Answered step by step

Verified Expert Solution

Question

1 Approved Answer

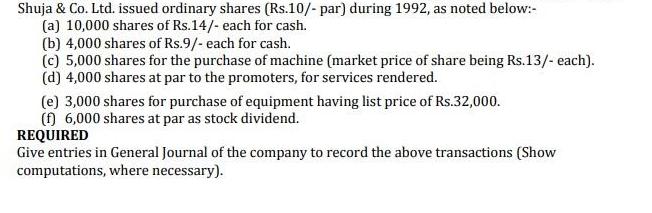

Shuja & Co. Ltd. issued ordinary shares (Rs.10/- par) during 1992, as noted below:- (a) 10,000 shares of Rs.14/- each for cash. (b) 4,000

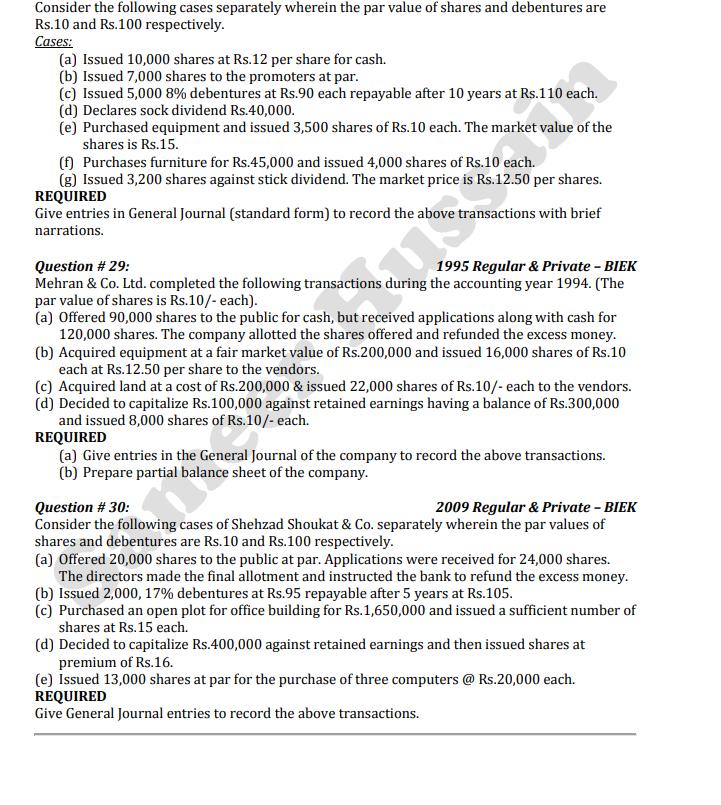

Shuja & Co. Ltd. issued ordinary shares (Rs.10/- par) during 1992, as noted below:- (a) 10,000 shares of Rs.14/- each for cash. (b) 4,000 shares of Rs.9/- each for cash. (c) 5,000 shares for the purchase of machine (market price of share being Rs.13/- each). (d) 4,000 shares at par to the promoters, for services rendered. (e) 3,000 shares for purchase of equipment having list price of Rs.32,000. (f) 6,000 shares at par as stock dividend. REQUIRED Give entries in General Journal of the company to record the above transactions (Show computations, where necessary). Consider the following cases separately wherein the par value of shares and debentures are Rs.10 and Rs.100 respectively. Cases: (a) Issued 10,000 shares at Rs.12 per share for cash. (b) Issued 7,000 shares to the promoters at par. (c) Issued 5,000 8% debentures at Rs.90 each repayable after 10 years at Rs.110 each. (d) Declares sock dividend Rs.40,000. (e) Purchased equipment and issued 3,500 shares of Rs.10 each. The market value of the shares is Rs.15. (f) Purchases furniture for Rs.45,000 and issued 4,000 shares of Rs.10 each. (g) Issued 3,200 shares against stick dividend. The market price is Rs.12.50 per shares. REQUIRED Give entries in General Journal (standard form) to record the above transactions with brief narrations. Question # 29: 1995 Regular & Private - BIEK Mehran & Co. Ltd. completed the following transactions during the accounting year 1994. (The par value of shares is Rs.10/- each). (a) Offered 90,000 shares to the public for cash, but received applications along with cash for 120,000 shares. The company allotted the shares offered and refunded the excess money. (b) Acquired equipment at a fair market value of Rs.200,000 and issued 16,000 shares of Rs.10 each at Rs.12.50 per share to the vendors. (c) Acquired land at a cost of Rs.200,000 & issued 22,000 shares of Rs.10/- each to the vendors. (d) Decided to capitalize Rs.100,000 against retained earnings having a balance of Rs.300,000 and issued 8,000 shares of Rs.10/- each. REQUIRED (a) Give entries in the General Journal of the company to record the above transactions. (b) Prepare partial balance sheet of the company. Question # 30: 2009 Regular & Private - BIEK Consider the following cases of Shehzad Shoukat & Co. separately wherein the par values of shares and debentures are Rs.10 and Rs.100 respectively. (a) Offered 20,000 shares to the public at par. Applications were received for 24,000 shares. The directors made the final allotment and instructed the bank to refund the excess money. (b) Issued 2,000, 17% debentures at Rs.95 repayable after 5 years at Rs.105. (c) Purchased an open plot for office building for Rs.1,650,000 and issued a sufficient number of shares at Rs.15 each. (d) Decided to capitalize Rs.400,000 against retained earnings and then issued shares at premium of Rs.16. (e) Issued 13,000 shares at par for the purchase of three computers @ Rs.20,000 each. REQUIRED Give General Journal entries to record the above transactions.

Step by Step Solution

★★★★★

3.44 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

SOLUTION Case a a Issued 10000 shares at Rs12 per share for cash Cash AC Dr 120000 Share Capital AC Cr 100000 Share Premium AC Cr 20000 To record the issuance of 10000 shares at Rs12 per share for cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started