Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Siena Inc., a large tech company, is considering making an offer to purchase Maive Inc., a smaller network company. Both firms are all equity

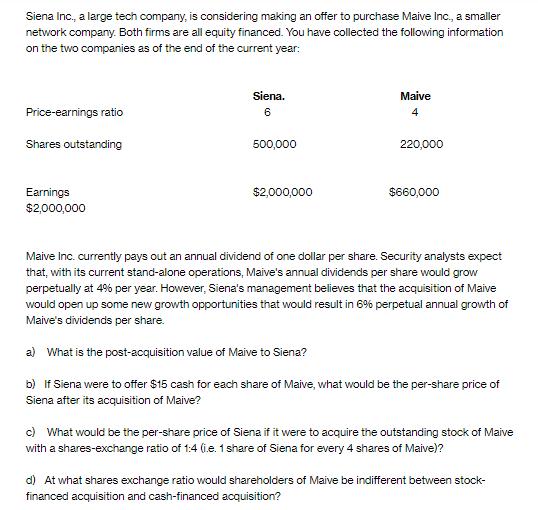

Siena Inc., a large tech company, is considering making an offer to purchase Maive Inc., a smaller network company. Both firms are all equity financed. You have collected the following information on the two companies as of the end of the current year: Price-earnings ratio Shares outstanding Earnings $2,000,000 Siena. 6 500,000 $2,000,000 Maive 4 220,000 $660,000 Maive Inc. currently pays out an annual dividend of one dollar per share. Security analysts expect that, with its current stand-alone operations, Maive's annual dividends per share would grow perpetually at 4% per year. However, Siena's management believes that the acquisition of Maive would open up some new growth opportunities that would result in 6% perpetual annual growth of Maive's dividends per share. a) What is the post-acquisition value of Maive to Siena? b) If Siena were to offer $15 cash for each share of Maive, what would be the per-share price of Siena after its acquisition of Maive? c) What would be the per-share price of Siena if it were to acquire the outstanding stock of Maive with a shares-exchange ratio of 1:4 (i.e. 1 share of Siena for every 4 shares of Maive)? d) At what shares exchange ratio would shareholders of Maive be indifferent between stock- financed acquisition and cash-financed acquisition?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

We need to calculate the present value of Maives perpetually growing dividends per share using the appropriate growth rate a Postacquisition value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started