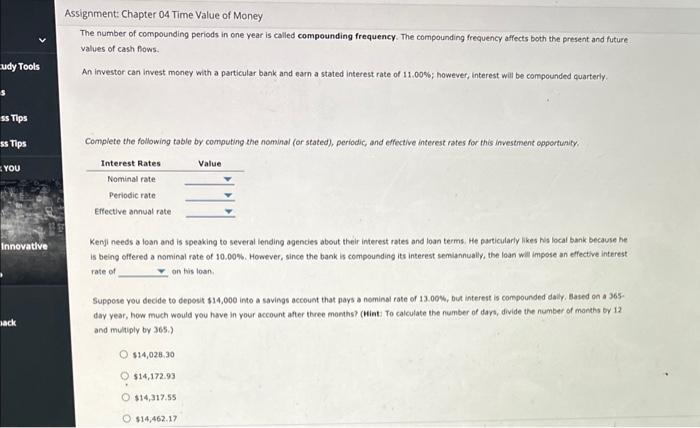

signment: Chapter 04 Time Value of Money The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash fows. An investor can invest money with a particular bank and eam a stated interest rate of 11.00%; however, interest wiil be compounded quarterly: Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. Kenji needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes ha local bank because he is being offered a nominal rate of 10.00%. However, since the bank is compounding its interest semiannually, the loan will impose an effective interest rate of on this loan. Suppose you decide to depost $14,000 into a savings account that pays a nominal rate of 13.00%, but interest is compounded daily, Based on a 365 : day year, how much would you have in your account after three months? (hiat: To calculate the number of dars, divide the number of manths or 12 and multiply by 365.) $14,028.30$14,172.93$14,317.55$14,462.17 signment: Chapter 04 Time Value of Money The number of compounding periods in one year is called compounding frequency. The compounding frequency affects both the present and future values of cash fows. An investor can invest money with a particular bank and eam a stated interest rate of 11.00%; however, interest wiil be compounded quarterly: Complete the following table by computing the nominal (or stated), periodic, and effective interest rates for this investment opportunity. Kenji needs a loan and is speaking to several lending agencies about their interest rates and loan terms. He particularly likes ha local bank because he is being offered a nominal rate of 10.00%. However, since the bank is compounding its interest semiannually, the loan will impose an effective interest rate of on this loan. Suppose you decide to depost $14,000 into a savings account that pays a nominal rate of 13.00%, but interest is compounded daily, Based on a 365 : day year, how much would you have in your account after three months? (hiat: To calculate the number of dars, divide the number of manths or 12 and multiply by 365.) $14,028.30$14,172.93$14,317.55$14,462.17