Answered step by step

Verified Expert Solution

Question

1 Approved Answer

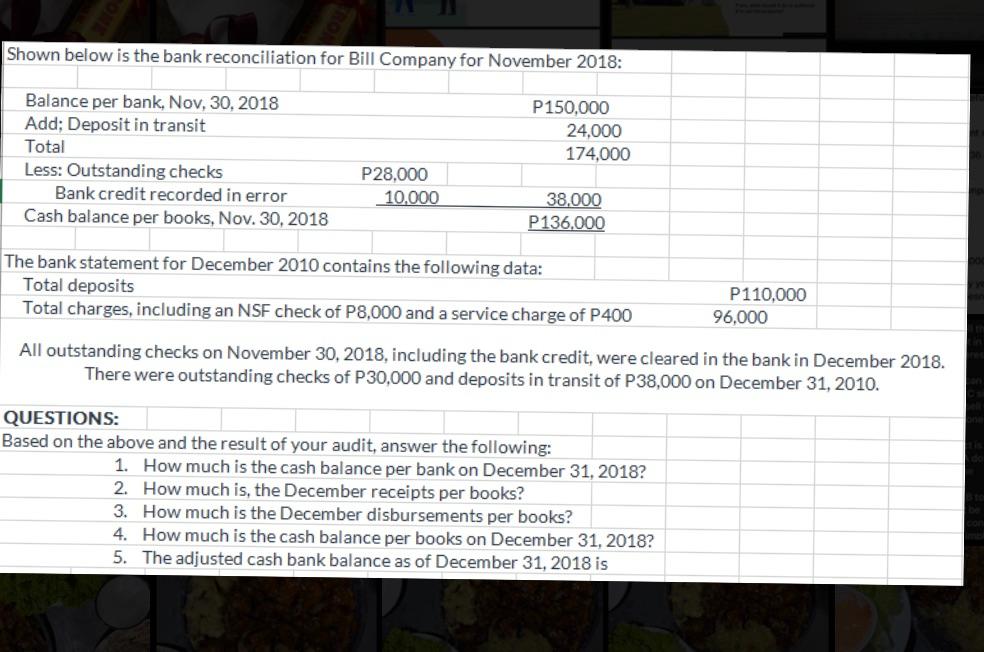

Shown below is the bank reconciliation for Bill Company for November 2018: Balance per bank, Nov, 30, 2018 Add; Deposit in transit Total Less:

Shown below is the bank reconciliation for Bill Company for November 2018: Balance per bank, Nov, 30, 2018 Add; Deposit in transit Total Less: Outstanding checks Bank credit recorded in error Cash balance per books, Nov. 30, 2018 P28,000 10,000 P150,000 24,000 174,000 38,000 P136,000 The bank statement for December 2010 contains the following data: Total deposits Total charges, including an NSF check of P8,000 and a service charge of P400 QUESTIONS: Based on the above and the result of your audit, answer the following: P110,000 All outstanding checks on November 30, 2018, including the bank credit, were cleared in the bank in December 2018. There were outstanding checks of P30,000 and deposits in transit of P38,000 on December 31, 2010. 1. How much is the cash balance per bank on December 31, 2018? 2. How much is, the December receipts per books? 3. How much is the December disbursements per books? 4. How much is the cash balance per books on December 31, 2018? 5. The adjusted cash bank balance as of December 31, 2018 is 96,000

Step by Step Solution

★★★★★

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

The solution is given below Ans 1 Balance per bank Nov 30 2018 15000000 Add Total deposits per bank ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started