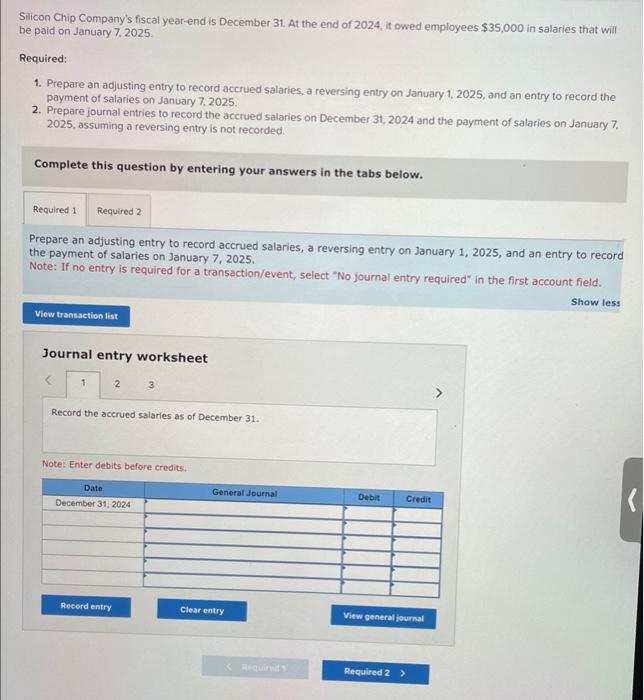

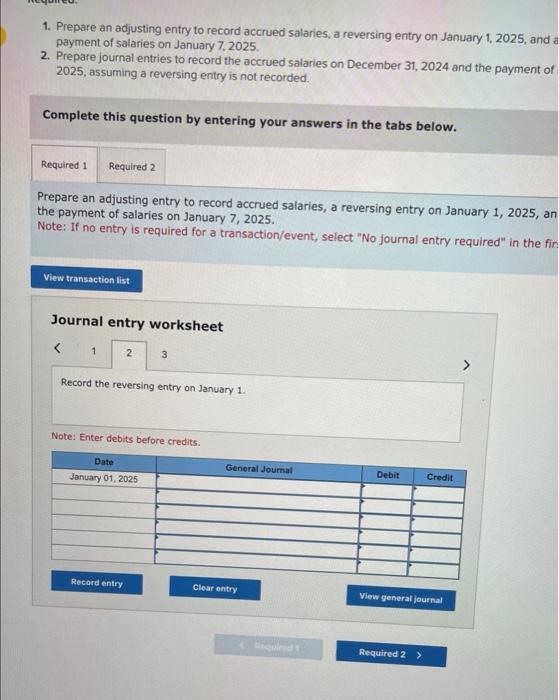

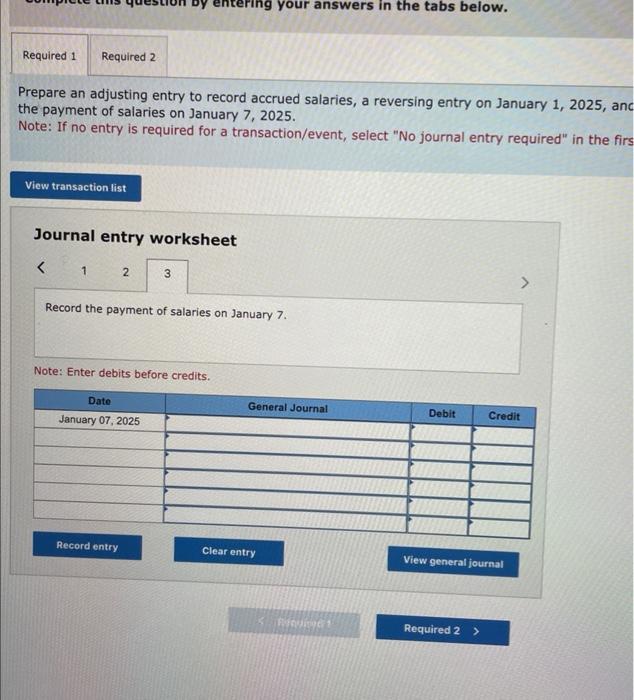

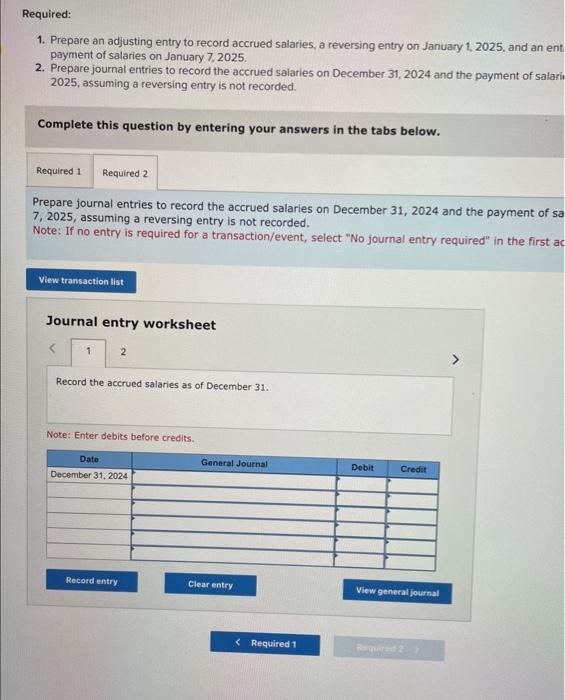

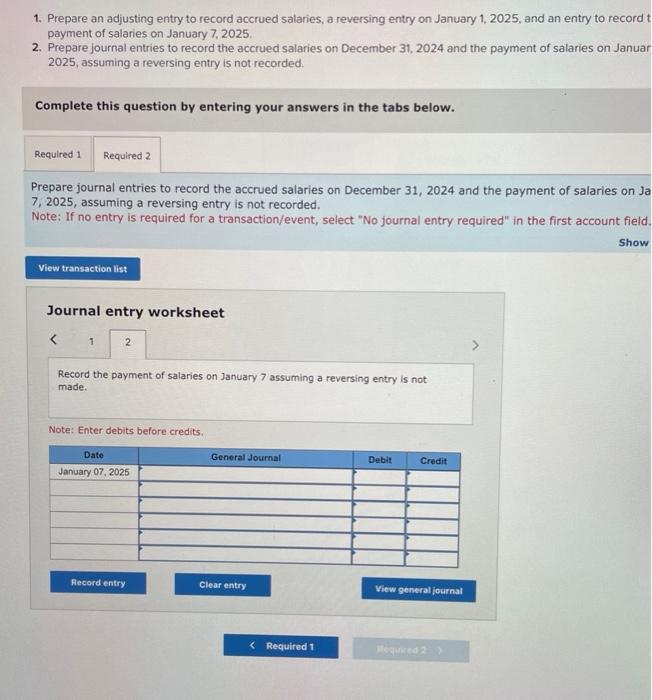

Silicon Chip Company's fiscal year-end is December 31 . At the end of 2024 , it owed employees $35,000 in salaries that will be paid on January 7.2025. Required: 1. Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, and an entry to record the payment of salaries on January 7, 2025. 2. Prepare journal entries to record the accrued salaries on December 31, 2024 and the payment of salaries on January 7, 2025 , assuming a reversing entry is not recorded. Complete this question by entering your answers in the tabs below. Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, and an entry to record the payment of salaries on January 7, 2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Show less Journal entry worksheet Record the accrued salaries as of December 31 . Note: Enter debits before credits. 1. Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, and a payment of salaries on January 7, 2025. 2. Prepare journal entries to record the accrued salaries on December 31, 2024 and the payment of 2025 , assuming a reversing entry is not recorded. Complete this question by entering your answers in the tabs below. Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, an the payment of salaries on January 7,2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the fir: Journal entry worksheet 3 Record the reversing entry on January 1. Note: Enter debits before credits: Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, an the payment of salaries on January 7,2025. Note: If no entry is required for a transaction/event, select "No journal entry required" in the fir Journal entry worksheet Record the payment of salaries on January 7. Note: Enter debits before credits. Required: 1. Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, and an ent payment of salaries on January 7, 2025. 2. Prepare journal entries to record the accrued salaries on December 31, 2024 and the payment of salari 2025 , assuming a reversing entry is not recorded. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the accrued salaries on December 31, 2024 and the payment of sa 7,2025 , assuming a reversing entry is not recorded. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first ad Journal entry worksheet Record the accrued salaries as of December 31. Note: Enter debits before credits. 1. Prepare an adjusting entry to record accrued salaries, a reversing entry on January 1, 2025, and an entry to record payment of salaries on January 7.2025, 2. Prepare journal entries to record the accrued salaries on December 31, 2024 and the payment of salaries on Januar 2025 , assuming a reversing entry is not recorded. Complete this question by entering your answers in the tabs below. Prepare journal entries to record the accrued salaries on December 31,2024 and the payment of salaries on Ja 7,2025 , assuming a reversing entry is not recorded. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Show Journal entry worksheet Record the payment of salaries on January 7 assuming a reversing entry is not made. Note: Enter debits before credits