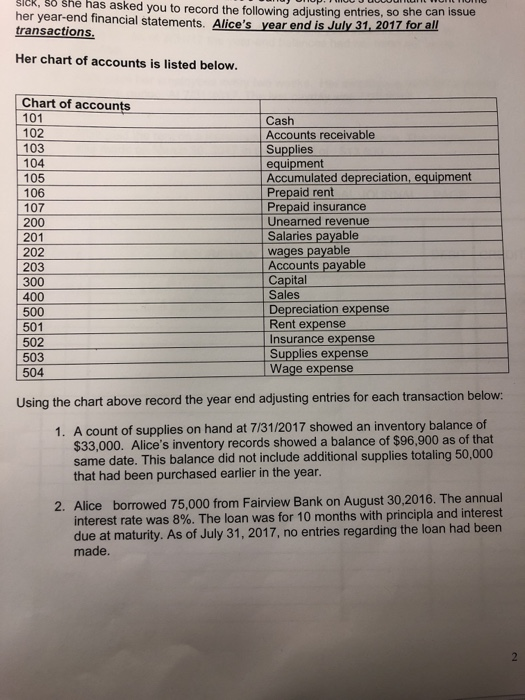

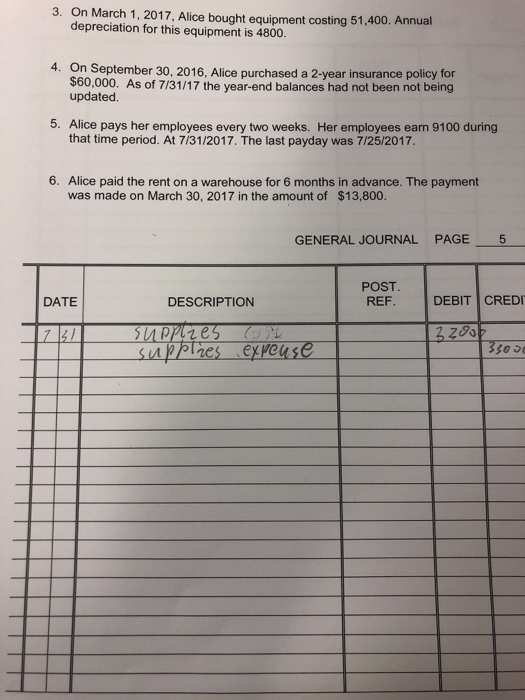

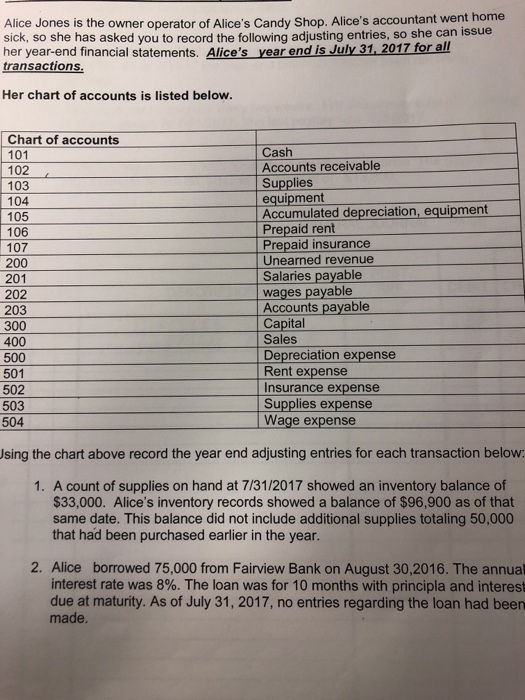

SIGN, SU She has asked you to record the following adjusting entries, so she can issue her year-end financial statements. Alice's vear end is July 31, 2017 for all transactions. Her chart of accounts is listed below. Chart of accounts 101 102 103 106 107 200 201 202 203 300 400 Cash Accounts receivable Supplies equipment Accumulated depreciation, equipment Prepaid rent Prepaid insurance Unearned revenue Salaries payable wages payable Accounts payable Capital Sales Depreciation expense Rent expense Insurance expense Supplies expense Wage expense 503 504 Using the chart above record the year end adjusting entries for each transaction below: 1. A count of supplies on hand at 7/31/2017 showed an inventory balance of $33,000. Alice's inventory records showed a balance of $96,900 as of that same date. This balance did not include additional supplies totaling 50,000 that had been purchased earlier in the year. 2. Alice borrowed 75,000 from Fairview Bank on August 30,2016. The annual interest rate was 8%. The loan was for 10 months with principla and interest due at maturity. As of July 31, 2017, no entries regarding the loan had been made. 3. On March 1, 2017, Alice bought equipment costing 51,400. Annual depreciation for this equipment is 4800. 4. On September 30, 2016. Alice purchased a 2-year insurance policy for $60,000. As of 7/31/17 the year-end balances had not been not being updated. 5. Alice pays her employees every two weeks. Her employees earn 9100 during that time period. At 7/31/2017. The last payday was 7/25/2017. 6. Alice paid the rent on a warehouse for 6 months in advance. The payment was made on March 30, 2017 in the amount of $13,800. GENERAL JOURNAL PAGE 5 POST. REF. DATE DESCRIPTION DEBIT CREDI 73/ superiores expeuse 13200 $39 | Alice Jones is the owner operator of Alice's Candy Shop. Alice's accountant went home sick, so she has asked you to record the following adjusting entries, so she can issue her year-end financial statements. Alice's vear end is July 31, 2017 for all transactions. Her chart of accounts is listed below. Chart of accounts 101 102 103 105 106 107 200 201 202 203 300 400 500 501 Cash Accounts receivable Supplies equipment Accumulated depreciation, equipment Prepaid rent Prepaid insurance Unearned revenue Salaries payable wages payable Accounts payable Capital Sales Depreciation expense Rent expense Insurance expense Supplies expense Wage expense 503 504 Using the chart above record the year end adjusting entries for each transaction below: 1. A count of supplies on hand at 7/31/2017 showed an inventory balance of $33,000. Alice's inventory records showed a balance of $96,900 as of that same date. This balance did not include additional supplies totaling 50,000 that had been purchased earlier in the year. 2. Alice borrowed 75,000 from Fairview Bank on August 30,2016. The annua interest rate was 8%. The loan was for 10 months with principla and interes due at maturity. As of July 31, 2017, no entries regarding the loan had beer made