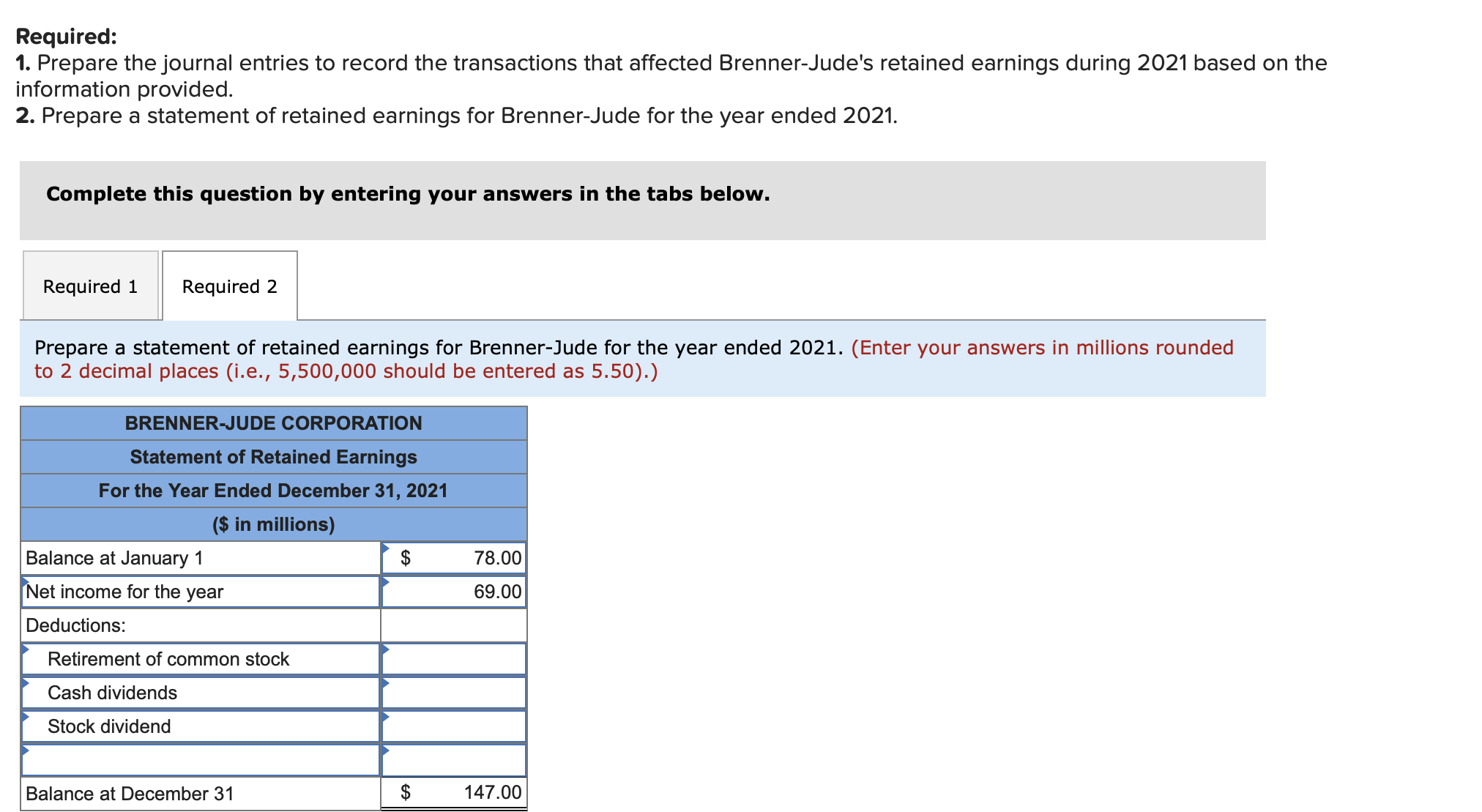

Shown below in T-account format are the changes affecting the retained earnings of Brenner-Jude Corporation during 2021 . At January 1, 2021, the corporation had outstanding 94.00 million common shares, $3.0 par per share. Required: 1. Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on the information provided. 2. Prepare a statement of retained earnings for Brenner-Jude for the year ended 2021. Complete this question by entering your answers in the tabs below. Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on the information provided. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on the information provided. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Journal entry worksheet 4 Note: Enter debits before credits. Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on the information provided. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Journal entry worksheet Record closing entry of net income to retained earnings Note: Enter debits before credits. Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on the information provided. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Journal entry worksheet Note: Enter debits before credits. Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on the information provided. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50).) Journal entry worksheet Record declaration and payment of a $0.25 per share cash dividend. Note: Enter debits before credits. Required: 1. Prepare the journal entries to record the transactions that affected Brenner-Jude's retained earnings during 2021 based on t information provided. 2. Prepare a statement of retained earnings for Brenner-Jude for the year ended 2021. Complete this question by entering your answers in the tabs below. Prepare a statement of retained earnings for Brenner-Jude for the year ended 2021. (Enter your answers in millions rounded to 2 decimal places (i.e., 5,500,000 should be entered as 5.50 ).)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started