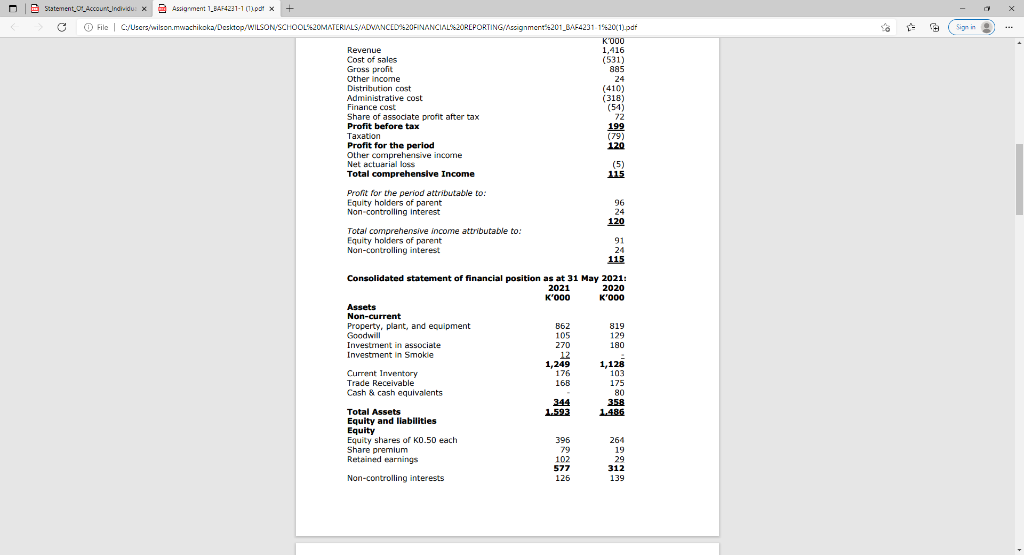

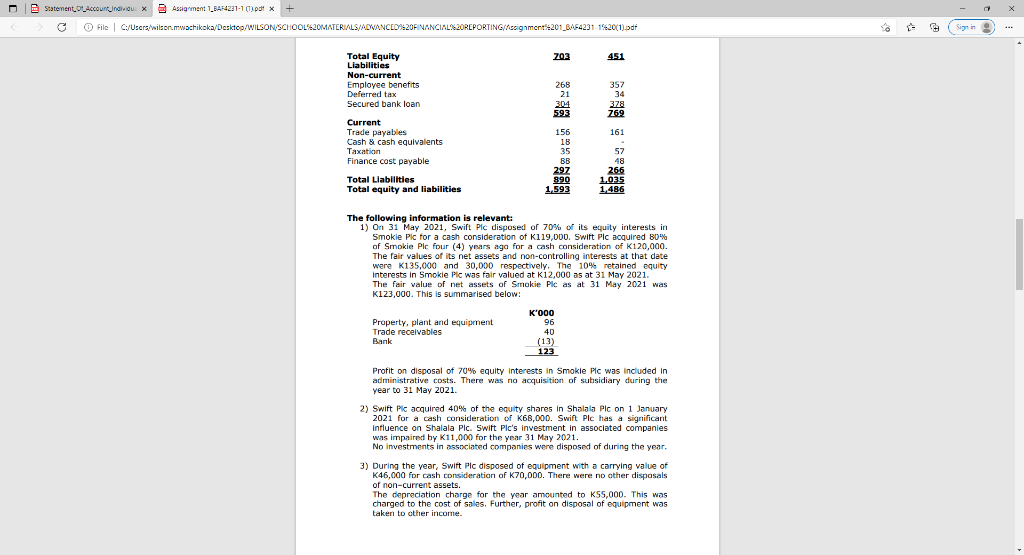

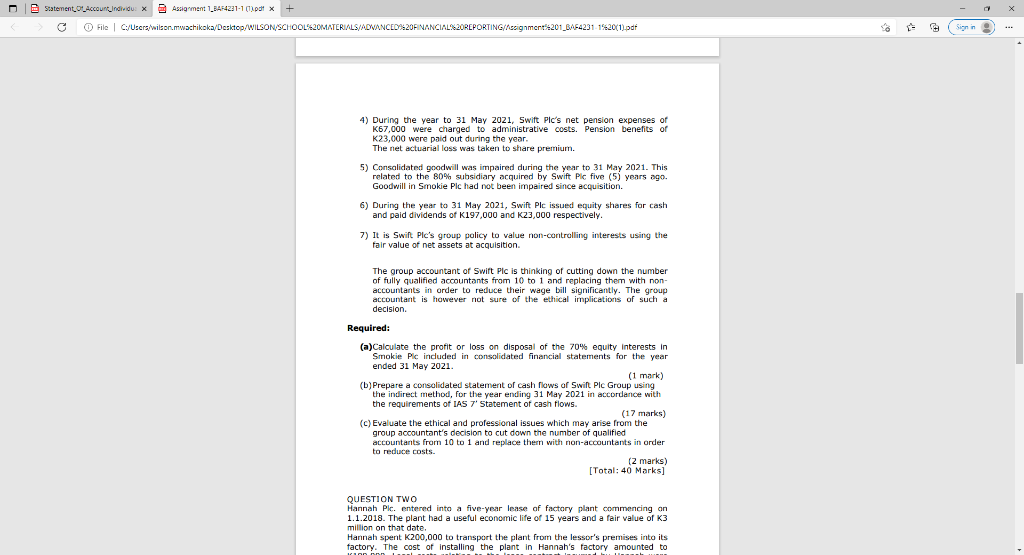

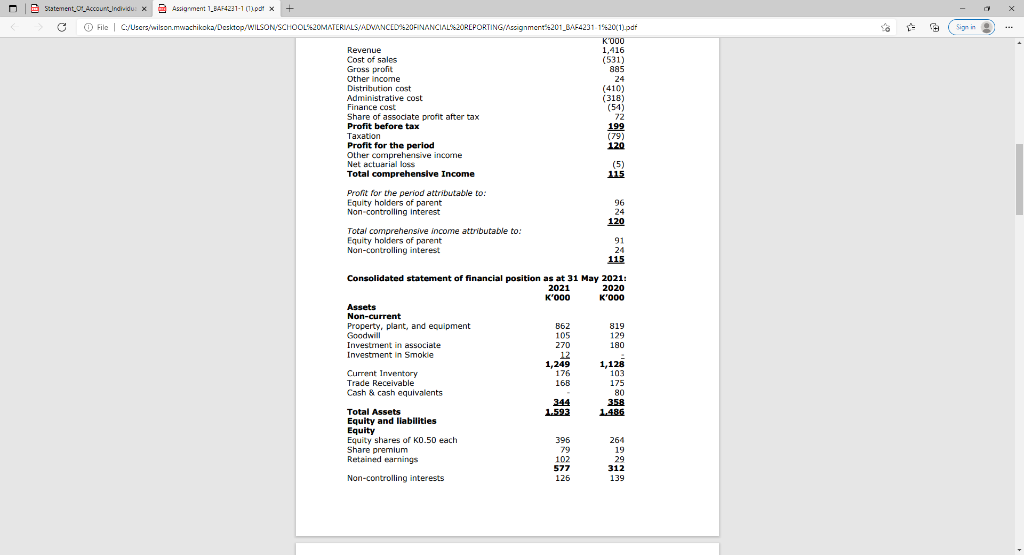

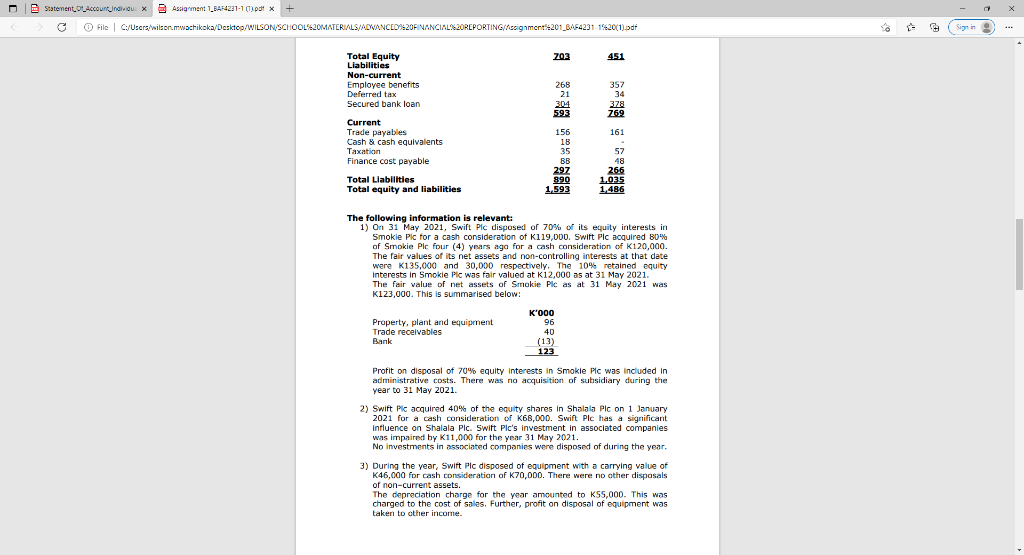

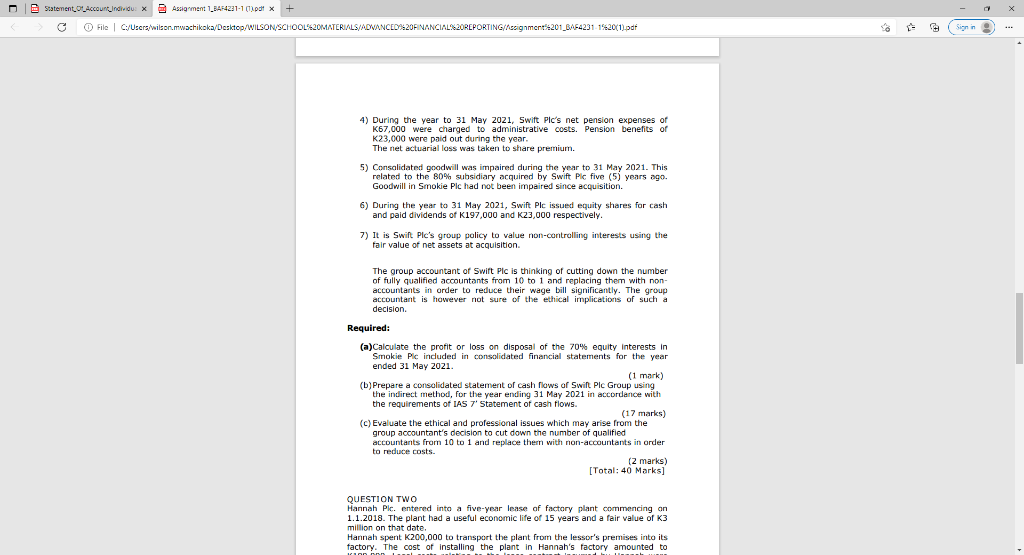

- Sign in . a statement_Ot_Account_ndividu: * Assigment 1_3474231-1 (pdf x + x G O File C:/Users/wilson.mwachikoka/Desktop/WILSON SCHOOLS-20MATERIALS/ADVANCED :20FINANCIAL%20REPORTING//cignment/201_BA54231 1920(1).pdf K000 Revenue 1,416 Cost of sales (531) () Gross profit sas Other income 24 Distribution cost (410) Administrative cost (318) Finance cost (54) ( Share of associate profit after tax 72 Profit before tax 199 Taxation (79) Profit for the period 120 Other comprehensive income Net actuarial loss (5) ( Total comprehensive Income 115 Profit for the period attributable to: Equity holders of parent Non-controlling interest Total comprehensive income attributable to: Equity holders of parent Non-controlling interest 96 24 120 91 24 115 Consolidated statement of financial position as at 31 May 2021: 202 2020 06 K'000 K'000 Assets Non-current Property, plant, and equipment B62 819 Goodwill 105 129 Investment in associate 270 180 Investment in Smokie 12 1,249 1,128 Current Inventory 176 103 Trade Receivable 16B 175 Cash & cash equivalents 80 344 358 Total Assets 1.593 1.486 Equity and liabilities Equity Equity shares of K0.50 each 396 264 200 Share premium 19 Retained earnings 102 29 577 312 Non-controlling interests 126 139 Statement_Ot_Account Individu: * Assignment 123454221-1 (pdf x + x G O File C:/Users/wilson.mwachikoka/Desktop/WILSON SCHOOL":20MATERIALS/ADVANCED :20FINANCIAL%20REPORTING/Accignment201_BA542311542011.pdf Sign in . 703 451 268 21 304 593 357 34 378 100 769 Total Equity Liabilities Non-current Employee benefits Deferred tax Secured bank loan Current Trade payables Cash & cash equivalents Taxation Finance cost payable Total Liabilities Total equity and liabilities 161 156 18 35 BB 297 890 1,593 57 48 266 1,035 1.486 The following information is relevant: 1) On 31 May 2021, Swift Plc disposed of 70% of its equity interests in Smokie Plc for a cash consideration of K119,000. Swift Plc acquired 80% of Smokie Plc four (4) years ago for a cash consideration of K120,000 The fair values of its net assets and non-controlling interests at that date were K135,000 and 30,000 respectively. The 10% retained equity Interests in Smokle Pic was fair valued at K12,000 as at 31 May 2021. The fair value of net assets of Smokie Plc as at 31 May 2021 was K123,000. This is summarised below! Property, plant and equipment Trade receivables Bank K'000 96 40 (13) 123 Profit on disposal of 70% equity Interests in Smokle Plc was included in administrative costs. There was no acquisition of subsidiary during the year to 31 May 2021. 2) Swift Plc acquired 40% of the equity shares in Shalala Plc on 1 January 2021 for a cash consideration of K68,000. Swift Plc has a significant influence on Shalala Plc. Swift Pic's investment in associated companies was impaired by K11,000 for the year 31 May 2021. No investments in associated companies were disposed of during the year. 3) During the year, Swift Plc disposed of equipment with a carrying value of K46,000 for cash consideration of K70,000. There were no other disposals of non-current assets. The depreciation charge for the year amounted to K55,000. This was charged to the cost of sales. Further, profit on disposal of equipment was taken to other income. a statement_Ot_Account_ndividu: * Assigment 1_3474231-1 (pdf x + x G O File C:/Users/wilson.mwachikoka/Desktop/WILSON SCHOOLS:20MATERIALS/ADVANCED%20FINANCIAL%20REPORTING//coignment:201_BA42311820(1).pdf Sign in 4) During the year to 31 May 2021, Swift Plc's net pension expenses of K67,000 were charged to administrative costs. Pension benefits of K23,000 were paid out during the year. The net actuarial loss was taken to share premium. 5) Consalidated goodwill was impaired during the year to 31 May 2021. This related to the 80% subsidiary acquired by Swift Plc five (5) years ago. Goodwill in Smokie Plc had not been impaired since acquisition. 6) During the year to 31 May 2021, Swift Plc issued equity shares for cash and paid dividends of K197,000 and K23,000 respectively. 7) It is Swift Pic's group policy to value non-controlling interests using the fair value of net assets at acquisition. The group accountant of Swift Plc is thinking of cutting down the number of fully qualified accountants from 10 to 1 and replacing them with non- accountants in order to reduce their wage bill significantly. The group accountant is however not sure of the ethical implications of such a decision Required: (a)Calculate the profit or loss on disposal of the 70% equity interests in Smokie Plc induced in consolidated financial statements for the year ended 31 May 2021 (1 mark) (b)Prepare a consolidated statement of cash flows of Swift Plc Group using the indirect method, for the year ending 31 May 2021 in accordance with the requirements of IAS 7' Statement of cash flows. (17 marks) (c) Evaluate the ethical and professional issues which may arise from the group accountant's decision to cut down the number of qualified accountants from 10 to 1 and replace thern with non-accountants in order to reduce costs. (2 marks) [Total: 40 Marks] QUESTION TWO Hannah Plc. entered into a five-year lease of factory plant commencing on 1.1.2018. The plant had a useful economic life of 15 years and a fair value of K3 million on that date. Hannah spent K200,000 to transport the plant from the lessor's premises into its factory. The cost of installing the plant in Hannah's factory amounted to - Sign in . a statement_Ot_Account_ndividu: * Assigment 1_3474231-1 (pdf x + x G O File C:/Users/wilson.mwachikoka/Desktop/WILSON SCHOOLS-20MATERIALS/ADVANCED :20FINANCIAL%20REPORTING//cignment/201_BA54231 1920(1).pdf K000 Revenue 1,416 Cost of sales (531) () Gross profit sas Other income 24 Distribution cost (410) Administrative cost (318) Finance cost (54) ( Share of associate profit after tax 72 Profit before tax 199 Taxation (79) Profit for the period 120 Other comprehensive income Net actuarial loss (5) ( Total comprehensive Income 115 Profit for the period attributable to: Equity holders of parent Non-controlling interest Total comprehensive income attributable to: Equity holders of parent Non-controlling interest 96 24 120 91 24 115 Consolidated statement of financial position as at 31 May 2021: 202 2020 06 K'000 K'000 Assets Non-current Property, plant, and equipment B62 819 Goodwill 105 129 Investment in associate 270 180 Investment in Smokie 12 1,249 1,128 Current Inventory 176 103 Trade Receivable 16B 175 Cash & cash equivalents 80 344 358 Total Assets 1.593 1.486 Equity and liabilities Equity Equity shares of K0.50 each 396 264 200 Share premium 19 Retained earnings 102 29 577 312 Non-controlling interests 126 139 Statement_Ot_Account Individu: * Assignment 123454221-1 (pdf x + x G O File C:/Users/wilson.mwachikoka/Desktop/WILSON SCHOOL":20MATERIALS/ADVANCED :20FINANCIAL%20REPORTING/Accignment201_BA542311542011.pdf Sign in . 703 451 268 21 304 593 357 34 378 100 769 Total Equity Liabilities Non-current Employee benefits Deferred tax Secured bank loan Current Trade payables Cash & cash equivalents Taxation Finance cost payable Total Liabilities Total equity and liabilities 161 156 18 35 BB 297 890 1,593 57 48 266 1,035 1.486 The following information is relevant: 1) On 31 May 2021, Swift Plc disposed of 70% of its equity interests in Smokie Plc for a cash consideration of K119,000. Swift Plc acquired 80% of Smokie Plc four (4) years ago for a cash consideration of K120,000 The fair values of its net assets and non-controlling interests at that date were K135,000 and 30,000 respectively. The 10% retained equity Interests in Smokle Pic was fair valued at K12,000 as at 31 May 2021. The fair value of net assets of Smokie Plc as at 31 May 2021 was K123,000. This is summarised below! Property, plant and equipment Trade receivables Bank K'000 96 40 (13) 123 Profit on disposal of 70% equity Interests in Smokle Plc was included in administrative costs. There was no acquisition of subsidiary during the year to 31 May 2021. 2) Swift Plc acquired 40% of the equity shares in Shalala Plc on 1 January 2021 for a cash consideration of K68,000. Swift Plc has a significant influence on Shalala Plc. Swift Pic's investment in associated companies was impaired by K11,000 for the year 31 May 2021. No investments in associated companies were disposed of during the year. 3) During the year, Swift Plc disposed of equipment with a carrying value of K46,000 for cash consideration of K70,000. There were no other disposals of non-current assets. The depreciation charge for the year amounted to K55,000. This was charged to the cost of sales. Further, profit on disposal of equipment was taken to other income. a statement_Ot_Account_ndividu: * Assigment 1_3474231-1 (pdf x + x G O File C:/Users/wilson.mwachikoka/Desktop/WILSON SCHOOLS:20MATERIALS/ADVANCED%20FINANCIAL%20REPORTING//coignment:201_BA42311820(1).pdf Sign in 4) During the year to 31 May 2021, Swift Plc's net pension expenses of K67,000 were charged to administrative costs. Pension benefits of K23,000 were paid out during the year. The net actuarial loss was taken to share premium. 5) Consalidated goodwill was impaired during the year to 31 May 2021. This related to the 80% subsidiary acquired by Swift Plc five (5) years ago. Goodwill in Smokie Plc had not been impaired since acquisition. 6) During the year to 31 May 2021, Swift Plc issued equity shares for cash and paid dividends of K197,000 and K23,000 respectively. 7) It is Swift Pic's group policy to value non-controlling interests using the fair value of net assets at acquisition. The group accountant of Swift Plc is thinking of cutting down the number of fully qualified accountants from 10 to 1 and replacing them with non- accountants in order to reduce their wage bill significantly. The group accountant is however not sure of the ethical implications of such a decision Required: (a)Calculate the profit or loss on disposal of the 70% equity interests in Smokie Plc induced in consolidated financial statements for the year ended 31 May 2021 (1 mark) (b)Prepare a consolidated statement of cash flows of Swift Plc Group using the indirect method, for the year ending 31 May 2021 in accordance with the requirements of IAS 7' Statement of cash flows. (17 marks) (c) Evaluate the ethical and professional issues which may arise from the group accountant's decision to cut down the number of qualified accountants from 10 to 1 and replace thern with non-accountants in order to reduce costs. (2 marks) [Total: 40 Marks] QUESTION TWO Hannah Plc. entered into a five-year lease of factory plant commencing on 1.1.2018. The plant had a useful economic life of 15 years and a fair value of K3 million on that date. Hannah spent K200,000 to transport the plant from the lessor's premises into its factory. The cost of installing the plant in Hannah's factory amounted to