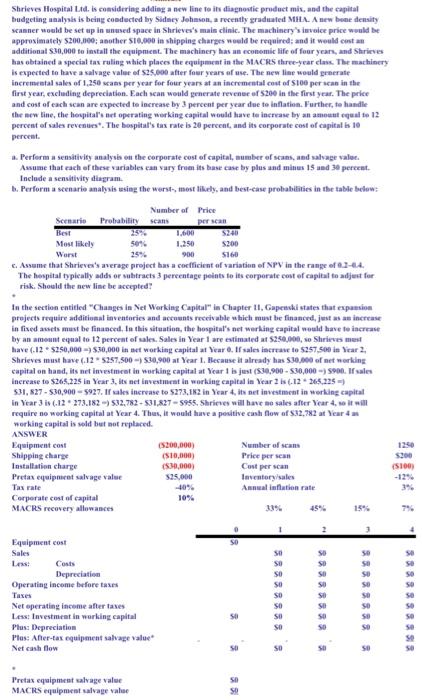

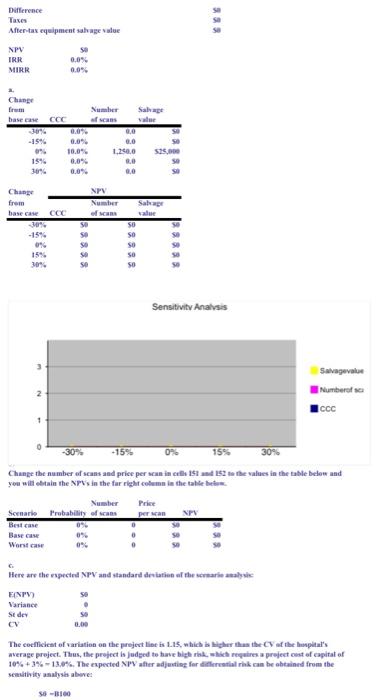

Shrives Hospital Ltd. is considering adding a new line to its diagnostic product mis, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MHA. A new home density scanner would be set up in used space in Shreves's mais clinic. The machinery's voice price would be approximately $200,1000: another 10.000 in shipping charges would be required and it would cost an additional $20,000 to install the equipment. The machinery has an economic life of four years, and Shieves has obtained a special tas ruling which places the equipment in the MACRS three-year class. The machinery is expected to have a salvage value of $25.000 after four years of use. The new line would generate incremental sales of 1,256 sans per year for four years at an incremental cost of 100 persoas in the first year, excluding depreciation. Each scan would generate revenue of $200 in the first year. The price and cost of each scanare expected to increase by 3 percent per year due to inflation. Further, to handle the new line, the hospital's net operating working capital would have to increase by an amount equal to 12 percent of sales revenues. The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 percent. a. Perform a sensitivity analysis on the corporate cost of capital, number of scans, and shage value Assume that each of these variables can vary from its base case by plus and minus 15 and 38 percent Include a sensitivity diagram. b. Perform a scenario analysis using the worst, most likely, and best-case probabilities in the table below Number of Price Scenario Probability Scans per scan Best 1.600 Most likely 5046 1.250 Worst c. Assume that Shriever's average project has a coefficient of variation of NPV in the range of 0.3-4. The hospital typically adds or subtracts 3 percentage points to its corporate cost of capital to adjust for risk. Should the new line be accepted! In the section entitled "Changes in Net Working Capital in Chapter II, Gapend states that expansion projects require additional inventories and accounts receivable which must be financed, just as an increase in fixed assets must be financed. In this situation, the hospital's networking capital would have to increase by an amount equal to 12 percent of sales, Sales in Year 1 are estimated at $250,000, so Shieves mest have (125250,000 $30,000 in networking capital at Year. If sales increase to $257.500 in Vicar 2, Shrieves must have 6.12 5257.500 - 530,900 at Year 1. Because it already has $30,000 of networking capital on hand, its net investment in working capital at Year 1 is just (530,900 - 530,000 5900. If sales increase to $265.325 in Year 3. Its net investment in working capital in Year 2 is (.12 365.225 531, 827-530,900 5927. If sales increase to $273.182 in Year 4. its net investment in working capital in Year 3 in (.12.273.182 532.782-531,827-5955. Shrives will have no sales after Year 4. so it will require no working capital at Year 4. Thus, it would have a positive cash flow of $32,782 at Year working capital is sold but not replaced ANSWER Equipment cost (S200,000) Number of scan 1250 Shipping charge (10,000) Price per scan Installation charge (530,000) Cul persa (100) Pretax equipment salvage value $25.000 Inventory sales Tax rate -40% Annual inflation rate 396 Corporate cost of capital 10% MACRS recovery allowances $160 1 SO So SO SO SO Equipment cost Sales Les Costs Depreciation Operating income before tases Tases Net operating income after taxes Less Investment in working capital Plus: Depreciation Plus: Aher-tax equipment salvage value Net cash flow So so so SO so SO SO 38 39 SO so 33333 Se So so so Pretax equipment salvage value MACRS equipment salvage value SS Difference 333 After tar equipment sagele NPV 0.0% MIRR 0.0% IRR Change taseme Number Samp value 1.250.0 0% 15% 10.0" 0.0% 0.0% Change from basecas CCC NPV Number Sah value SSSSS SSSS Sensitivity Analysis Salvage value Numbers Iccc 1 0% 30% Change the number of scans and price per scan in cells and 152 the values in the table below and you will stain the NP s in the fur right come in the talebelum Number Price Scenario Probability of cams perman Bestene 05 Worst case 09 Here are the repected NPV and standard deviation will the scenario analyse EINPV) . Variance Seder CV 0.00 The coefficient of variation on the project line is 1.15, which is higher than the cathepital's average project. Thus, the project is judged to have big risk, which requires a project cost of capital of 10% +3% -13.0%. The expected NPV after adjusting for differential rk can be obtained from the sensitivity analysis above: Shrives Hospital Ltd. is considering adding a new line to its diagnostic product mis, and the capital budgeting analysis is being conducted by Sidney Johnson, a recently graduated MHA. A new home density scanner would be set up in used space in Shreves's mais clinic. The machinery's voice price would be approximately $200,1000: another 10.000 in shipping charges would be required and it would cost an additional $20,000 to install the equipment. The machinery has an economic life of four years, and Shieves has obtained a special tas ruling which places the equipment in the MACRS three-year class. The machinery is expected to have a salvage value of $25.000 after four years of use. The new line would generate incremental sales of 1,256 sans per year for four years at an incremental cost of 100 persoas in the first year, excluding depreciation. Each scan would generate revenue of $200 in the first year. The price and cost of each scanare expected to increase by 3 percent per year due to inflation. Further, to handle the new line, the hospital's net operating working capital would have to increase by an amount equal to 12 percent of sales revenues. The hospital's tax rate is 20 percent, and its corporate cost of capital is 10 percent. a. Perform a sensitivity analysis on the corporate cost of capital, number of scans, and shage value Assume that each of these variables can vary from its base case by plus and minus 15 and 38 percent Include a sensitivity diagram. b. Perform a scenario analysis using the worst, most likely, and best-case probabilities in the table below Number of Price Scenario Probability Scans per scan Best 1.600 Most likely 5046 1.250 Worst c. Assume that Shriever's average project has a coefficient of variation of NPV in the range of 0.3-4. The hospital typically adds or subtracts 3 percentage points to its corporate cost of capital to adjust for risk. Should the new line be accepted! In the section entitled "Changes in Net Working Capital in Chapter II, Gapend states that expansion projects require additional inventories and accounts receivable which must be financed, just as an increase in fixed assets must be financed. In this situation, the hospital's networking capital would have to increase by an amount equal to 12 percent of sales, Sales in Year 1 are estimated at $250,000, so Shieves mest have (125250,000 $30,000 in networking capital at Year. If sales increase to $257.500 in Vicar 2, Shrieves must have 6.12 5257.500 - 530,900 at Year 1. Because it already has $30,000 of networking capital on hand, its net investment in working capital at Year 1 is just (530,900 - 530,000 5900. If sales increase to $265.325 in Year 3. Its net investment in working capital in Year 2 is (.12 365.225 531, 827-530,900 5927. If sales increase to $273.182 in Year 4. its net investment in working capital in Year 3 in (.12.273.182 532.782-531,827-5955. Shrives will have no sales after Year 4. so it will require no working capital at Year 4. Thus, it would have a positive cash flow of $32,782 at Year working capital is sold but not replaced ANSWER Equipment cost (S200,000) Number of scan 1250 Shipping charge (10,000) Price per scan Installation charge (530,000) Cul persa (100) Pretax equipment salvage value $25.000 Inventory sales Tax rate -40% Annual inflation rate 396 Corporate cost of capital 10% MACRS recovery allowances $160 1 SO So SO SO SO Equipment cost Sales Les Costs Depreciation Operating income before tases Tases Net operating income after taxes Less Investment in working capital Plus: Depreciation Plus: Aher-tax equipment salvage value Net cash flow So so so SO so SO SO 38 39 SO so 33333 Se So so so Pretax equipment salvage value MACRS equipment salvage value SS Difference 333 After tar equipment sagele NPV 0.0% MIRR 0.0% IRR Change taseme Number Samp value 1.250.0 0% 15% 10.0" 0.0% 0.0% Change from basecas CCC NPV Number Sah value SSSSS SSSS Sensitivity Analysis Salvage value Numbers Iccc 1 0% 30% Change the number of scans and price per scan in cells and 152 the values in the table below and you will stain the NP s in the fur right come in the talebelum Number Price Scenario Probability of cams perman Bestene 05 Worst case 09 Here are the repected NPV and standard deviation will the scenario analyse EINPV) . Variance Seder CV 0.00 The coefficient of variation on the project line is 1.15, which is higher than the cathepital's average project. Thus, the project is judged to have big risk, which requires a project cost of capital of 10% +3% -13.0%. The expected NPV after adjusting for differential rk can be obtained from the sensitivity analysis above