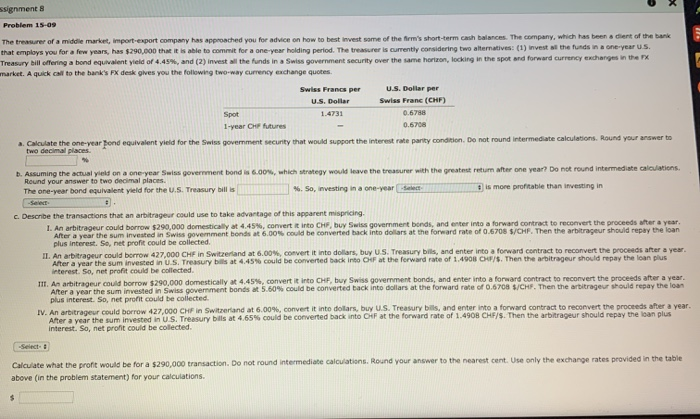

signment Problem 15-09 The treasurer of middle market,mport-export company has approached you for ce on how to best met some of the short-term ch balances. The company, which has been a dart of the bank that employs you for a few years, has $290,000 thot e to commit for a one year holding period. Ther e is currently coming two alternatives (1) vest the funds in a one years Treasury bill offering a bond equivalent yield of 4.45, and (2) invest all the funds in a Swiss government security over the same horizon, locking in the spor and forward Currency exchanges in the market. A quick to the bank's FX desk gives you the following two-way currency exchange quotes Swiss Francs per US Dollar per US Dollar Swiss Franc (CHF) Spot 0.6788 1-year futures 0.60 a. Calculate the one year ond equivalentul for the Swiss government security that wou support the interese party condon. Do not round Intermediate calculations. Round your answer to . Assuming the actual yield on a oneyear Swiss government bonds 6.00, which strategy would leave the treasurer with the greatest return after one year Do not found intermediate actions Round your answer to two decimal places The one-year bond equivalent yield for the U.S. Treasury bill is . So, Investing in a one-year is more profitable than investing in c. Describe the transactions that an arbitrageur could use to take advantage of this apparent mispricing I. An arbitrageur could borrow $290,000 domestically at 4.45%, convert it into CHF, buy Swiss government bonds, and enter into a forward contract to reconvert the proceeds after a year. After a year the sum invested in Swiss government bonds at 6.00 ou be converted back inte d ans at the forward rate of 0.6708 S/CHF. Then the arbitrageur should repay the loan plus interest. So, net profit could be collected Antrer could borrow 427.000 CHF in Switzerland at 6.00, convertit te dollars, buy US Treasury bills, and enter into a forward contract to reconvert the proceeds after a year After a year the sun invested in US Treasury at 445 be converted back into the forward rate of 1.4908 . Then the trageur should pay the loan plus terest. So, net profit could be collected II. An arbitrageur could borrow $290,000 domestically at 4.45, convertint CHF, buy Swiss government bonds, and enter into a forward contract to reconvert the proceeds after a year After a year the sum invested in Swiss government bonds at 5.60 could be converted back into dars at the forward rate of 0.6708 S/CH. Then the arbitrage should repay the loan plus interest. So, net profit could be collected IV. An arbitrageur could borrow 427.000 CHF in Switzerland at 6.00%, convert it into dolas, buy US Treasury bels, and enter into a forward contract to reconvert the proceeds ter a year After a year the sum invested in US Treasury bills at 4.65% could be converted back into that the forward rate of 1.4908 CHF/S. Then the arbitrageur should repay the loan plus interest. So, net profit could be collected Calculate what the profit would be for a $290,000 transaction. Do not round intermediate calculations. Round your answer to the nearest cent. Use only the exchange rates provided in the table above (in the problem statement for your calculations. signment Problem 15-09 The treasurer of middle market,mport-export company has approached you for ce on how to best met some of the short-term ch balances. The company, which has been a dart of the bank that employs you for a few years, has $290,000 thot e to commit for a one year holding period. Ther e is currently coming two alternatives (1) vest the funds in a one years Treasury bill offering a bond equivalent yield of 4.45, and (2) invest all the funds in a Swiss government security over the same horizon, locking in the spor and forward Currency exchanges in the market. A quick to the bank's FX desk gives you the following two-way currency exchange quotes Swiss Francs per US Dollar per US Dollar Swiss Franc (CHF) Spot 0.6788 1-year futures 0.60 a. Calculate the one year ond equivalentul for the Swiss government security that wou support the interese party condon. Do not round Intermediate calculations. Round your answer to . Assuming the actual yield on a oneyear Swiss government bonds 6.00, which strategy would leave the treasurer with the greatest return after one year Do not found intermediate actions Round your answer to two decimal places The one-year bond equivalent yield for the U.S. Treasury bill is . So, Investing in a one-year is more profitable than investing in c. Describe the transactions that an arbitrageur could use to take advantage of this apparent mispricing I. An arbitrageur could borrow $290,000 domestically at 4.45%, convert it into CHF, buy Swiss government bonds, and enter into a forward contract to reconvert the proceeds after a year. After a year the sum invested in Swiss government bonds at 6.00 ou be converted back inte d ans at the forward rate of 0.6708 S/CHF. Then the arbitrageur should repay the loan plus interest. So, net profit could be collected Antrer could borrow 427.000 CHF in Switzerland at 6.00, convertit te dollars, buy US Treasury bills, and enter into a forward contract to reconvert the proceeds after a year After a year the sun invested in US Treasury at 445 be converted back into the forward rate of 1.4908 . Then the trageur should pay the loan plus terest. So, net profit could be collected II. An arbitrageur could borrow $290,000 domestically at 4.45, convertint CHF, buy Swiss government bonds, and enter into a forward contract to reconvert the proceeds after a year After a year the sum invested in Swiss government bonds at 5.60 could be converted back into dars at the forward rate of 0.6708 S/CH. Then the arbitrage should repay the loan plus interest. So, net profit could be collected IV. An arbitrageur could borrow 427.000 CHF in Switzerland at 6.00%, convert it into dolas, buy US Treasury bels, and enter into a forward contract to reconvert the proceeds ter a year After a year the sum invested in US Treasury bills at 4.65% could be converted back into that the forward rate of 1.4908 CHF/S. Then the arbitrageur should repay the loan plus interest. So, net profit could be collected Calculate what the profit would be for a $290,000 transaction. Do not round intermediate calculations. Round your answer to the nearest cent. Use only the exchange rates provided in the table above (in the problem statement for your calculations