Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sierra Company manufactures woven blankets and accounts for product costs using process costing. Data below are for one of its processing departments. The following information

Sierra Company manufactures woven blankets and accounts for product costs using process costing. Data below are for one of its processing departments. The following information is available regarding its May inventories.

| Beginning Inventory | Ending Inventory | |||||

| Raw materials inventory | $ | 60,000 | $ | 92,500 | ||

| Work in process inventory | 435,000 | 515,000 | ||||

| Finished goods inventory | 633,000 | 605,000 | ||||

The following additional information describes the company's production activities for May.

| Raw materials purchases (on credit) | $ | 250,000 | |

| Factory wages cost (paid in cash) | 1,530,000 | ||

| Other overhead cost (Other Accounts credited) | 87,000 | ||

| Materials used | |||

| Direct | $ | 157,500 | |

| Indirect | 60,000 | ||

| Labor used | |||

| Direct | $ | 780,000 | |

| Indirect | 750,000 | ||

| Overhead rate as a percent of direct labor | 115 | % | |

| Sales (on credit) | $ | 2,500,000 | |

rev: 09_05_2017_QC_CS-97362

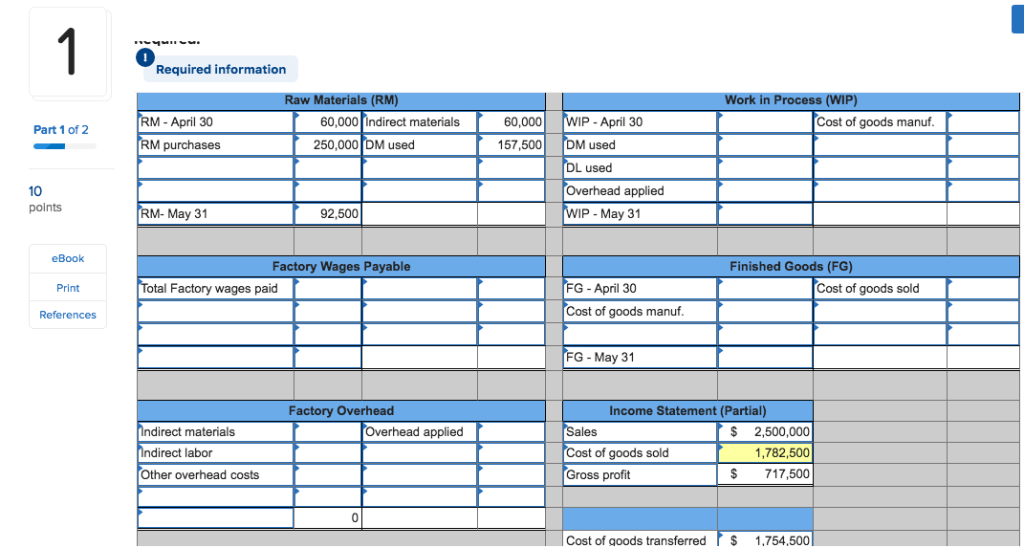

Required: 1. Compute the cost of products transferred from production to finished goods and cost of goods sold.  I really need help finishing this chart for accounting, I do not understand it! Thank you!!

I really need help finishing this chart for accounting, I do not understand it! Thank you!!

Required information Materials (RM Work in Process (WIP) M- April 30 M purchases 60,000 Indirect materials 60,000 IP - April 30 M used L used Cost of goods manuf Part 1 of 2 250,000 DM used 157,500 10 points Overhead applied M- May 31 92,500 IP - May 31 eBook Factory Wages Payable Finished Goods (FG) otal Factory wages paid G - April 30 Cost of goods manuf Print Cost of goods sold References G - May 31 Factory Overhead Income Statement (Partial) ndirect materials $ 2,500,000 1,782,500 S 717,500 Overhead applied ales direct labor t of goods sold Other overhead costs Gross profit 0 Cost of goods transferred $ 1.754.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started