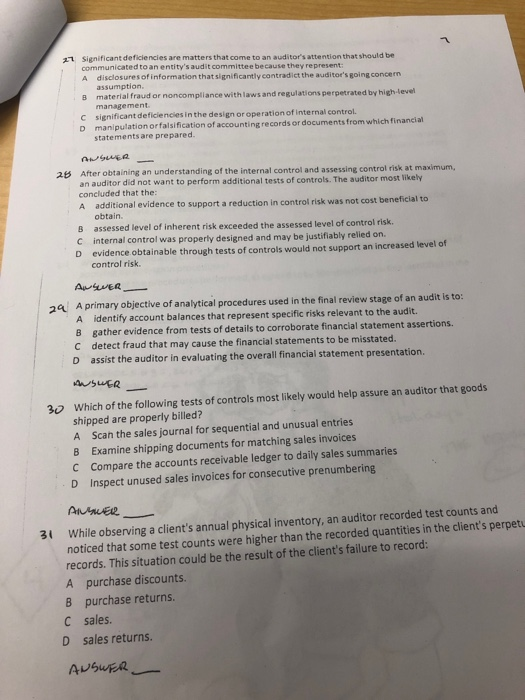

Significant deficiencies are matters that come to an auditor's attention thas should be communicated toan entity's audit committee because they represent A disclosures of information that significantly contradict the auditor's going concern . assumption. 8 material fraud or noncompliance with laws and regulations perpetrated by high-level management nificant deficiencies in the design or operation of internal control. C D sig manipulation orfalsification of accounting records or documents from which fin statements are prepared ancial 2B After obtaining an understanding of the internal control and assessing control risk at maximum, an auditor did not want to perform additional tests of controls. The auditor most likely concluded that the: A additio nal evidence to support a reduction in control risk was not cost beneficial to obtain. assessed level of inherent risk exceeded the assessed level of control risk. intern evidence obtainable through tests of controls would not support an increased level of B C al control was properly designed and may be justifiably relied on. control risk. A primary objective of analytical procedures used in the final review stage of an audit is to: A 2a B C D identify account balances that represent specific risks relevant to the audit. gather evidence from tests of details to corroborate financial statement assertions. detect fraud that may cause the financial statements to be misstated. assist the auditor in evaluating the overall financial statement presentation. Which of the following tests of controls most likely would help assure an auditor that goods shipped are properly billed? A Scan the sales journal for sequential and unusual entries B Examine shipping documents for matching sales invoices C Compare the accounts receivable ledger to daily sales summaries D Inspect unused sales invoices for consecutive prenumbering 30 While observing a client's annual physical inventory, an auditor recorded test counts and noticed that some test counts were higher than the recorded quantities in the client's perpetu records. This situation could be the result of the client's failure to record A purchase discounts. 31 8 purchase returns C sales. D sales returns