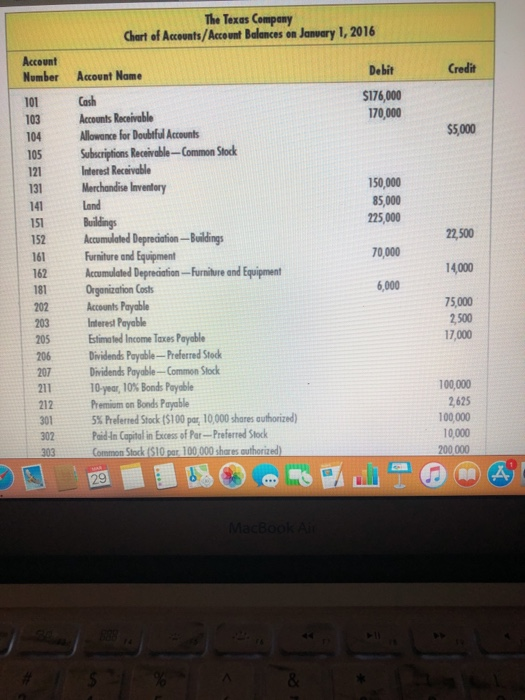

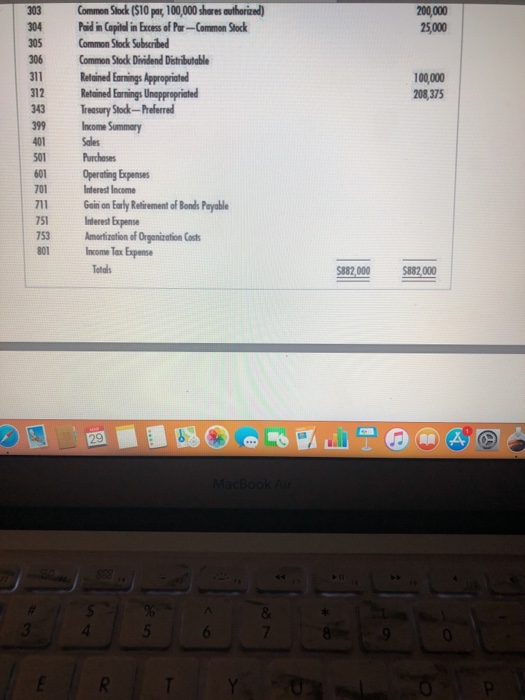

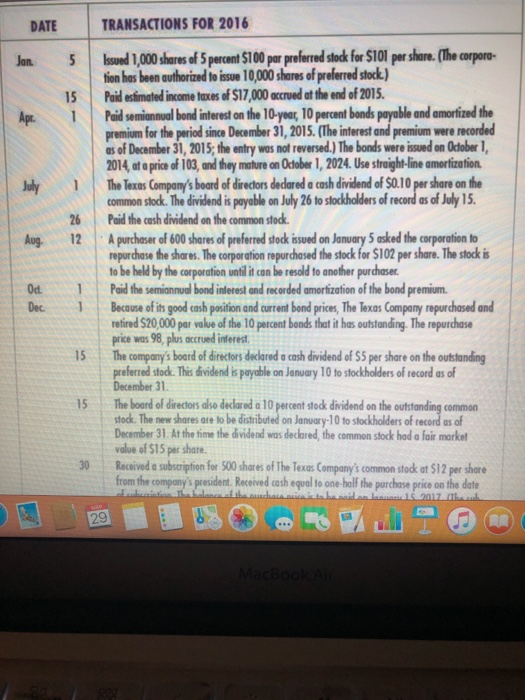

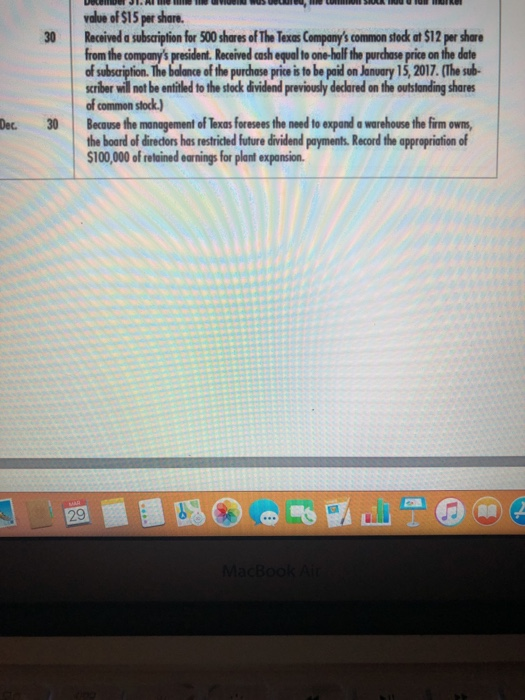

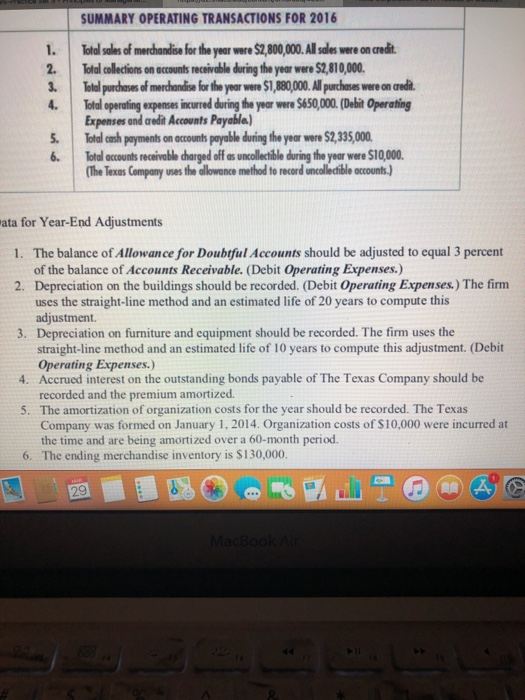

shown on the next page. Texas does not use reversing entries. INSTRUCTIONS Round all computations to the nearest whole dollar. 1. Open the general ledger accounts and enter the balances for January 1, 2016. Obtain the necessary figures from the trial balance. 2. Analyze the transactions on the pages that follow, and record them in the general journal. Use 1 as the number of the first journal page. 3. Post the journal entries to the general ledger accounts. 4. Prepare a worksheet for the year ended December 31,2016. 5. Prepare a summary income statement for the year ended December 31, 2016. 6. Prepare a statement of retained earnings for the year ended December 31, 2016. 7. Prepare a balance sheet as of December 31, 2016. 8. Journalize and post the adjusting entries as of December 31, 2016. 9. Journalize and post the closing entries as of December 31, 2016 Analyze: Assume that the firm declared and issued a 3:1 stock split of common stock in 2016. What is the effect on total par value? 2 The Texas Company Chart of Accounts/Account Balances on Janvary 1, 2016 Debit Credit Number Account Name S176,000 170,000 101 Cash 03 ACcounts Receivable 104 llowance for Doubtful Accounts 105 Subscriptions Receivable-Common Stock 121 Interest Receivable 131 Merchondise Inventory 141 Land 51 Buildings 152 Accomulated Depreciation-Buildings 61 Furniture and Equipment 162 Accumulated Depreciation-Furniture and Equipment 181 Orgonization Codts 202 Accounts Poyabl 203 Interest Payable 205 stimated Income Taxes Payable $5,000 50,000 85,000 225,000 70,000 14,000 75,000 2500 17,000 2 206 Dividends Payable-Preferred Stock 207 Dividends Payable-Common Stock 211 10-year, 10% Bonds Payable 212 Premiom on Bonds Payable 301 302Pd 100,000 5% Preferred Stock t$100 p, 10,000 shares authorized) Paid-In Capital in Excess of Par-Preferred Stock Common Stock ($10 par 100000 shares outhorized 100,000 10,000 200 000 303 Common Slock (510 par, 100,000 shares outhorized 304 Paid in Capital in Excess of Par- Common Stock 305 Common Slock Sobscribed 306 311 Retained Earnings Approprioted 312 Retained Earnings Unappropriate 200,000 25,000 Common Stock Dividend Distributable 100,000 208,375 easury Stock-Preferred 399 Income Summary 401 Sales 0 Purchases 601 Operating Expenses 701 Interest Income 711 Gein on Early Retirement of Bonds Payable 751 Interest Expens 753 Amortization of Organization Cost 01 Income Tax Expense S82 000 882000 5 6 DATE TRANSACTIONS FOR 2016 on 5 sued 1,000shares of 5percent $100 par preferrd stok for S1O1 per share.(The corpore Apr tion has been authorized to isse 10,000 shares of preferred stock Paid estmated income taxes of $17,000 accrued at the end of 2015. Paid semiannual bond interest on the 10-year, 10 percent bonds payable and amortized the as of December 31, 2015; the entry was not reversed.) The bonds were issued on October 1 15 premium for the period since December 31,2015. (The interest and premium were recorded 014 at a price of 103, and they mature on October 1,2024. Use straight-line amortization The Texas Company's board of directors dedared a cash dividend of $0.10 per share on the common stock. The dividend is payable on July 26 to stockholders of record as of July 15 July1 26 Paid the cash dividend on the common stodk 12 Aug Od. Paid the semiannual bond interest and recorded amortization of the bond premium Dec Because of its good cash pesition and current bond prices, The Texas Company repurchased and A purchaser of 600 shares of preferred stock issed on Janvary 5 asked the corporation to repurchase the shares. The corporation repurchased the stock for $102 per share. The stock i to be held by the corporation until it con be resold to another purchaser refired $20,000 par value of the 10 percent bonds that it has outstanding. The repurchase price was 98, plus accrued interest 15 The company's boord of directors decdared a cash dividend of $5 per share on the outstanding preferred stock. This dividend is payable on January 10 to stockholders of record as of December 31 15 ' board of directors do declared a 10 percent stock dividend on the common stock The new shares are to be distributed on January- 10 to stockholders of record as of December 31. At the time the dividend was declared, the common stock had o fair morket value of $15 per share. 30 Received a subueciption for $00 shares of The Texes Company's common stodk at $12 per shore from the company's president. Received cash equal to one-half the purchase price on the date 29 value of $15 per share 30 Received a subscription for 500 shares of The Texas Company's common steck at $12 per share balance of the purchase price is to be paid on January 15, 2017. (The sub rom the company's president. Received cash equal to one-halfthe purchase price on the date scrber will not be entitled to the stock dividend previously declored on the outstanding shares of common stock) Dec. 30 Because the management of Texas foresees the need to expand a warehouse the firm owns, the board of diredors has restricted future dividend payments. Record the appropriation of 100,000 of retained earnings for plant expansion. 29 UMMARY OPERATING TRANSACTIONS FOR 2016 Total sales of merchandise for the year were $2,800,000. All sales were on credit 2. Total collections on accounts receivable during the year were $2,810,000 1el Purdosesofmerdanbefrtheyear were $1,880,000. AllPurchases wereoned operating expenses incurred during the year were S650,000. (Debit Operating Expenses and aredit Accounts Payabla) Total cash payments on occounts payable during the year were $2,335,000 | tal accounts receivable charged offas uncollectible during the year were SI0000. The Texes Company uses the allowance method to record uncollectible accounts) 6. ata for Year-End Adjustments The balance of Allowance for Doubtful Accounts should be adjusted to equal 3 percent of the balance of Accounts Receivable. (Debit Operating Expenses.) Depreciation on the buildings should be recorded. (Debit Operating Expenses.) The firm uses the straight-line method and an estimated life of 20 years to compute this adjustment. Depreciation on furniture and equipment should be recorded. The firm uses the straight-line method and an estimated life of 10 years to compute this adjustment. (Debit Operating Expenses) 1. 2. 3. 4. Accrued interest on the outstanding bonds payable of The Texas Company should be 5. The amortization of organization costs for the year should be recorded. The Texas 6. The ending merchandise inventory is $130,000, recorded and the premium amortized. Company was formed on January 1, 2014. Organization costs of $10,000 were incurred at the time and are being amortized over a 60-month period. 29